Summary.

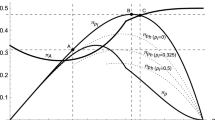

Both oligopoly theory and experiments are concerned almost uniquely with sellers' behavior. Buyers' ability to exhibit non-trivial behavior in different market institutions remains unaddressed. This paper investigates the impact of three variables (number of buyers, surplus division at the market-clearing price and information revelation) on strategic and fairness-motivated demand withholding. Demand withholding and its ability to force lower prices increase as the number of buyers or the share of surplus earned by the buyers decreases. However, increasing the information revealed to subjects about the surplus inequality favoring sellers mildly facilitates collusion among sellers rather than provoking demand withholding as conjectured.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received: March 27, 1999; revised version: October 26, 1999

Rights and permissions

About this article

Cite this article

Ruffle, B. Some factors affecting demand withholding in posted-offer markets. Econ Theory 16, 529–544 (2000). https://doi.org/10.1007/PL00020942

Issue Date:

DOI: https://doi.org/10.1007/PL00020942