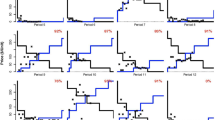

Summary. We report results from fifteen computerized double auctions with concurrent trading of two commodities. In contrast to prior experimental markets, buyers' demands are induced via CES earnings functions defined over the two traded goods, with a fiat money expenditure constraint. Sellers receive independent marginal cost arrays for each commodity. Parameters for buyers' earnings functions and sellers' costs are set to yield a stable, competitive equilibrium. In spite of the complexity introduced by the demand interdependence, the competitive model is a good predictor of market outcomes, although prices tend to be above (below) the competitive prediction in the low-price (high-price) market.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received: April 30, 1999; revised version: June 7, 1999

Rights and permissions

About this article

Cite this article

Williams, A., Smith, V., Ledyard, J. et al. Concurrent trading in two experimental markets with demand interdependence. Econ Theory 16, 511–528 (2000). https://doi.org/10.1007/PL00020941

Issue Date:

DOI: https://doi.org/10.1007/PL00020941