Abstract

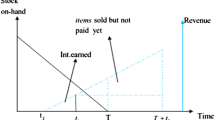

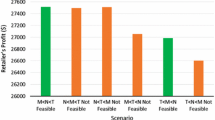

In most of the inventory models with trade credit, it is assumed that the supplier would offer a credit period to the retailer but the retailer in turn would not offer any credit period to his customers, which is termed as one stage credit policy, but this type of credit policy is debatable in most business transactions. As in reality, most of the retailer’s do offer the credit period to his customers in order to stimulate their demand. Such a situation where both the supplier as well as the retailer offers the credit period to their respective customers is known as two-stage credit policy. Although the presence of credit period has been incorporated in many inventory models but the impact of credit period on demand is unfortunately ignored. In reality, it is observed that demand of an item does depend upon the length of the credit period as well as price offered by the retailer. In order to incorporate this phenomenon, an inventory model has been developed, considering that the retailer’s sales are divided in two categories (i) on cash, (which is price sensitive) and (ii) on credit, (which is a function of customer’s credit period and price). A solution procedure is provided for determining the retailer’s optimal price and cycle length simultaneously. Finally, the results have been validated by numerical example.

Similar content being viewed by others

References

Chang, H.J., Hung C.H. and Dye, C.Y., (2004). “An Inventory Model with Stock-Dependent Demand and Time-Value of Money when Credit Period is Provided”, J. of Information and Optimization Sciences 25. No. 2, 237–254.

Huang, Y-F (2003). “Optimal Retailer’s Ordering Policies in the EOQ Model under Trade Credit Financing”, J Opl Res Soc 54, 1011–1015.

Dye, Chung-Yuan (2002). “A Deteriorating Inventory Model with Stock-Dependent Demand Rate and Partial Backlogging under Conditions of Permissible Delay in Payments”, Opsearch 39, 189–198.

Teng, J.T. (2002). “On Economic Order Quantity under Conditions of Permissible Delay in Payments”, J Opl Res Soc 53, 915–918.

Chung, K. J. (2000) “The inventory replenishment policy for deteriorating items under permissible delay in payments”, Oper. Res. 37, 267–281.

Jamal, A.M.M., Sarkar, B.R. and Wang, S. (2000). “Optimal Payment Time for a Retailer under Permitted Delay of Payment by the Wholesaler”, Int. J. of Production Economics 66, 59–66.

Sarker, B.R., Jamal, A.M.M and Wang, S. (2000). “Supply chain model for perishable products under inflation and permissible delay in payment”, Comput. Open Res. 27, 59–75.

Sarker, B.R., Jamal, A.M.M and Wang, S. (2000). “Optimal payment time under permissible delay in payments for the product with deterioration, Prod. Plan. Control 11, 380–390.

Chung, K. J. (1998). “A theorem on the determination of economic order quantity under conditions of permissible delay of payments”, Comput. Oper. Res. 25, 49–52.

Chu, P. Chung and Lan, S.P. (1998). “Economic order quantity of deteriorating items under permissible delay in payments”, Comput. Oper. Res. 25, 817–824.

Hwang, H. and Shinn, S.W. (1997). “Retailer’s Pricing and Lot sizing Policy for Exponentially Deteriorating Products under the condition of Permissible Delay in Payments”, Comput. Oper. Res 24, 539–547.

Shinn, S.W. (1997). “Determining optimal retail price and lot size under day terms supplier credit”, Comput. Ind. Eng. 33, 717–720.

Khouja, M. and Mehrez, A. (1996). “Optimal inventory policy under different supplier credits”, J. Manuf. Syst. 15, 334–339.

Aggarwal, S.P. and Jaggi, C.K. (1995). “Ordering Policies of Deteriorating Item under Permissible Delay in Payments”, J. Oper. Res. Soc. 46, 658–662.

Jaggi, C.K. and Aggarwal, S.P. (1994). “Credit Financing in Economic Ordering Policies of Deteriorating Items”, Int. J. of Production Economics 34, 151–155.

Shah, N.H. (1993) “A Lot size Model for Exponentially Decaying Inventory when Delay in Payments is Permissible”, Cashiers CERO, Belgium 35, 115–123.

Chung, K.H. (1989). “Inventory Control and Trade credit revisited”, J Opl Res Soc 40, 495–498.

Chand, S. and Ward, J. (1987). “A note on economic order quantity under conditions of permissible delay in payments”, J. Oper. Res. Soc. 38, 83–84.

Goyal, S.K. (1985). “Economic Ordering Quantity under Conditions of Permissible Delay in Payments”, J. Opl. Res. Soc. 36, 335–343.

Haley, C.W. and Higgins R.C. (1973). “Inventory Policy and Trade Credit Financing”, Mngt. Sci. 20, 464–471.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jaggi, C.K., Kausar, A. & Khanna, A. Joint optimization of retailer’s unit selling price and cycle length under two-stage credit policy when the end demand is price as well as credit period sensitive. OPSEARCH 44, 172–182 (2007). https://doi.org/10.1007/BF03399205

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03399205