Abstract

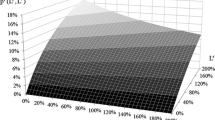

This paper reviews different schools of thought on the question of if and how personal taxes should be incorporated into the valuation of companies or projects. The paper shows under which conditions the risk-neutral valuation approach yields the same result as the Tax-CAPM. Special cases are analyzed that imply irrelevance of personal taxes. In addition, empirical questions are addressed, such as how to determine the expected market rate of return after personal taxes. For this purpose current market prices are used in combination with cash-flow forecasts of financial analysts. Finally, a view is presented on the precision required to estimate the personal tax rate. If both the investment opportunity and its alternative are similarly tax affected, then relative values should not change too much as a function of the tax rate. However, common sensitivity analyses indicate the opposite.

Similar content being viewed by others

References

Ballwieser, Wolfgang (1993), Methoden der Unternehmensbewertung, in: Handbuch des Finanzmanagements, pp. 151–176.

Ballwieser, Wolfgang (1995), Unternehmensbewertung und Steuern, in: Elschen, Rainer/Siegel, Theodor/Wagner, Franz W. (eds.), Unternehmenstheorie und Besteuerung, pp. 15–38.

Ballwieser, Wolfgang (1997), Kalkulationszinsfuß und Steuern, in: Der Betrieb, Vol. 50, pp. 2393–2396.

Ballwieser, Wolfgang (2001), Ertragswert örtlicher Stromnetze — Anmerkungen zur aktuellen BGH-Rechtsprechung, in: Betriebs-Berater, Vol. 56, S. 1519–1526.

Bimberg, Lothar (1991), Langfristige Renditenberechnung zur Ermittlung von Risikoprämien.

Brennan, Michael (1970), Taxes, Market Valuation and Corporate Financial Policy, in: National Tax Journal, Vol. 23, pp. 417–427.

Copeland, Tom/Koller, Tim/Murrin, Jack (2001), Valuation, Measuring and Managing the Value of Companies, 3rd edition.

Dirrigl, Hans (1988), Die Bewertung von Beteiligungen an Kapitalgesellschaften — Betriebswirtschaftliche Methoden und steuerlicher Einfluß.

Drukarczyk, Jochen (2003), Unternehmensbewertung, 4th edition.

Drukarczyk, Jochen/Richter, Frank (1995), Unternehmensgesamtwert, anteilseignerorientierte Finanzentscheidungen und APV-Ansatz, in: Die Betriebswirtschaft, Vol. 55, pp. 559–580.

Duffie, Darrel (1988), Security Markets, Stochastic Models.

Harris, Robert (1986), Using Analyst’s Growth Forecasts to Estimate Shareholder Required Rate of Return, in: Financial Management, Vol. 15, pp. 58–67.

Herrmann, Volker/Richter, Frank (2003), Pricing with Performance-Controlled Multiples, in: sbr, Vol. 55, pp. 194–219.

Husmann, Sven/Kruschwitz, Lutz/Löffler, Andreas (2001), WACC and a Generalized Tax Code, Working Paper Nr. 243, University of Hanover.

Husmann, Sven/Kruschwitz, Lutz/Löffler, Andreas (2002), Unternehmensbewertung unter deutschen Steuern, in: Die Betriebswirtschaft, Vol. 62, pp. 24–42.

Ibbotson Associates, Stocks, Bonds, Bills, and Inflation Yearbook.

IDW (2000), IDW Standard: Grundsätze zur Durchführung von Unternehmensbewertungen (IDW S 1), in: Die Wirtschaftsprüfung, Vol. 53, p. 825–842.

Leuthier, Rainer (1988), Zur Berücksichtigung der Besteuerung bei der Unternehmensbewertung, in: Betriebswirtschaftliche Forschung und Praxis, Vol. 40, pp. 505–521.

Löffler, Andreas (1998), Wacc-approach and nonconstant leverage ratio, Working Paper, Freie Universität Berlin.

Löffler, Andreas/Schneider, Dirk (2002), Martingales, Taxes, and Neutrality, Working Paper, University of Hanover.

Miles, James/Ezzell, John (1980), Weighted Average Cost of Capital, Perfect Capital Markets, and Project Life: A Clarification, in: Journal of Financial and Quantitative Analysis, Vol. 15, pp. 719–730.

Miller, Merton (1977), Debt and Taxes, in: Journal of Finance, Vol. 32, pp. 265–275.

Moxter, Adolf (1983), Grundsätze ordnungsmäßiger Unternehmensbewertung, 2nd edition.

Ollmann, Michael/Richter, Frank (1999), Kapitalmarktorientierte Unternehmensbewertung und Einkommensteuer — Eine deutsche Perspektive im Kontext internationaler Praxis, in: Kleineidam, Hans-Jochen (ed.), Unternehmenspolitik und internationale Besteuerung, pp. 159–178.

Pliska, Stanley (2001), Introduction to Mathematical Finance, Discrete Time Models.

Richter, Frank (2001), Simplified Discounting Rules in Binomial Models, in: sbr, Vol. 53, pp. 175–196.

Richter, Frank (2002), Simplified Discounting Rules, Variable Growth, and Leverage, in: sbr, Vol. 54, pp. 136–147.

Richter, Frank (2002a), On the Relevance and the Irrelevance of Personal Income Taxes for the Valuation of Equity Investments, Working Paper 90, University Witten/Herdecke.

Richter, Frank/Drukarczyk, Jochen (2001), Wachstum, Kapitalkosten und Finanzierungseffekte, in: Die Betriebswirtschaft, Vol. 61, pp. 627–639.

Ross, Stephen (1987), Arbitrage and Martingales with Taxation, in: Journal of Political Economy, Vol. 95, pp. 371–393.

Samuelson, Paul (1964), Tax deductibility of economic depreciation to insure invariant valuations, in: Journal of Political Economy, Vol. 72, pp. 604–606.

Sick, Gordon (1990), Tax-Adjusted Discount Rates, in: Management Science, Vol. 36, pp. 1432–1450.

Stehle, Richard/Hartmond, Anette (1991), Durchschnittsrenditen deutscher Aktien, in: Kredit und Kapital, Vol. 25, pp. 371–411.

Taggert, Robert (1991), Consistent Valuation and Cost of Capital Expressions with Corporate and Personal Tax, in: Financial Management, Vol. 20, pp. 8–20.

Wallmeier, Martin (1999), Kapitalkosten und Finanzierungsprämissen, in: Zeitschrift für Betriebswirtschaft, Vol. 69, pp. 1473–1490.

Author information

Authors and Affiliations

Additional information

I would like to thank two anonymous referees for their helpful and constructive comments as well as Christian Timmreck, who never objects to read my papers to provide me with valuable remarks.

Rights and permissions

About this article

Cite this article

Richter, F. Valuation With or Without Personal Income Taxes?. Schmalenbach Bus Rev 56, 20–45 (2004). https://doi.org/10.1007/BF03396684

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03396684