Abstract

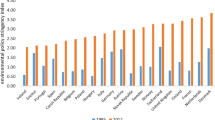

This article reports the effects of environmental fiscal reform recently undertaken in Germany. Our assessment uses a computable general equilibrium model of Germany and the rest of the European Union (EU) calibrated to input-output data for 1995. We found that the environmental fiscal reform yielded a moderate double dividend in terms of reduced CO2 emissions and increased employment but had little impact on the gross domestic product (GDP). Even though the manufacturing industries are facing reduced ecotax rates, the trend toward deindustrialization is strengthened owing to significant induced changes in the structure of demand. The favorable employment effect vanishes, and the GDP effect turns negative if there is an initial rise in employment that triggered rising wage claims. Effects elsewhere in the EU, especially in terms of emissions, are negligible.

Similar content being viewed by others

References

Armington PS (1969) A theory of demand for products distinguished by place of production. IMF Staff Papers 16:159–178

Arndt HW, Heins B, Hillebrand EC, Meyer W, Pfaffenberger W, Ströbele W (1998) Ökosteuern auf dem Prüfstand der Nachhaltigkeit. Analytica, Berlin

Bach S, Kohlhaas M, Meyer B, Praetorius B, Welsch H (2002) The effects of environmental fiscal reform in Germany: a simulation study. Energy Policy 30:803–811

Barker T (1999) The effects on competitiveness of coordinated vs. unilateral fiscal policies reducing GHG emissions in the EU: an assessment of a 10% reduction by 2010 using the E3ME model. Energy Policy 26:1083–1098

Beutel J (1999) Input-output tables for the European Union 1995. Report to the Statistical Office of the European Communities, Konstanz/Luxembourg

Böhringer C (2002) Environmental tax differentiation between industries and households: implications for efficiency and employment. ZEW Discussion Paper 02–08. Boehringer, Mannheim

Böhringer C, Rutherford TC, Pahlke A, Fahl U, Voss A (1997) Volkswirtschaftliche Effekte einer Umstrukturierung des deutschen Steuersystems unter besonderer Berücksichtigung von Umweltsteuern. IER, Stuttgart

Bosello F, Carraro C, Galeotti M (2001) The double-dividend issue: modeling strategies and empirical findings. Environment and Development Economics 6:9–45

Burniaux J-M, Martin JP, Nicoletti G, Olivera Martins J (1992) A multi-sector, multi-region general equilibrium model for quantifying the costs of curbing CO2 emissions: a technical manual. OECD Economics Department Working Paper No. 116. OECO, Paris

Buttermann HG, Hillebrand B (1996) Sektorale und regionale Wirkungen von Energiesteuern. Untersuchungen des RWI, no. 19. RWI, Essen

Conrad K, Schmidt TFN (1998) Coordinated CO2 policy in the EU: an AGE analysis. Economic Systems Research 10:161–182

Conrad K, Wang J (1993) Quantitative Umweltpolitik: gesamtwirtschaftliche Auswirkungen einer CO2-Besteuerung in Deutschland (West). Jahrbücher für Nationalökonomie und Statistik 213:308–324

DIW (1995) Wirtschaftliche Auswirkungen einer ökologischen Steuerreform. Sonderhefte des DIW No. 153, Berlin

EUROSTAT (1992) National accounts: input output tables 1985. EUROSTAT, Luxembourg

Forum für Energiemodelle und Energiewirtschaftliche Systemanalysen (1999) Energiemodelle zum Klimaschutz in Deutschland: Strukturelle und gesamtwirtschaftliche Auswirkungen aus nationaler Perspektive. Physica, Heidelberg

Hoster F, Welsch H, Böhringer C (1997) CO2 abatement and economic structural change in the European internal market. Physica, Heidelberg

IEA (1998a) Energy balances of OECD countries. IEA, Paris

IEA (1998b) Energy statistics of OECD Countries. IEA, Paris

IEA (1999a) Electricity information. IEA, Paris

IEA (1999b) Energy prices and taxes. IEA, Paris

IPCC (1995) Climate change 1995: economic and social dimensions of climate change. Contribution of Working Group III to the second assessment report of the Intergovernmental Panel on Climate Change. IPCC, Cambridge

IPCC (2001) Climate change 2001: mitigation. Contribution of Working Group III to the third assessment report of the Intergovernmental Panel on Climate Change. IPCC, Cambridge

Kemfert C, Welsch H (2000) Energy-capital-labor substitution and the economic effects of CO2 abatement: evidence for Germany. Journal of Policy Modeling 22:641–660

Meyer B, Welfens PJJ (2001) CO2 taxes, growth, labor market effects and structural change: an empirical analysis. In: Welfens PJJ (ed) Internationalization of the economy and environmental policy options. Springer, Berlin

Pearce D (1991) The role of carbon taxes in adjusting to global warming, The Economic Journal 101:938–948

Statistisches Bundesamt (1997) Kostenstruktur der Unternehmen des Verarbeitenden Gewerbes sowie des Bergbaus und der Gewinnung von Steinen und Erden. Fachserie 4: Produzierendes Gewerbe. Series 4.3. Schaefer-Pöschel, Stuttgart

Statistisches Bundesamt (1998) Beschäftigung, Umsatz und Energieversorgung der Unternehmen und Betriebe des Verarbeitenden Gewerbes sowie des Bergbaus und der Gewinnung von Steinen und Erden. Fachserie 4: Produzierendes Gewerbe. Series 4.1.1. Schaefer-Pöschel, Stuttgart

Statistisches Bundesamt (1999) Input-output Tabellen 1995. Fachserie 18: Volkswirtschaftliche Gesamtrechnungen. Series 2. Schaefer-Pöschel, Stuttgart

Umweltrat (2000) Umweltgutachten 2000. www.umweltrat.de/gut00kf2

Welsch H (1996) Recycling of carbon/energy taxes and the labor market: a general equilibrium analysis for the European community. Environmental and Resource Economics 8:141–151

Welsch H, Hoster F (1995) A general equilibrium analysis of European carbon/energy taxation: model structure and macroeconomic results. Zeitschrift für Wirtschafts- und Sozialwissenschaften 115:275–303

Welsch H, Ochsen C (2002) The determinants of aggregate energy use in West Germany. Discussion Paper V-244-02. Department of Economics, University of Oldenburg

Author information

Authors and Affiliations

About this article

Cite this article

Welsch, H., Ehrenheim, V. Environmental fiscal reform in Germany: a computable general equilibrium analysis. Environ Econ Policy Stud 6, 197–219 (2004). https://doi.org/10.1007/BF03353937

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03353937