Abstract

Background: Because pharmaceutical price controls fall outside the domain of historical experience in the US, standard retrospective statistical analyses of firm- and/or industry-level data are not appropriate for studying the long-run impact of price controls on pharmaceutical innovation. Simulation modeling, however, can be used to address this issue.

Objective: To examine, through simulation experiments, the long-run impact of several hypothetical US price-control policies on pharmaceutical innovation; a computer simulation model of pharmaceutical competition and innovation was developed.

Study design: Using the most current economic data available, a hypothetical pharmaceutical industry was created. This industry was formulated to reflect many of the relevant aspects of innovation and competition found in today’s global pharmaceutical industry. This industry was then simulated over a 50-year time horizon, under several different price-control scenarios, in order to better understand the quantitative implications price regulation may have on pharmaceutical innovation.

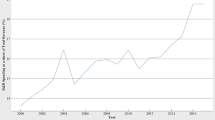

Main outcome measures and results: The primary outcome of interest in this study was pharmaceutical innovative output. Because pharmaceutical firms finance their research and development (R&D) with internally generated funds (after-tax sales revenues), price controls in the model have the effect of reducing R&D investment, and therefore innovation. This was measured by two variables: annual innovative productivity (the annual number of drugs produced by the industry) and cumulative innovative productivity (the total number of drugs produced by the industry over the 50-year time horizon studied). Under a system of public-utility type, cost-based price controls, annual innovative productivity in the model fell by between 67 and 73% relative to baseline (the model without price controls); cumulative innovative output fell by between 30 and 37%. Simulation experiments were also run assuming less extreme forms of pharmaceutical price regulation. These experiments produced smaller reductions in innovative output: annual and cumulative innovative productivity fell by between 21 and 49% and 6 and 24%, respectively.

Conclusion: The regulation of pharmaceutical prices in the US could have a precipitous effect on pharmaceutical innovation in the long run. Careful consideration must be given to any new policy that advocates imposing controls on pharmaceutical prices. Long run costs — in terms of forgone pharmaceutical innovation — must be weighed against any short-term benefits price regulation may impart.

Similar content being viewed by others

References

Grabowski H, Vernon J. Returns to R&D on new drug introductions in the 1980s. J Health Econ 1994; 13: 383–406

Grabowski H, Vernon J. The distribution of sales revenues from pharmaceutical innovation. Pharmacoeconomics 2000; 18Suppl. 1: 21–32

DiMasi J. Success rates for new drugs entering clinical testing in the United States. Clin Pharmacol Ther 1995; 58(1): 1–14

Pharmaceutical Research and Manufacturers of America. 2000 Industry profile. Washington, DC: PhRMA, 2000

DiMasi J, Hansen R, Grabowski H. Cost of innovation in the pharmaceutical industry. J Health Econ 1991; 10(2): 107–42

Nelson R, Winter S. An evolutionary theory of economic change. Cambridge (MA): Harvard University Press, 1982

Fazzari S, Hubbard G, Petersen B. Financing constraints and corporate investment. Brookings Pap Econ Act. 1988; 1: 149–95

Fazzari S, Hubbard G, Petersen B. Investment, financing decisions, and tax policy. Am Econ Rev 1988; 78(2): 200–5

Hubbard G. Capital-market imperfections and investment. J Econ Lit 1998; 36(1): 193–225

Hall B. Investment and research and development at the firm level: does the source of financing matter? NBER Working Papers 1992, Paper No. 4096

Grabowski H. The determinants of industrial research and development: a study of the chemical, drug, and petroleum industries. J Polit Econ 1968; 76(2): 292–306

Grabowski H, Vernon J. The determinants of pharmaceutical research and development expenditures. J Evolut Econ. 2000; 10: 201–15

Masi J, Hansen, R Grabowski H. The price of innovation: new estimates of drug development costs. J Health Econ 2003; 22(2): 151–85

Standard & Poor’s Compusat financial industry data. New York: Standard & Poor, 2002

Grabowski H, Vernon J. Pioneers, imitators, and generics: a simulation model of schumpeterian competition. Q J Econ 1987; 102(3): 491–526

Grabowski H. Health reform and pharmaceutical innovation. Washington, DC: AEI Press, 1994

Grabowski H, Vernon J. Prospects for returns to pharmaceutical R&D under health care reform. In: Helms R, editor. Competitive strategies in the pharmaceutical industry. Washington, DC: AEI Press, 1996: 194–207

Pharmaceutical R&D: costs, risks, and rewards 1993. Washington, DC: Congress of the United States, Office of Technology Assessment, 1993

Drummond M, Jonsson B, Rutten F. The role of economic evaluation in the pricing and reimbursement of medicines. Health Policy 1997; 40(3): 199–215

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vernon, J.A. Simulating the Impact of Price Regulation on Pharmaceutical Innovation. Pharm Dev Regul 1, 55–65 (2003). https://doi.org/10.1007/BF03257365

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03257365