Abstract

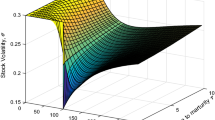

The aim of this study is to empirically examine the suitability of various models for evaluating warrants. In particular, the influence of the under-and overvaluation on the future price development of the warrant is to be determined.

Similar content being viewed by others

References

Black, F., Scholes, M. (1973): The Pricing of Options and Corporate Liabilities. Jl of Pol Econ 81: 637–654.

Fischer, E.O. (1989): Bewertung von Optionen mit aktienkursabhängigem Basispreis. ZfbF 41: 227–230.

Fuller, R.J. (1977): Factors Which Influence Listed Call Option Prices. Rev of Bus and Econ Research 13: 167–197.

Kassouf, S.T. (1969): An Econometric Model for Option Price with Implication for Investor's Expectations and Audacity. Econometrica 37: 685–694.

Parkinson, M. (1972): Empirical Warrant-Stock Relationships. Jl of Business 45: 563–569.

Pflaumer, P. (1990): Ökonometrische Modelle zur Bewertung von Optionsscheinen Forschungsbericht Nr 90/8, FB Statistik, Universität Dortmund.

Schulz, G.U., Trautmann, S. (1989): Valuation of Warrants. Working Paper, Universität Stuttgart.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Pflaumer, P. The evaluation of German warrants. Statistical Papers 32, 343–352 (1991). https://doi.org/10.1007/BF02925510

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02925510