Abstract

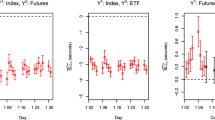

We consider the null distribution of autocorrelation coefficients for stock returns when the variance of the returns is infinite. We show that the empirical autocorrelations then tend to zero faster than in the standard case and that they tend, after suitable normalisation, in distribution to a rather complicated nonnormal law. An empirical application to the 14 most busy German stocks reveals that the significance of observed correlations is thereby in general reduced.

Similar content being viewed by others

References

ARAD, R.W. (1980): “Parameter Estimation for Symmetric Stable Distributions”,International Economic Review 21, 209–220.

BERGSTRÖM, H. (1952): “On some Expansions of Stable Distribution Functions”Arkiv för Mathematik, 2, 375–378.

DAVIS, R. and RESNICK, S. (1985): “More Limit Theory for the Sample Correlation Function of Moving Averages”,Stochastic Processes and their Applications 20, 257–279.

DAVIS, R. and RESNICK, S. (1986): “Limit Theory for Moving Averages of Random Variables with Regularly Varying Tail Probabilities”,The Annals of Statistics 14, 533–558.

FELLER, W. (1971):An Introduction to Probability Theory and its Applications, Vol 2 (2nd ed.), New York (Wiley).

IBRAGIMOV, I. A. and LINNIK, Y. U. (1971):Independent and Stationary Sequences of Random Variables, Groningen (Wolters-Noordhof).

KRÄMER, W. and RUNDE, R. (1990): “Die Autokorrelation von Aktienkursen”,Forschungsbericht Nr. 90/10, Department of Statistics, University of Dortmund.

PHILLIPS, P. C. B. and LORETAN, M. (1991): “The Durbin-Watson Ratio under Infinite-Variance Errors”,Journal of Econometrics, 47, 85–114.

TAYLOR, S. (1986):Modelling Financial Time Series, New York (Wiley).

ZOLOTAREV, V.M. (1966): “On Representation of Stable Laws by Integrals”,Selected Translations in Mathematical Statistics and Probability 6, 84–88.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Krämer, W., Runde, R. Testing for autocorrelation among common stock returns. Statistical Papers 32, 311–320 (1991). https://doi.org/10.1007/BF02925507

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02925507