Abstract

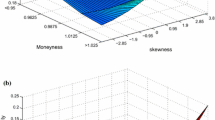

The Black-Scholes option pricing model assumes that (instantaneous) common stock returns are normally distributed. However, the observed distribution exhibits deviations from normality; in particular skewness and kurtosis. We attribute these deviations to gross data errors. Using options' transactions data, we establish that the sample standard deviation, sample skewness, and sample kurtosis contribute to the Black-Scholes model's observed mispricing of a sample from the Berkeley Options Data Base of 2323 call options written on 88 common stocks paying no dividends during the options'life. Following Huber's statement that the primary case for robust statistics is when the shape of the observed distribution deviates slightly from the assumed distribution (usually the Gaussian), we show that robust volatility estimators eliminate the mispricing with respect to sample skewness and sample kurtosis, and significantly improve the Black-Scholes model's pricing performance with respect to estimated volatility.

Similar content being viewed by others

Bibliography

Ball, C. andTorous, W. (1984): «The Maximum Likelihood Estimation of Security Price Volatility; Theory, Evidence, and Application to Option Pricing”, Journal of Business, 57, 97–112.

Beckers, S. (1981): «A note on Estimating the Parameters of a Diffusion-Jump Model of Stock Returns”, Journal of Financial and quantitative Analysis, 36, 127–140.

Bhattacharya, M. (1983): «Transactions Data Tests of Efficiency of the Chicago Board Options Exchange”, Journal of Financial Economics 12, 161–185.

Bickel, P. andK. Doksum (1977): Mathematical Statistics (Holden-Day, Oakland, California).

Black, F. andM. Scholes (1972): «The Valuation of Option Contracts and a Test of Market Efficiency”, Journal of Finance 27, 399–417.

Black, F. andM. Scholes (1973): «The Pricing of Option Contracts and Corporate Liabilities”, Journal of Political Economy 81, 637–654.

Black, F. (1976): “Studies of Stock Price Volatility Changes”, Proceedings of the Journal of American Statistical Association, 177–181.

Boyle, P. andAnanthanarayanan, A.L. (1977): «The Impact of Variance Estimation in Option Valuation Models”, Journal of Financial Economics, 5, 375–388.

Cox, J. (1975): “Notes on Constant Elasticity of Variance Option Pricing”, unpublished manuscript (Stanford University, Stanford, California).

Cox, J. andS. Ross (1976): «The Valuation of Options for Alternative Stochastic Processes”, Journal of Financial Economics, 3, 145–166.

Fama, E. (1965): «The Behavior of Stock Market Prices”, Journal of Business 38, 34–105.

Galai, D. (1977): «Tests of Market Efficiency of the Chicago Board Options Exchange”, Journal of Business, 50, 167–197.

Garman, M. andM. Klass (1980): «On the Estimation of Security Price Volatilities from Historical Data”, Journal of Business 53, 67–78.

Geske, R. (1979): «The Valuation of Compound Options”, Journal of Financial Economics, 7, 63–81.

Geske, R. andR. Roll (1984): “Isolating the Observed Biases in American Call Option Pricing: An Alternative Variance Estimator”, unpublished manuscript (University of California, Los Angeles).

Huber, P. (1977): Robust Statistical Procedures (SIAM, Philadelphia).

Huber, P. (1981): Robust Statistics, John Wiley and Sons, New York.

Latane, H. andRendleman, R. (1976): «Standard Deviations of Stock Price Ratios Implied in Option Prices”, Journal of Finance, 31, 369–382.

Lax, D. (1985): «Robust Estimators of Scale: Finite-Sample Performance in Long-Tailed Symmetric Distributions”, Journal of the American Statistical Association, 80, 736–741.

MacBeth, J. andMerville, L. (1979): «An Empirical Examination of the Black-Scholes Call Option Pricing Model”, Journal of Finance, 34, 1173–1186.

Merton, R.C. (1976): «Options Pricing When Underlying Returns are Discontinuous”, Journal of Financial Economics, 3, 126–145.

Parkinson, M. (1980): «The Extreme Value Method for Estimating the Variance of the Rate of Return”, Journal of Business 53, 61–65.

Press, S.J. (1967): «A Compound Events Model for Security Prices”, Journal of Business 40, 317–335.

Rogalski, R. (1978): «Variances and Option Prices in Theory and Practice”, Journal For Portfolio Management, 4, 43–51.

Rosenberg, B. (1972): “The Behavior of Random Variables with Nonstationary Variance and the Distribution of Security Prices”, unpublished manuscript (University of California, Berkeley).

Rubinstein, M. (1983): «Displaced Diffusion Option Pricing”, Journal of Finance 38, 213–217.

Rubinstein, M. (1985): «Nonparametric Tests of Alternative Option Pricing Models Using All Reported Trades and Quotes on the 30 most active CBOE Option Classes from August 23, 1976 through August 31, 1978”, Journal of Finance 40, 455–480.

Tukey, J. (1960): “A Survey of Sampling from Contaminated Distributions”, in Contributions to Probability and Statistics (Stanford University Press, Stanford, California).

Whaley, R. (1981): «On the Valuation of American Call Options On Stock with Known Dividends”, Journal of Financial Economics, 9, 207–212.

Wichman, B. andI. Hill (1982): «An Efficient and Portable Pseudo-Random Number Generator”, Applied Statistics 311, 188–190.

Author information

Authors and Affiliations

Additional information

We would like to thank Richard Roll, Mark Rubinstein, and seminar participants at Stanford University for helpful comments. Brian Betker and Kwan-Ho Kim provided excellent research assistance.

Rights and permissions

About this article

Cite this article

Geske, R., Torous, W. Skewness, kurtosis, and black-scholes option mispricing. Statistical Papers 32, 299–309 (1991). https://doi.org/10.1007/BF02925505

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02925505