Abstract

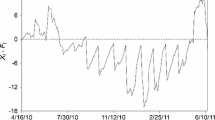

This paper examines the behavior of near term S&P 500 index futures contract prices in the context of the theory of normal backwardation. Daily S&P 500 futures prices for 41 contracts over the 1982–1992 period are examined. There is no evidence that S&P 500 futures prices are biased estimates of the expected future spot price on expiration. Daily futures prices usually lie below the expected future spot price on expiration and usually rise over the contract period, but these price movements are not statistically significant. The surprising result of this study is the number of observations where backwardation appears not to hold. Furthermore, changes in the U.S. dollar exchange rates, the Tax Reform Act of 1986 and the switching of S&P 500 contracts quarterly expiration day had no significant effect on the behavior of S&P 500 futures prices.

Similar content being viewed by others

References

Ekman, Peter. “Intraday Pattern in the S&P 500 Index Futures Market.”Journal of Futures Markets 12, no. 4 (August 1992): 365–382.

Figlewski, Stephen. “Explaining the Early Discounts on Stock Index Futures: The Case for Disequilibrium.”Financial Analysts Journal 40, no. 4 (July–August 1984): 43–47.

Herbst, Anthony F. andEdwin D. Maberly. “Stock Index Futures, Expiration Day Volatility, and the ‘Special’ Friday Opening: A Note.”Journal of Futures Markets 10, no. 3 (June 1990): 323–325.

Keynes, John Maynard.A Treatise on Money. London: Macmillan, 1930, vol. 2.

Kolb, Robert W., James V. Jordan andGerald D. Gay. “Futures Prices and Expected Future Spot Prices.”Review of Research in Futures Markets 2, no. 1 (1983): 110–134.

Kolb, Robert W. “Is Normal Backwardation Normal?.”Journal of Futures Markets 12, no. 1 (February 1992): 75–91.

Kolb, Robert W. Understanding Futures Markets Miami: Kolb Publishing, 1994.

Merrick, John. “Portfolio Insurance with Stock Index Futures.”Journal of Futures Markets 8, no. 4 (August 1988): 441–455.

Peters, Edgar E. “The Growing Efficiency of Index Futures Markets.”Journal of Portfolio Management 11, no. 4 (Summer 1985): 52–56.

United States Government Printing Office.Economic Report of the President Transmitted to the Congress Washington D.C.: Annual Publication.

Zeckhauser, Richard, andVictor Niederhoffer. “The Performance of Market Index Futures Contracts.”Financial Analysts Journal 39, no. 1 (January–February 1983): 59–65.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hassan, M.M. S&P 500 futures market and the normal backwardation hypothesis. J Econ Finan 19, 85–103 (1995). https://doi.org/10.1007/BF02920616

Issue Date:

DOI: https://doi.org/10.1007/BF02920616