Abstract

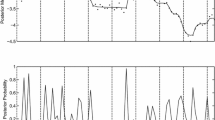

In this study, the impact of regression tendency and order bias on the calculated average residuals and around the event period is examined. The findings indicate that the abnormal return calculated with unadjusted parameters may lead to a misestimation of the true average residual. However, the bias due to regression tendency and order bias may not change the essential conclusions about the significance of the residuals if they are highly significant. However, for residuals that are borderline statistically significant, compensation for order bias and regression tendency may be important. In addition, if the magnitude of the abnormal return is of interest, residuals calculated with biased betas may over- or understate the true abnormal return. For small non-randomly selected samples, the differences in the residuals using unadjusted and order-bias-adjusted betas are more prominent. Therefore, the researcher should be aware of the impact that regression tendency and order bias can have on the interpretation of results.

Similar content being viewed by others

References

Bar-Yosef, Sasson, andLucy Huffman. “The Information Content of Dividends: A Signalling Approach”.Journal of Financial and Quantitative Analysis 21, no. 1 (March 1986), 47–58.

Blume, Marshall E. “On the Assessment of Risk”.Journal of Finance 26, no. 1 (March 1971), 1–10.

Blume, Marshall E. “Betas and Their Regression Tendencies”.Journal of Finance 30, no. 3 (June 1975), 785–795.

Blume, Marshall E.. “Betas and Their Regression Tendencies: Some Further Evidence.”Journal of Finance 34 no. 1 (March 1979), 265–267.

Carroll, Carolyn, andR. Stephen Sears. “Dividend Announcements and Changes in Beta: A Regression Tendency”.Financial Review 29, no. 3 (August 1994): 371–393.

Chan, Kam C., Benton E. Gup, andMing Shiun Pan. “An Empirical Analysis of Stock Prices in Major Asian Markets and the United States”.Financial Review 27, no. 2 (May 1992): 289–307

Charest, Guy. “Dividend Information, Stock Returns and Market Efficiency”.Journal of Financial Economics 6, no. 3 (September 1978), 297–330.

Dielman, Terry E. andHenry R. Oppenheimer. “An Examination of Investor Behavior during Periods of Large Dividend Changes”.Journal of Financial and Quantitative Analysis 19, no. 2 (June 1984), 197–216.

Eades, Kenneth. “Empirical Evidence on Dividends as a Signal of Firm Value.”Journal of Financial and Quantitative Analysis 17, no. 4 (November 1982) 471–500.

Elgers, Pieter T., James R. Haltiner, andWilliam H. Hawthorne. “Beta Regression Tendencies: Statistical and Real Causes”.Journal of Finance 34, no. 1 (March 1979): 261–263.

Foster, Taylor W. III,Don R. Hansen andDon W. Vickrey. “Additional Evidence on the Abatement of Errors in Predicting Beta Through Increases in Portfolio Size and on the Regression Tendency”.Journal of Business Finance and Accounting 15, no. 2 (Summer 1988): 185–197.

Goldberg, Michael A.. “An Explanation of Security Beta Regression Tendencies”.Southern Economic Journal 47, no. 3 (January 1981): 809–815.

Gooding, Arthur E. andTerence P. O'Malley. “Market Phase and the Stationarity of Beta”.Journal of Financial and Quantitative Analysis 12, no. 5 (December 1977): 833–857.

Iqbal, Zahid, andPrakash L. Dheeriya. “A Comparison of the Market Model and Random Coefficient Model Using Mergers as an Event”.Journal of Economics and Business 43, no. 1 (February 1991): 87–93.

Klemkosky, Robert C. andJohn D. Martin. “The Adjustment of Beta Forecasts”.Journal of Finance 30, no. 4 (September 1975): 1123–1128.

Kolb, Robert W. andRicardo J. Rodriques. “The Regression Tendencies of Betas: A Reappraisal”.Financial Review 24, no. 2 (May 1988): 319–334.

Lee, Cheng F. andCarl R. Chen. “Beta Stability and Tendency: An Application of a Variable Mean Response regression Model”.Journal of Economics and Business 34, no. 3 (August 1982): 201–206.

Lockwood, Larry J. andK. Rao Kadiyala. “Risk Measurement for Event-Dependent Security Returns”.Journal of Business and Economic Statistics 6, no. 1 (January 1988): 43–49.

Mantripragada, Krishna G. “Beta Adjustment Methods”.Journal of Business Research 8, no. 3 (September 1980): 329–339.

Rozeff, Michael S. “Growth, Beta and Agency Costs as Determinants of Dividend Payout Ratios”.Journal of Financial Research 5, no. 3 (Fall 1982): 249–59.

Vasicek, Oldrich A.. “A Note on Using Cross-Sectional Information in Bayesian Estimation of Security Betas”.Journal of Finance 28, no. 5 (December 1973): 1233–1239.

Woolridge, J. Randall. “The Informational Content of Dividend Changes”.Journal of Financial Research 5, no. 3 (Fall 1982): 237–247.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Carroll, C., Fok, R.C.W. Adjusted beta responses to dividend announcements. J Econ Finan 19, 75–92 (1995). https://doi.org/10.1007/BF02920216

Issue Date:

DOI: https://doi.org/10.1007/BF02920216