Abstract

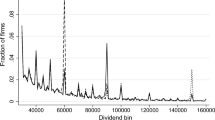

We examine managers’ adjustment of dividends to information about earnings. We base our analysis on a ‘permanent earnings’ model of dividend behavior, which implies that dividends are changed primarily in response to permanent changes in earnings; transitory earnings changes have little or no effect on dividends. Within the permanent earnings framework, the permanent component of earnings may be the predominant factor affecting dividend payouts, or it may be one of the important factors affecting dividends. In the former case earnings and dividends are co-integrated; in the latter they are not.

Using a sample of 337 firms over the 40 year period from 1950–1989, we find the data to be strongly consistent with the permanent earnings model. We also find that the data are more consistent with a model that relates dividend and earnings changes rather than levels. Thus, we conclude that earnings and dividends are not co-integrated. This contrasts with the implicitly co-integrated (levels) dividend model of Lintner (1956), and indicates that factors other than the permanent component of earnings, such as tax policy, clientele effects, transaction costs, etc. may have a significant impact on the long-run behavior of dividends.

Similar content being viewed by others

References

Aharony, Joseph, and Itzchak Swary. (1980) “Quarterly Dividend and Earnings Announcements and Stockholder Returns: An Empirical Analysis”.Journal of Finance 35, 1–12.

Beaver, William. (1981)Financial Reporting: An Accounting Revolution. Englewood Cliffs: Prentice Hall.

Bernard, Victor L., and Jacob Thomas. (1990) “Evidence That Stock Prices Do Not Fully Reflect the Implications of Current Earnings for Future Earnings”.Journal of Accounting and Economics 13, 305–340.

Brealey, Richard, and Stewart Myers. (1988)Principles of Corporate Finance, Third Edition. New York: McGraw-Hill.

Carroll, Thomas J. (1995) “The Information Content of Quarterly Dividend Changes”.Journal of Accounting. Auditing, and Finance 10, 293–317.

Choe, Hyuk. (1990) “Intertemporal and Cross-Sectional Variation of Corporate Dividend Policy.” Unpublished doctoral dissertation, University of Chicago.

Christie, Andrew A. (1987) “On Cross-Sectional Analysis in Accounting Research”.Journal of Accounting and Economics 9, 231–258.

Collins, Daniel W., and S. P. Kothari. (1989) “An Analysis of Intertemporal and Cross-Sectional Determinants of Earnings Response Coefficients”.Journal of Accounting and Economics 11, 143–181.

Easton, Peter D. (1985) “Accounting Earnings and Security Valuation: Empirical Evidence of the Fundamental Links”.Journal of Accounting Research 23 Supplement, 54–77.

Easton, Peter D., and Mark Zmijewski. (1989) “Cross-sectional Variation in the Stock Market Response to Accounting Earnings Annoucements”.Journal of Accounting and Economics 11, 117–141.

Engle, Robert, and Clive W. Granger. (1987) “Co-integration and Error Correction: Representation, Estimation, and Testing”.Econometrica 55, 251–276.

Fama, Eugene F., and Harvey Babiak. (1968) “Dividend Policy: An Empirical Analysis”.Journal of the American Statistical Association 53, 1132–1161.

Feltham, Gerald A., and James A. Ohlson. (1994) “A No Arbitrage Valuation Model Based on Anticipated Realizations of Accounting Data.” Working paper. University of British Columbia and Columbia University.

Flavin, Marjorie. (1981) “The Adjustment of Consumption to Changing Expectations About Future Income”.Journal of Political Economy, 89, 974–1009.

Friedman, Milton. (1957)A Theory of the Consumption Function. Princeton: Princeton University Press.

Hall, Robert E. (1978) “Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence”.Journal of Political Economy 86, 971–987.

Healy, Paul M., and Krishna Palepu. (1988) “Earnings Information Conveyed by Dividend Initiations and Omissions”Journal of Financial Economics 21, 149–175.

Kleidon, Allan. (1986) “Variance Bounds Tests and Stock Price Valuation Models”.Journal of Political Economy 94, 953–1001.

Kormendi, Roger, and Laura LaHaye. (1987) “Cross-Regime Tests of the Permanent Income Hypothesis.” Working paper, University of Michigan.

Kormendi, Roger, and Robert Lipe. (1987) “Earnings Innovations, Earnings Persistence, and Stock Returns”.Journal of Business 60, 323–345.

Kormendi, Roger, and Philip Meguire. (1990) “Government Debt, Government Spending, and Private Sector Behavior: Reply and Update”.American Economic Review 80, 604–617.

Lee, Bong-Soo. (1995) “Time-Series Implications of Aggregage Dividend Behavior.” Working paper, University of Minnesota.

Lintner, John. (1956) “The Distribution of Incomes of Corporations Among Dividends, Retained Earnings and Taxes”.American Economic Review 46, 97–113.

Marsh, Terry A., and Robert Merton. (1986) “Dividend Variability and Variance Bounds Tests for the Rationality of Stock Market Prices”.American Economic Review 76, 483–498.

Marsh, Terry A., and Robert Merton. (1987) “Dividend Behavior for the Aggregate Stock Market”.Journal of Business 60, 1–40.

Miller, Merton H. (1987) “The Informational Content of Dividends”. In:Macroeconomics and Finance: Essays in Honor of Franco Modigliani. Cambridge: MIT Press.

Miller, Merton H., and Franco Modigliani. (1961) “Dividend Policy, Growth and the Valuation of Shares”.Journal of Business 34, 411–433.

Miller, Merton H., and Franco Modigliani. (1966) “Some Estimates of the Cost of Capital to the Electric Utility Industry, 1954–57”.American Economic Review 56, June, 333–391.

Miller, Merton H., and Kevin Rock. (1985) “Dividend Policy Under Asymmetric Information”.Journal of Finance 40, 1031–1051.

Ohlson, James A. (1989) “Ungarbled Earnings and Dividends: An Analysis and Extension of the Beaver, Lambert, and Morse Valuation Model”.Journal of Accounting and Economics, 11, 109–115.

Shiller, Robert. (1981) “Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?”.American Economic Review 71, 421–436.

Shiller, Robert. (1986) “The Marsh-Merton Model of Managers’ Smoothing of Dividends”.American Economic Review, 76, 499–503.

Shiller, Robert. (1990) “Market Volatility and Investor Behavior”.American Economic Review 80, 58–65.

Stock, James. (1988) “A Reexamination of Friedman’s Consumption Puzzle”.Journal of Business and Economic Statistics 6, 401–407.

Watts, Ross. (1973) “The Information Content of Dividends”.Journal of Business 46, 191–211.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Kormendi, R., Zarowin, P. Dividend policy and permanence of earnings. Rev Acc Stud 1, 141–160 (1996). https://doi.org/10.1007/BF02918229

Issue Date:

DOI: https://doi.org/10.1007/BF02918229