Abstract

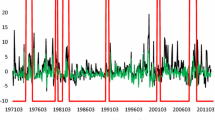

We use the NYSE industrial index, the NYSE utility index, and the NASDAQ industrial index to examine the relationship between short-run and long-run volatility. We establish that the NASDAQ index has substantially more daily volatility than the NYSE indices. The initial examination shows that the individual U-shaped intraday patterns of the two NYSE indices are roughly similar in both position and shape, while we find that NASDAQ U-shaped pattern is distinctively different in both position and shape. However, after controlling for conditional volatility in a GARCH model, the U-shaped intraday volatility patterns of all three indices are similar.

Similar content being viewed by others

References

Admati, A., and P. Pfleiderer. 1988. “A Theory of Intraday Patterns: Volume and Price Variability.”The Review of Financial Studies 1:3–40.

Andersen, T., and T. Bollerslev. 1997. “Intraday Periodicity and Volatility Persistence in Financial Markets.”Journal of Empirical Finance 4:115–158.

Bollerslev, T., R. Chou, and K. Kroner. 1992. “ARCH Modeling in Finance.”Journal of Econometrics 52:5–59.

Bollerslev, T., and H. Mikkelsen. 1996. “Modeling and Pricing Long Memory in Stock Market Volatility.”Journal of Econometrics 73:151–184.

Brock, W., and A. Kleidon. 1992. “Periodic Market Closure and Trading Volume.”Journal of Economic Dynamics and Control 16:451–489.

Chou, R. 1988. “Volatility Persistence and Stock Valuation: Some Empirical Evidence Using GARCH.”Journal of Applied Econometrics 3:279–294.

Cyree, K., and D. Winters. 2001. “An Intraday Examination of the Federal Funds Market: Implications for the Theoreies of the Reverse-J Pattern.”Journal of Business 74:535–556.

Dimson, E. 1979. “Risk Measurement When Shares Are Subject to Infrequent Trading.”Journal of Financial Economics 7:197–226.

Ito, Takatoshi, and Wen-Ling Lin. 1992. “Lunch Break and Intraday Volatility of Stock Returns: An Hourly Data Analysis of Tokyo and New York and Stock Markets.”Economic Letters 39:85–90.

Lockwood, L., and S. Linn. 1990. “An Examination of Stock Market Return Volatility During Overnight and Intraday Periods, 1964–1989.”Journal of Finance45:591–601.

Scholes, M., and J. Williams. 1977. “Estimating Betas from Nonsynchronous Data.”Journal of Financial Economics 5:309–327.

Woods, R., T. McInish, and K. Ord. 1985. “An Investigation of Transactions Data for NYSE Stocks.”Journal of Finance 40:723–739.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank seminar participants at the 2001 FMA and 2004 AEF meetings for their comments. We also wish to thank Junsoo Lee for his inputs on time-series econometrics. The views expressed in this paper are those of the authors and do not represent the views of the Federal Reserve Bank of St. Louis or the Board of Governors of the Federal Reserve System.

Rights and permissions

About this article

Cite this article

Hughes, M.P., Winters, D.B. & Rawls, J.S. What is the source of different levels of time-series return volatility? the intraday U-shaped pattern or time-series persistence. J Econ Finan 29, 300–312 (2005). https://doi.org/10.1007/BF02761576

Issue Date:

DOI: https://doi.org/10.1007/BF02761576