Abstract

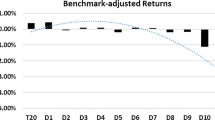

The purpose of this article is to introduce the statistical technique of meta-analysis of regression results using as our example the Lee and Rahmann (1990) study of the performance of 93 mutual funds. Specifically, we derive and estimate the meta-analysis formulas, explicitly adjusted for correlated regression residuals, which quantify the effect of sampling error on their reported regression results. Our analysis of selectivity reveals some real variation around a mean risk-adjusted excess return of about 1% per year; while our analysis of market timing reveals some real variation around a negative mean value and confirms that the correction for heteroscedasticity does make a difference. An examination of the 80% probability interval for the mean selectivity value indicates that the best mutual funds can deliver substantial risk-adjusted excess returns.

Similar content being viewed by others

References

Bhattacharya, S and Pfleiderer, P., “A Note on Performance Evaluation.” Technical Report No. 714, Graduate School of Business, Stanford University, Stanford, CA (1983).

Birge, R.T., “The Calculation of Errors by the Method of Least Squares.”Physical Review 40, 207–227, (1932).

Breen, W., Jagannathan, R. and Ofer, A.R., “Correcting for Heteroscedasticity in Tests for Market Timing.”Journal of Business 59, 585–598, (1986).

Chang, E.C. and Lewellen, W.G., “Market Timing and Mutual Fund Investment Peformance.”Journal of Business 56, 57–72, (1984).

Christie, A.A., “Aggregation of Test Statistics.”Journal of Accounting and Economics 12, 15–36, (1990).

Chua, J.H. and Woodward, R.S.,Gains from Market Timing. Monograph No. 1986-2, Graduate School of Business Administration, New York University, New York, NY (1986).

Coggin, T.D. and Hunter, J.E., “Problems in Measuring the Quality of Investment Information.”Financial Analysts Journal 39, 25–33, (1983).

Coggin, T.D. and Hunter, J.E., “A Meta-Analysis of Pricing ‘Risk’ Factors in APT.”Journal of Portfolio Management 14, 35–38, (1987).

Cohen, J.,Statistical Power Analysis for the Behavioral Sciences. 2nd ed., Hillsdale, NJ: Lawrence Erlbaum Associates, (1988).

Connor, G. and Korajczyk, R.A., “The Attributes, Behavior and Performance of U.S. Mutual Funds.”Review of Quantitative Finance and Accounting 1, 5–26, (1991).

Dimson, E. and Marsh, P., “An Analysis of Brokers' and Analysts' Unpublished Forecasts of UK Stock Returns.”Journal of Finance 39, 1257–1292, (1984).

Farley J.U. and Lehmann, D.R.,Meta-Analysis in Marketing. Lexington, MA: Lexington Books, 1986.

Glass, G.V., “Primary, Secondary and Meta-Analysis of Research.”Educational Researcher 5, 3–8, (1976).

Glass, G.V., “Integrating Findings.”Review of Research in Education 5, 351–379, (1977).

Grinblatt, M. and Titman, S., “Mutual Fund Performance.”Journal of Business 62, 393–416, (1989).

Halvorsen, K.T., “Combining Results from Independent Investigations.” in J.C. Bailar and F. Mosteller, eds.,Medical Uses of Statistics. Waltham, MA: NEJM Books, 1986.

Hedges, L.V. and Olkin, I.,Statistical Methods for Meta-Analysis. Orlando, FL: Academic Press, 1985.

Henriksson, R.D., “Market Timing and Mutual Fund Performance.”Journal of Business 57, 73–96, (1984).

Henriksson, R.D. and Merton, R.C., “On Market Timing and Investment Performance II.”Journal of Business 54, 513–533, (1981).

Hunter, J.E. and Coggin, T.D., “The Sampling Error in the Average Correlation.” Working Paper, Michigan State University, East Lansing, MI (1992).

Hunter, J.E., Coggin, T.D. and Rahman, S., “The Correlation Between Sampling Errors in Estimating Security Selection and Market Timing Ability.” Working Paper, Michigan State University, East Lansing, MI (1992).

Hunter, J.E. and Schmidt, F.L.,Methods of Meta-Analysis. Newbury Park, CA: Sage Publications, 1990.

Jagannathan, R. and Korajczyk, R.A., “Assessing the Market Timing Performance of Managed Portofolios.”Journal of Business 59, 217–235, (1986).

Johnston, J.,Econometric Methods. 3rd ed., New York, NY: McGraw-Hill, 1984.

Kon, S.J., “The Market-Timing Performance of Mutual Fund Managers.”Journal of Business 56, 323–347, (1983).

Lee, C.F. and Rahman, S. “Market Timing, Selectivity, and Mutual Fund Performance.”Journal of Business 63, 261–278, (1990).

Lehmann, B.N. and Modest, D.M., “Mutual Fund Performance Evaluation.”Journal of Finance 42, 233–265, (1987).

Schmidt, F.L. and Hunter, J.E., “Development of a General Solution to the Problem of Validity Generalization.”Journal of Applied Psychology 62, 529–540, (1977).

Thorndike, R.L.,Applied Psychometrics, Boston, MA: Houghton Mifflin, 1982.

Treynor, J.L. and Mazuy, K., “Can Mutual Funds Outguess the Market?”Harvard Business Review. 44 131–136 (1966).

Trotman, K.T. and Wood, R., “A Meta-Analysis of Studies on Internal Control Judgments.”Journal of Accounting Research 29, 180–192 (1991).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Coggin, T.D., Hunter, J.E. A meta-analysis of mutual fund performance. Rev Quant Finan Acc 3, 189–201 (1993). https://doi.org/10.1007/BF02407005

Issue Date:

DOI: https://doi.org/10.1007/BF02407005