Abstract

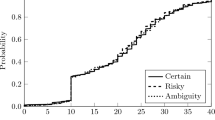

This paper studies the truth-inducing property of a class of budget-variance-based payment schemes calledkinked linear schemes. In these schemes, the manager is either paid a bonus proportional to a favorable budget variance, or charged a penalty proportional to an unfavorable budget variance. With the penalty rate higher than the bonus rate per unit variance, the payment to the manager is piecewise linear in the actual output and kinked at the budgeted output. This paper shows that participative budgeting with kinked linear compensation schemes can induce truthful reporting of expected output from an informed manager even when the manager can shift the underlying output distribution by his unobservable efforts. Furthermore, participative budgeting with kinked linear payment schemes can achieve optimal contracting between a risk-neutral manager and a risk-neutral owner even in a setting where a menu of linear payment schemes cannot.

Similar content being viewed by others

References

Bonin, J., “On the Design of Managerial Incentive Structures in a Decentralized Planning Environment.”The American Economic Review 66, No. 4, p. 682–687, (September 1976).

Bonin, J. and W. Fukuda, “Controlling a Risk-Averse, Effort-Selecting Manager in the Soviet Incentive Model.”Journal of Comparative Economics 11 pp. 221–233, (1987).

Bonin, J. and A. Marcuse, “Information, Motivation, and Control in Decentralized Planning: the Case of Discretionary Managerial Behavior.”Journal of Comparative Economics 3 pp. 235–253, (1979).

Cailaud, B., R. Guesnerie and P. Rey, “Noisy Observation in Adverse Selection Models.’ 1988, Working paper.

Chow, C., J. Cooper and W. Waller, “Participative Budgeting: Effects of a Truth-Inducing Pay Scheme and Information Asymmetry on Slack and Performance”The Accounting Review LXIII, No. 1, pp. 111–122, (January 1988).

Fan, L., “On the Reward System.”The American Economic Review 65, No. 1, pp. 226–229, (March, 1975).

Gonik, J., “Tie Salesmen's Bonuses to Their Forecast.”Harvard Business Review (May–June 1978).

Holmstrom, B., “Design of Incentive Schemes and the New Soviet Incentive Model.”European Economic Review. 17, pp. 127–148, (1982).

Horngren, C. and G. Foster,Cost Accounting: A Managerial Emphasis. 7th ed., Englewood Cliffs, NJ: Prentice-Hall, 1991.

Ijiri, Y., J. Kinard and F. Putney, “An Integrated Evaluation System for Budget Forecasting and Operating Performance.”Journal of Accounting Research pp. 1–11, (Spring, 1968).

Kaplan, R. and A. Atkinson,Advanced Management Accounting. 2nd Edition, Englewood Cliffs, NJ: Prentice-Hall Inc., 1989.

Kirby, A., S. Reichelstein, P. Sen and T. Paik, “Participation, Slack, and Budget-Based Performance Evaluation.”Journal of Accounting Research, pp. 109–128, (Spring 1991).

Laffont, J. and J. Tirole, “Using Cost Observation to Regulate Firms.”Journal of Political Economy, 1986.

Magee, R.,Advanced Managerial Accounting. NY: Harper & Row, Publisher, 1986.

McAfee, R. and J. McMillan, “Competition for Agency Contracts.”Rand Journal of Economics, 18, No. 2, pp. 296–307, (Summer 1987).

Melumad, N. and S. Reichelstein, “Value of Communication in Agencies.”Journal of Economic Theory, 47, pp. 334–368, 1989.

Miller, J. and J. Thornton, “Efforts, Uncertainty, and the New Soviet Incentive Scheme.”Southern Economic Journal, pp. 432–446, (October, 1978).

Paik, T., “Optimal Input Combination with Asymmetric Information.” Working paper, 1992.

Paik, T. and P. Sen, “Project Evaluation and Control in Decentralized Firms: Is Capital Rationing Always Optimal?” 1992, Working paper.

Picard, P., “On the Design of Incentive Schemes Under Moral Hazard and Adverse Selection.”Journal of Public Economics 33, No. 3, (August 1987).

Ramakrishnan, R., “Participative Budgeting and Performance Evaluation with Precontractual Asymmetric Information.” April 1986, Working paper.

Rogerson, W., “On the Optimiality of Menus of Linear Contracts.” 1987, Northwestern University, Working paper.

Sen, P. and T. Paik, “Role of Budget Variance in Controlling Discretionary Expenditure.” 1989, Working paper.

Snowberger, V., “The New Soviet Incentive Model: Comment.”Bell Journal of Economics, pp. 591–600, (Autumn 1977).

Waller, W., “Slack in Participative Budgeting: the Join Effect of a Truth-inducing Pay Scheme and Risk Preferences.”Accounting, Organizations and Society No. 1 pp. 87–98, (1988).

Weitzman, M., “The New Soviet Incentive Model.”Bell Journal of Economics, pp. 251–257, (Spring 1976).

Yeom, S., K. Balachandran and J. Ronen, “Piecewise Linear Incentive Scheme and Participative Budgeting.”Review of Quantitative Finance and Accounting 3, No. 1, 1993.

Author information

Authors and Affiliations

Additional information

This paper is based on my dissertation at University of California-Berkeley. I am grateful to my dissertation committee members (P.K. Sen, Nils Hakansson, and Robert Anderson), and other faculty members at the University of California-Berkeley. I thank anonymous referees, my colleagues at New York University, and the participants at the 1991 annual meetings of the American Accounting Association and the European Accounting Association for their helpful comments.

Rights and permissions

About this article

Cite this article

Paik, TY. Participative budgeting with kinked linear payment schemes. Rev Quant Finan Acc 3, 171–187 (1993). https://doi.org/10.1007/BF02407004

Issue Date:

DOI: https://doi.org/10.1007/BF02407004