Abstract

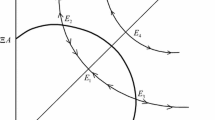

This paper considers an exhaustible resource market where firms realize economies of scale in the production of the resource, and may augment reserves through exploration. With the non-convexities inherent in this model, the typical firm's optimal decisions are corner solutions. It either operates at full intensity or not at all. Firms with larger current reserves have a greater incentive to produce today; firms with smaller reserves will tend to hold their reserves for production at a later date. It follows that the market supply curve in any given period is a step function. As price rises, production increases discontinuously: at discrete intervals, the marginal firm will change from not producing today to producing all of its reserves. With such a supply curve, the market may or may not clear. Simulation of this model suggests: (i) the chance of market clearing in any period is near 1/2; (ii) such an industry is unlikely to exhibit a significant increase in concentration over time.

Similar content being viewed by others

References

Charles Rivers Associates,Uranium Price Formation, Electric Power Research Institute report no. EA-498, Palo Alto, California, 1977.

Eswaran, Hukesh, Tracy R. Lewis, and Terry Heaps, “On the Nonexistence of Market Equilibria in Exhaustible Resource Markets with Decreasing Costs,”Journal of Political Economy, 91 (February 1983), pp. 154–167.

Hotelling, H., “The Economics of Exhaustible Resources,”Journal of Political Economy, 39 (1931), pp. 137–175.

Lewis, Tracy R., Steven A. Matthews, and H. Stuart Burness, “Monopoly and the Rate of Extraction of Exhaustible Resources: Note,”American Economic Review, 69, (March 1979), pp. 227–230.

— and Richard Schmalansee, “On Oligopolistic Markets for Nonrenewable Resources,”Quarterly Journal of Economics, 95 (November 1980), pp. 475–491.

Mason, C.F.,Regulation and Information in the U.S. Uranium Industry, unpublished Ph.D. thesis, University of California, Berkeley, 1983.

Mason, C.F., “Scale Economies and Exhaustible Resource Markets,” University of Wyoming working paper, 1984.

Nelson, R.R. and S.G. Winter, “Forces Generating and Limiting Concentration Under Schumpeterian Competition,”Bell Journal of Economics, 9 (1978), pp. 524–548.

Oleweiler, Nancy D. “Capacity Constraints and Destructive Competition in the Extraction of Non-renewable Natural Resources,” Discussion paper no. 421, Queen's University, 1981.

Zimmerman, M.B., “Modeling Depletion in a Mineral Industry: The Case of Coal,”Bell Journal of Economics, 8 (1977), pp. 41–65.

Additional information

Department of Economics, University of Wyoming, Laramie, WY 82071. I thank d'Arge, Bruce Forster, Ed Gallick, Jack Multi, and Todd Sander for helful coments. Any remaining errors are my responsibility.

Rights and permissions

About this article

Cite this article

Mason, C.F. On scale economies and exhaustible resource markets. Rev Ind Organ 2, 144–159 (1985). https://doi.org/10.1007/BF02354218

Issue Date:

DOI: https://doi.org/10.1007/BF02354218