Abstract

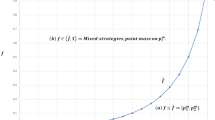

In this paper we provide a sufficient condition for collusive outcomes in a single-shot game of simultaneous price choice in a homogeneous product market with symmetric firms and strictly convex costs. We also prove the counterintuitive result: if the second derivative of the cost function is nonincreasing in output, it is easier to sustain collusion when the number of firms increases.

Similar content being viewed by others

References

Benoit, J.-P., and Krishna, V. (1985): “Finitely Repeated Games.”Econometrica 53: 890–904.

Bulow, J., Geanakoplos, J., and Klemperer, P. (1985): “Multimarket Oligopoly: Strategic Substitutes and Complements.”Journal of Political Economy 93: 488–511.

Dastidar, K. G. (1993): “On Some Aspects of Oligopolistic Behaviour: a Game Theoretic Analysis.” Unpublished Ph.D. Dissertation, Centre for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University, New Delhi.

(1995): “On the Existence of Pure Strategy Bertrand Equilibrium.”Economic Theory 5: 19–32.

(1999): “Perfect Cartelisation in Price Competition.” Working Paper no. 2/99, Centre for Economic Studies and Planning, School Of Social Sciences, Jawaharlal Nehru University, New Delhi.

Dixon, H. (1990): “Bertrand-Edgeworth Equilibria when Firms Avoid Turning Customers Away.”Journal of Industrial Economics 39: 131–146.

Friedman, J. (1971): “A Non Cooperative Equilibrium for Supergames,”Review of Economic Studies 28: 1–12.

Kreps, D., Milgrom, P., Roberts, J. and Wilson, R. (1982): “Rational Cooperation in the Finitely Repeated Prisoner's Dilemma.”Journal of Economic Theory 27: 245–252.

Stahler, F. (1997): “Bertrand Competition under Convex Cost Functions: Some Extensions.” Mimeo, Kiel Institute of World Economics, Kiel, Germany.

Salop, S. (1986): “Practices that Credibly Facilitate Oligopoly Coordination.” InNew Developments in the Analysis of Market Structure, edited by J. Stiglitz and F. Mathewson. Cambridge, Mass.: MIT Press.

Tirole, J. (1988):Industrial Organisation Theory. Cambridge, Mass.: MIT Press.

Vives, X. (1990): “Nash Equilibrium with Strategic Complementarities.”Journal of Mathematical Economics 19: 305–321.

(1999):Oligopoly Pricing: Old Ideas and New Tools. Cambridge, Mass.: MIT Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Dastidar, K.G. Collusive outcomes in price competition. Zeitschr. f. Nationalökonomie 73, 81–93 (2001). https://doi.org/10.1007/BF02339582

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02339582