Abstract

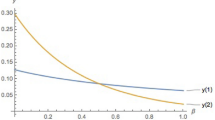

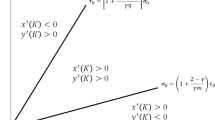

This paper deals with an oligopolistic industry where firms are engaged in cost-reducting R&D activity to maximize their market shares. The existence and uniqueness of a feedback-Nash-optimal R&D strategy for each firm are discussed. Our simulations highlight that variations in spillovers hardly influence the firms' R&D investment, if their absorptive capacities to exploit extramural knowledge depend on their R&D efforts. Moreover, extramural knowledge cannot completely replace in-house R&D. However, a high level of public R&D favors the firm with the most restrictive R&D expenditure constraint and/or with the lowest initial R&D stock, provided it invests in R&D.

Similar content being viewed by others

References

Arrow, K. J. (1962): “Economic Welfare and the Allocation of Resources for Invention.” InThe Rate and Direction of Inventive Activity, edited by R. R. Nelson. Princeton: Princeton University Press.

Basar, T., and Olsder, G. J. (1995):Dynamic Noncooperative Game Theory, 2nd ed. New York: Academic Press.

Calderini, M., and Garrone, P. (1998): “R&D Allocation: an Evolutionary Perspective on Italy's Telecom Market.” Discussion Paper, International Telecommunications Society, 12th International Conference, Stockholm, June 21–24.

Campisi, D., Mancuso, P., and Nastasi, A. (1997): “Cost Reduction, Competitive Pressure and Firms Optimal R&D Strategies in a Duopolistic Industry.”Review of Industrial Organization 12: 259–270.

Cohen, W. M. (1995): “Empirical Studies of Innovative Activity.” InHandbook of the Economics of Innovation and Technological Change, edited by P. Stoneman. Oxford: Blackwell.

Cohen, W. M., and Levinthal, D. A. (1989): “Innovation and Learning: the two Faces of R&D.”Economic Journal 99: 569–596

Dasgupta, P. S., and Stiglitz, J. E. (1980): “Uncertainty, Industrial Structure and the Speed of R&D.”Bell Journal Of Economics 11: 1–28.

D'Aspremont, C., and Jacquemin, A. (1988): “Cooperative and Noncooperative R&D in Duopoly with Spillovers.”American Economic Review 78: 1133–1137.

Friedman, J. W. (1990):Game Theory with Applications to Economics, 2nd ed. New York: Oxford University Press.

Fudenberg, D., Gilbert, R., Stiglitz, J., and Tirole, J. (1983): “Preemption, Leapfrogging and Competition in Patent Races.”European Economic Review 22: 3–31.

Grossman, G. M., and Shapiro, C. (1987): “Dynamic R&D Competition.”Economic Journal 97: 372–387.

Harris, C., and Vickers, J. (1985): “Perfect Equilibrium in a Model of a Race.”Review of Economic Studies 52: 193–209.

Kamien, M. I., Muller, E., and Zang, I. (1992): “Research Joint Ventures and R&D Cartels.”American Economic Review 82: 1293–1306.

Levin, R. C., Klevorick, A. K., Nelson, R. R., and Winter, S. G. (1987): “Appropriating the Returns from Industrial R&D.”Brooking Papers on Economic Activity 3: 783–820.

Loury, G. C. (1979): “Market Structure and Innovation.”Quarterly Journal of Economics 93: 395–410.

Mansfield, E. (1986): “Patents and Innovation: an Empirical Study.”Management Science 32: 173–181.

Nelson, R. R. (1959): “The Simple Economics of Basic Sesearch.”Journal of Political Economics 67: 297–306.

Reinganum, J. (1981): “Dynamic Games of Innovation.”Journal of Economic Theory 25: 21–41.

(1982): “A Dynamic Game of R&D: Patent Protection and Competitive Behavior.”Econometrica 50: 671–688.

(1985): “Innovation and Industry Evolution.”Quarterly Journal of Economics 99: 81–99.

Rosen, J. B. (1965): “Existence and Uniqueness of Equilibrium Points for ConcaveN-Person Games.”Econometrica 33: 520–534.

Rosenberg, N. (1994):Exploring the Black Box. Cambridge: Cambridge University Press.

Spence, A. M. (1984): “Cost Reduction, Competition, and Industry Performance.”Econometrica 52: 101–121.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Campisi, D., Mancuso, P. & Nastasi, A. R&D competition, absorptive capacity, and market shares. Zeitschr. f. Nationalökonomie 73, 57–80 (2001). https://doi.org/10.1007/BF02339581

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02339581

Keywords

- cost-reducing R&D

- stock of technological knowledge

- extra-industry R&D

- dynamic noncooperative feedback game