Abstract

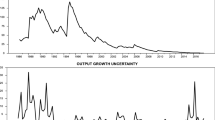

The empirically documented regularity that dis-inflationary shocks are associated with larger output changes than are positive shocks presents an interesting puzzle to macroeconomists. This paper presents, and empirically supports, a new explanation for this asymmetry. The authors show, using a TARCH model, that negative inflationary shocks result in greater inflation uncertainty than positive shocks. As Friedman [1977] argues, and a body of empirical evidence demonstrates, inflation uncertainty leads to lower output growth. Drawing on this explanation, this essay points to an avenue by which the output asymmetry of inflationary shocks can be explained.

Similar content being viewed by others

References

Blanchard, Olivier. “The Lucas Critique and the Volcker Deflation,”The American Economic Review Papers and Proceedings, 74, 2, 1984, pp. 211–5.

Caporale, Tony; McKiernan, Barbara. “High and Variable Inflation: Further Evidence on the Friedman Hypothesis,”Economics Letters, 54, 1997, pp. 65–8.

Cover, James. “Asymmetric Effects of Positive and Negative Money Supply Shocks,”Quarterly Journal of Economics, 107, 4, 1992, pp. 1261–82.

Davis, George; Kango, Bryce. “On Measuring the Effect of Inflation Uncertainty on Real GNP Growth,”Oxford Economic Papers, 48, 1, 1996, pp. 163–75.

Friedman, Milton. “Nobel Lecture: Inflation and Unemployment,”Journal of Political Economy, 85, 1977, pp. 451–72.

Freidman, Milton; Schwartz, Anna.A Monetary History of the United States, 1867–1960, Princeton, New Jersey: Princeton University Press, 1963.

Glosten, L. R.; Jagannathan R.; Runkle D. “On the Relation Between the Expected Value and the Volatility of the Normal Excess Return on Stocks,”Journal of Finance, 48, 1993, pp. 1779–801.

Grier, Kevin B.; Perry, Mark. “The Effects of Real and Nominal Uncertainty on Inflation and Output Growth: Some GARCH-M Evidence,”Journal of Applied Econometrics, 15, 1, 2000, pp. 45–58.

Romer, Christina; Romer, David. “Does Monetary Policy Matter? A New Test in the Spirit of Friedman and Schwartz,”NBER Macroeconomics Annual, 4, 1989, pp. 121–70.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Caporale, B., Caporale, T. Asymmetric effects of inflation shocks on inflation uncertainty. Atlantic Economic Journal 30, 385–388 (2002). https://doi.org/10.1007/BF02298781

Issue Date:

DOI: https://doi.org/10.1007/BF02298781