Abstract

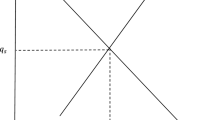

The recent instability in M1 velocity can be explained by recognizing that M1 consists of two types of transactions balances: those that are used for GDP transactions and those that are used for non-GDP transactions (mainly financial transactions). A model is developed to adjust for instability in the non-GDP transactions balancesvia measurements of portfolio adjustments between M1, non-M1 deposits, and nonbank assets. The model is much better in explaining post-1980 velocity instability, implying that portfolio adjustments induced by the rapid institutional change of this period are decisive factors in determining velocity changes. Also, an explanation of recent changes in V2 and V3 can be derived from the explanation of V1 changes.

Similar content being viewed by others

References

Baba, Y.; Hendry, D. F.; Starr, R. M. "The Demand for MI in the U.S.A., 1960–1988,"Review of Economic Studies, 59, 1992, pp. 25–61.

Bordo, M.; Jonung, L. "The Long-run Behavior of Velocity: The Institutional Approach Revisited,"Journal of Policy Modeling, 12, Summer 1990, pp. 165–97.

Carlson, J.; Byrne, S. "Recent Behavior of Velocity: Alternative Measures of Money," Federal Reserve Bank of Cleveland,Economic Review, 28, 1, Quarter 1 1992, pp. 2–10.

Darin, R.; Hetzel, R. L. "A Shift-Adjusted M2 Indicator For Monetary Policy," Federal Reserve Bank of Richmond,Economic Quarterly, 80, 3, Summer 1994, pp. 25–47.

Greenspan, Alan, testimony before the U.S. House of Representatives, Committee on Banking, Housing, and Urban Affairs, July 20, 1993, pp. 9–10.

Hetzel, R. "How Useful is M2 Today?," Federal Reserve Bank of Richmond,Economic Review, 78, 5, September/October 1992, pp. 12–26.

Higgins, Bryon. "Policy Implications of Recent M2 Behavior," Federal Reserve Bank of Kansas City,Economic Review, 77, 3, Quarter 3 1992, pp. 21–36.

Mehra, Y. "Has M2 Demand Become Unstable?," Federal Reserve Bank of Richmond,Economic Review, 78, 5, September/October 1992, pp. 27–32.

Siklos, P. L. "Income Velocity and Institutional Change: Some New Time Series Evidence, 1870 – 1986,"Journal of Money Credit and Banking, 25, 3, Part I, August 1993, pp. 377–92.

Stauffer, R. "The Recent Behavior of M2 Velocity,"Atlantic Economic Journal, 21, 3, September 1993, p. 92.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Stauffer, R.F. Back to basics: The key to the velocity puzzle is M1. International Advances in Economic Research 2, 12–20 (1996). https://doi.org/10.1007/BF02295152

Issue Date:

DOI: https://doi.org/10.1007/BF02295152