Abstract

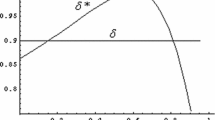

When a group of firms colludes on price, the industry price will rise even when there are some firms that do not participate in the conspiracy. If the government or private parties file antitrust suits, the noncolluders face the problem of establishing their innocence since their prices rise along with those of the colluders. We propose a simple output test. Under various models of oligopoly pricing—Bertrand, Cournot, and Stackelberg—we show that the colluders restrict their output while the noncolluders take advantage of the higher price by expanding their outputs. Thus, distinguishing between colluders and noncolluders involves simply observing the output behavior of the industry members.

Similar content being viewed by others

References

Bertrand, Joseph.Journal des Savants, (1883): 499–508.

Carlton, Dennis. "A Reexamination of Delivered Pricing Systems,"Journal of Law and Economics, 26 (April 1983), 51–70.

Cournot, Augustin.Recherches sur les Principes Mathematiques de la Theorie des Richesses, (1838) translated by Nathaniel T. Bacon (1927).

Elzinga, Kenneth. "New Developments on the Cartel Front,"Antitrust Bulletin, 29 (Spring 1984): 3–26.

Friedman, James.Oligopoly Theory, New York: Cambridge University Press, 1983.

Haddock, David. "Basing-Point Pricing: Competitive versus Collusive Theories,"American Economic Review, 72 (June 1982): 289–306.

Nash, John F. "Noncooperative Games,"Annals of Mathematics, 45 (1951): 286–295.

Posner, Richard. "Oligopoly and the Antitrust Laws: A Suggested Approach,"Stanford Law Review, 21 (June 1969): 1562–1606.

——. "Antitrust and Information: Reflections on theGypsum andEngineers Decisions,"Georgetown Law Journal, 67 (June 1979): 1187–1203.

Spence, Michael. "Tacit Co-ordination and Imperfect Information,"Canadian Journal of Economics, 11 (August 1978): 490–505.

Stackelberg, Heinrich von.The Theory of the Market Economy, translated by A.T. Peacock, London: William Hodge & Co., Ltd., 1952.

Stigler, George. "Notes on the Theory of Duopoly,"Journal of Political Economy, 48 (August 1940): 521–541.

——. "A Theory of Delivered Price Systems",American Economic Review, 39 (December 1949): 1143–1159.

——. "The Economic Effects of the Antitrust Laws,"Journal of Law and Economics 9 (October 1966): 225–258.

Turner, Donald. "The Definition of Agreement under the Sherman Act: Conscious Parallelism and Refusals to Deal,"Harvard Law Review, 75 (February 1962): 655–706.

Author information

Authors and Affiliations

Additional information

The authors appreciate the support of the Public Policy Research Center at the University of Florida. We regret that B&R Associates is purely imaginary as is the industry.

Rights and permissions

About this article

Cite this article

Blair, R.D., Romano, R.E. Proof of nonparticipation in a price fixing conspiracy. Rev Ind Organ 4, 101–117 (1989). https://doi.org/10.1007/BF02284663

Issue Date:

DOI: https://doi.org/10.1007/BF02284663