Abstract

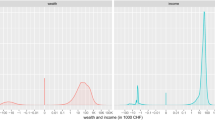

There are essentially two alternatives to analyse the impacts of tax reform proposals on risk-taking: the two-asset model and the certainty equivalent approach. Here risk-taking is defined in terms of the certainty equivalent approach. The paper discusses the effects of current tax reform proposals in the Federal Republic of Germany and in the United States with respect to risk-taking. Among others it is shown that there are unambiguous effects of the reform proposals as far as the upper income class is considered. Furthermore, the paper studies some impacts of the transition from the FRG-scheduleT 88 (coming into force at the beginning of 1988) to an intended schedule characterized by a linearly increasing marginal tax rate.

Similar content being viewed by others

References

S.M. Ahsan, Progression and risk-taking, Oxford Economic Papers 26 (1974) 318–328.

K.J. Arrow,Essays in the Theory of Risk-Bearing, Amsterdam-London (1970).

G. Bamberg and W.F. Richter, The effects of progressive taxation on risk-taking, Zeitschrift für Nationalökonomie 44 (1984) 93–102.

G. Bamberg and W.F. Richter, Risk-taking under progressive taxation: three partial effects, in:Measurement in Economics. Theory and Application of Economic Indices, eds. W. Eichhorn et al. (Physica-Verlag, Heidelberg, 1988) 479–497.

W. Buchholz, Die Wirkung progressiver Steuern auf die Vorteilhaftigkeit riskanter Investitionen, Zeitschrift für betriebswirtschaftliche Forschung 37 (1985) 682–690.

E.D. Domar and R.A. Musgrave, Proportional income taxation and risk-taking, Quarterly Journal of Economics 58 (1944) 388–422.

I. Friend and M.E. Blume, The demand for risky assets, American Economic Review 65 (1975) 900–922.

J. Mossin, Taxation and risk-taking: an expected utility approach, Economica 35 (1968) 74–82.

J.W. Pratt, Risk-aversion in the small and in the large, Econometrica 32 (1964) 122–136.

M.K. Richter, Cardinal utility, portfolio selection, and taxation, Review of Economic Studies 27 (1960) 152–166.

W.F. Richter, Modelltheoretische Analyse der Steuertarifreform 1986/88 und ihrer dämpfenden Wirkung auf die Risikobereitschaft im mittleren Einkommensbereich, Zeitschrift für betriebswirtschaftliche Forschung 37 (1985) 1070–1077.

D. Schneider, The effects of progressive and proportional income taxation on risk-taking, National Tax Journal 33 (1980) 67–76.

J.E. Stiglitz, The effects of income, wealth, and capital gains taxation on risk-taking, Quarterly Journal of Economics 83 (1969) 263–283.

J. Tobin, Liquidity preference as behavior towards risk, Review of Economic Studies 25 (1957/58) 65–86.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Bamberg, G., Richter, W.F. Decision-theoretic analysis of envisaged income tax reforms for FRG and USA. Ann Oper Res 16, 105–116 (1988). https://doi.org/10.1007/BF02283739

Issue Date:

DOI: https://doi.org/10.1007/BF02283739