Abstract

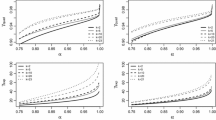

Traditional asset allocation of the Markowitz type defines risk to be the variance of the return, contradicting the common-sense intuition that higher returns should be preferred to lower. An argument of Levy and Markowitz justifies the mean/variance selection criteria by deriving it from a local quadratic approximation to utility functions. We extend the Levy-Markowitz argument to account for asymmetric risk by basing the local approximation onpiecewise linear-quadratic risk measures, which can be tuned to express a wide range of preferences and adjusted to reject outliers in the data. The implications of this argument lead us to reject the commonly proposed asymmetric alternatives, the mean/lower partial moment efficient frontiers, in favor of the “risk tolerance” frontier. An alternative model that allows for asymmetry is the tracking model, where a portfolio is sought to reproduce a (possibly) asymmetric distribution at lowest cost.

Similar content being viewed by others

References

V.S. Bawa, Optimal rules for ordering uncertain prospects, J. Fin. Econ. 10 (1975) 849–857.

R.S. Dembo, Scenario optimization, Ann. Oper. Res. 30 (1991) 63–80.

R.S. Dembo and A.J. King, Tracking models and the optimal regret distribution in asset allocation, IBM Research Report RC 17156 (1991).

P.C. Fishburn, Mean-risk analysis with risk associated with below-target returns, Amer. Econ. Rev. 67 (1977) 116–125.

W.V. Harlow and R.K.S. Rao, Asset pricing in a generalized mean-lower partial moment framework: Theory and evidence, J. Fin. Quantit. Anal. 24 (1989) 285–311.

W.V. Harlow, Asset allocation in a downside risk framework, Equity Portfolio Analysis Report, Salomon Brothers Inc. (1991).

P.J. Huber,Robust Statistics (Wiley, New York, 1981).

International Business Machines Corporation,Optimization Subroutine Library Guide and Reference (IBM Corp, Document SC23-0519-1, 1990).

D.L. Jensen and A.J. King, Frontier: a graphical interface for portfolio optimization in a piecewise linear-quadratic risk framework, IBM Syst. J. 31 (1992) 62–70.

A.J. King and D.L. Jensen, Linear-quadratic efficient frontiers for portfolio optimization, Appl. Stoch. Models Data Anal. 8 (1992) 195–207.

H. Konno, Piecewise linear risk function and portfolio optimization, J. Oper. Res. Soc. Japan 33 (1990) 139–156.

H. Levy and H.M. Markowitz, Approximating expected utility by a function of mean and variance, Amer. Econ. Rev. (June 1979) 308–317.

H.M. Markowitz,Portfolio Selection: Efficient Diversification of Investments (Wiley, New York, 1959).

T.J. Nantell, K. Price and B. Price, Mean-lower partial moment asset pricing model: Some empirical evidence, J. Fin. Quantit. Anal. 17 (1982) 763–782.

J.W. Pratt, Risk aversion in the small and in the large, Econometrica 32 (1964) 122–137.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

King, A.J. Asymmetric risk measures and tracking models for portfolio optimization under uncertainty. Ann Oper Res 45, 165–177 (1993). https://doi.org/10.1007/BF02282047

Issue Date:

DOI: https://doi.org/10.1007/BF02282047