Summary

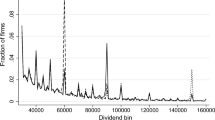

The optimum management with respect to the appropriation of entrepreneurial profits is described and explained by means of a utility model. For various reasons, distribution as well as retention of profits are supposed to be the arguments of a rather flexible utility function: a so-called ‘MCES-function.’ In conjunction with the optimum divident management, the effects of taxation are also studied: the degree of discrimination between the two components of the appropriation of profits is investigated for three systems of corporation profits taxation, namely, the classical system, the two rate system, and the imputation system. It is shown that the utility model is of a comprehensive character, which means that some other dividend models are special cases of it.

Similar content being viewed by others

Literatuurverwijzingen

Durand, D., ‘The Cost of Capital, Corporation Finance and the Theory of Investment: Comment’,American Economic Review, IL (1959), pp. 639–655.

Feldstein, M. S., ‘Corporate Taxation and Dividend Behaviour’,Review of Economic Studies, XXXVII (1970), pp. 57–72.

Gordon, M. J.,The Investment, Financing, and Valuation of the Corporation, Homewood, 1962.

—, ‘Optimal Investment and Financing Policy’,The Journal of Finance, XVIII (1963), pp. 264–272.

Heeden, K. Van Der,Dubbele belastingheffing van uitgedeelde winsten van besloten en open vennootschappen, Deventer, 1973.

Henderson, J. M. enR. E. Quandt,Microeconomic Theory: A Mathematical Approach, New York, 1971.

Hofstra, H. J., ‘Algemene Belastingherziening’,Weekblad voor Fiscaal Recht, XCI (1962), pp. 165–178.

Intriligator, M. D.,Mathematical Optimization and Economic Theory, Englewood Cliffs, 1971.

Keller, W. J., ‘A Nested CES-type Utility Function and its Demand and Price-Index Functions’,Report of the Econometric Institute and the Institute for Fiscal Studies, Erasmus University, Rotterdam, 1974.

Krouse, C. G., ‘On the Theory of Optimal Investment, Dividends, and Growth in the Firm’,American Economic Review, LXIII (1973), pp. 269–279.

Miller, M. H. enF. Modigliani, ‘The Cost of Capital, Corporation Finance and the Theory of Investment: A Reply’,American Economic Review, IL (1959), pp. 655–669.

—, ‘Dividend Policy, Growth, and the Valuation of Shares,Journal of Business, XXXIV (1961), pp. 411–433.

Moerland, P. W., ‘De Beleggingsbeslissing’, in Beslissen, C. van Dam en P. W. Moerland, redakteuren, Deventer (1974-1), pp. 73–83.

—, ‘Dividendpolitiek en Vennootschapsbelastingsystemen’,Maandblad Belastingbeschouwingen, XXXIII (1974-2), pp. 195–207.

Porterfield, J. T. S., ‘Dividend Policy and Shareholders' Wealth’, inFinancial Research and Management Decisions, A. A. Robichek, (ed.), New York, 1967.

Schendstok, B., ‘Het voorgestelde dubbele tarief van de vennootschapsbelasting’,Naamloze Vennootschap, XXXX (1962), pp. 17–21.

Tinbergen, J., ‘Prijsvorming op de aandeelenmarkt’,De Nederlandsche Conjunctuur, kwartaalschrift, samengesteld door bet Centraal Bureau voor de Statistiek, 4, 1932.

VanHorne, J. C. enJ. G. McDonald, ‘Dividend Policy and New Equity Financing’,The Journal of Finance, XXVI (1971), pp. 507–519.

Walter, J. E.,Dividend Policy and Enterprise Valuation, Belmont, 1967.

Watts, R., ‘The Information Content of Dividends’,The Journal of Business, XXXXVI (1973), pp. 191–211.

Additional information

De auteur wenst Prof. Dr. A. 1. Diepenhorst, Prof. Dr. W. H. Somermeijer en Ir. W. J. Keller hartelijk te bedanken voor hun waardevolle suggesties die deze studie ten goede zijn gekomen.

Rights and permissions

About this article

Cite this article

Moerland, P.W. Optimaal dividendbeleid en belastingheffing: Een nutsmodel. De Economist 123, 198–222 (1975). https://doi.org/10.1007/BF02078437

Issue Date:

DOI: https://doi.org/10.1007/BF02078437