Summary

The basic problem of duopoly theory is the hypothesis about conjectural price variations. Such a conjectural hypothesis is not required if we draw a distinction between induced and autonomous price changes. Induced price changes (for the pricesp 2 p2 and ∂p2 indicated as ∂p 1 and ape, respectively) occur as a result of, and after, autonomous price changes, whereas autonomous price (indicated asdp 1 anddp 2) are not results of other (autonomous) price changes.

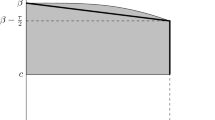

The duopoly model comprises two linear demand functions. For the sake of simplicity it has in the first instance been assumed that induced price changes depend on autonomous price changes according to the following linear price reaction functions:

where the price reaction coefficientsq 21 andq 12 are unknown constants.

The duopoly problem has been investigated in three directions. First, a dynamic process is presented in which both duopolists in each period reconsider their expectation about the price reaction coefficientsq 21 andq 12 respectively. These reconsiderations are based on recent factual price changes. The dynamic process converges to a steady state in which the expected price reaction coefficients equal the factual ones. The steady state refers to the equilibrium state of the duopoly situation because both duopolists cannot then increase their profit by an autonomous price change.

The second subject of investigation concerns the straightforward solution of the equilibrium state. By using the so-called continued partial derivatives (the first-order ones represent the sensitivity of both profits to autonomous price,changes), it is possible to deduct two first-order equilibrium conditions and two first-order reaction conditions that determine endogeneously the values ofp 1,p 2,q 21 andq 12 in the equilibrium state.

Finally, the case in which the duopoly model comprises two 5-th degree price reaction functions (instead of the abovementioned linear ones) has been investigated. For convenience in solving the model the 5-th degree has been preferred over the general n-th degree. These 5-th degree functions are

It-is pointed out that all unknown price reaction coefficients are endogeneously determined by the reaction conditions of first-through fifth-order. Further, it is shown that linearity of the demand functions implies linear price reaction functions.

Generalization of these concepts towards competition amongst many multiproduct enterprises is feasible without any restriction; a publication on this problem is in preparation.

Similar content being viewed by others

Literatuur

Chamberlin, E. H.,The Theory of Monopolistic Competition, 8e editie, Cambridge (Mass) 1962, p. 90.

Cournot, A.,Recherches sur los principes mathématiques de la théorie des richesses, Parijs 1838, p. 89.

Hall, R. L. and Hitch, C. J., Price Theory and Business Behaviour,Oxford Economic Papers, 1939, nr. 2, pp. 12–45; herdrukt inOxford Studies in the Price Mechanism, onder red. van T. Wilson en P. W. S. Andrews, Oxford 1951, pp. 107–138.

Heertje, A.,Enkele aspecten van de prijsvorming van consumptiegoedeven op monopolistische en oligopolistische markten, Leiden 1960, p. 92.

Heertje, A., Enkele opmerkingen over de dynamisering van de prijstheorie van hot oligopolie,Orbis Economicus, 1969, nr. 3/4, pp. 56–60.

Heuss, E.,Allgemeine Markttheorie, Tübingen 1965, p. 96.

Krelle, W.,Preistheorie, Tübingen 1961, p. 86.

Launhardt, W.,Mathematische Begründung der Volkswirtschaftslehre, Leipzig 1885, p. 161.

Ott, A. E., Gewinnmaximierung, Reaktionshypothese und Gleichgewichtsgebiet beim unvollkommenen Dyopol,Jahrbücher für Nationalökonomie und Statistik, 1963, pp. 428–440.

Sato, R. en Nagatani, K., The Stability of Oligopoly with Conjectural Variation,Review of Economic Studies, 1967, nr. 100, pp. 409–416.

Schneider, E., Eine dynamische Theorie des Angebotsdyopols,Archiv für mathematische Wirtschafts-und Sozialforschung, 1942, pp. 72–92; herdrukt in E. Schneider,Volkswirtschaft und Betriebswirtschaft, Tübingen 1964, pp. 62–83.

Sweezy, P. M., Demand under Conditions of Oligopoly,The Journal of Political Economy, 1939, pp. 568–573; herdrukt inReadings in Price Theory, London 1953, pp. 404–409.

Theocharis, R. D., Some Dynamic Aspects of the Oligopoly Problem,Jahrbücher für Nationalökonomie und Statistik, 1965, pp. 354–364.

Additional information

De schrijver is prof. dr. P. de Wolff, prof. dr. P. Hennipman en prof. dr. A. Heertje bijzonder erkentelijk voor hun opmerkingen, die even zo vele stimulansen tot verbetering zijn geweest.

Rights and permissions

About this article

Cite this article

van der Weel, H. Een Dynamisch Duopoliemodel. De Economist 118, 458–490 (1970). https://doi.org/10.1007/BF01712921

Issue Date:

DOI: https://doi.org/10.1007/BF01712921