Abstract

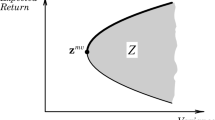

In this paper we discuss three applications of a class of (parametric) linear complementarity problems arising independently from such diverse areas as portfolio selection, structural engineering and actuarial graduation. After explaining how the complementarity problems emerge in these applications, we perform some analytical comparisons (based on operation counts and storage requirements) of several existing algorithms for solving this class of complementarity problems. We shall also present computational results to support the analytical comparisons. Finally, we deduce some conclusions about the general performance of these algorithms.

Similar content being viewed by others

References

R.W. Cottle, “Monotone solutions of the parametric linear complementarity problem”,Mathematical Programming 3 (1972) 210–224.

R.W. Cottle and G.B. Dantzig, “Complementary pivot theory and mathematical programming”,Linear Algebra and its Applications 1 (1968) 103–125.

J.J.H. Forst and J.A. Tomlin, “Updated triangular factors of the basis to maintain sparsity in the product form simplex method”,Mathematical Programming 2 (1972) 263–278.

P.E. Gill, G.H. Golub, W. Murray and M.A. Saunders, “Methods for modifying matrix factorizations”,Mathematics of Computation 28 (1974) 505–535.

R.L. Graves, “A principal pivoting simplex algorithm for linear and quadratic programming”,Operations Research 15 (1967) 482–494.

T.N.E. Greville,Graduation, Part 5 Study Notes (The Actuarial Society of America, 1974 Edition).

I. Kaneko, “A linear complementarity problem with ann by 2n “P”-matrix”,Mathematical Programming Study 7 (1978) 120–141.

I. Kaneko, “Complete solutions of a class of elastic-plastic structures”, Technical Report WP78-12, Department of Industrial Engineering, University of Wisconsin-Madison (July 1978).

I. Kaneko, “Piecewise linear elastic-plastic analysis”,International Journal for Numerical Methods in Engineering, to appear.

C.E. Lemke, “Bimatrix equilibrium points and mathematical programming”,Management Science 11 (1965) 681–689.

G. Maier, “A matrix structural theory of piecewise-linear elastoplasticity with interacting yield-planes”,Meccanica 5 (1970) 54–66.

H.M. Markowitz, “Portfolio selection”,The Journal of Finance 12 (1952) 77–91.

M.D. Miller,Elements of graduation (The Actuarial Society of America, 1949).

J.S. Pang, “Some new and efficient algorithms for portfolio analysis”, MRC Technical Summary Report No. 1738, Mathematics Research Center, University of Wisconsin-Madison (March 1977).

J.S. Pang, I. Kaneko and W.P. Hallman, “On the solution of some (parametric) linear complementarity problem with applications to portfolio analysis, structural engineering and graduation”, MRC Technical Summary Report No. 1758, Mathematics Research Center, University of Wisconsin-Madison (August 1977).

W.F. Sharpe, “A simplified model for portfolio analysis”,Management Science 9 (1963) 277–293.

W.F. Sharpe,Portfolio theory and capital markets (McGraw-Hill, New York, 1970).

Author information

Authors and Affiliations

Additional information

This research is supported in part by the United States Army under Contract No. DAAG29-75-C-0024, the National Science Foundation under Grant No. MCS75-17385 and Grant ENG77-11136.

Rights and permissions

About this article

Cite this article

Pang, J.S., Kaneko, I. & Hallman, W.P. On the solution of some (parametric) linear complementarity problems with applications to portfolio selection, structural engineering and actuarial graduation. Mathematical Programming 16, 325–347 (1979). https://doi.org/10.1007/BF01582119

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01582119