Abstract

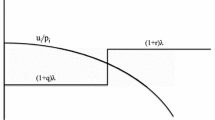

Notions of congruence between the tastes of the consumer and the market prices are defined and it is shown that the higher the degree of congruence, the worse off the consumer is. Applications to consumption over time and expected utility are given.

Zusammenfassung

In dieser Arbeit werden Begriffe der Kongruenz von Konsumentenpräferenzen und Marktpreisen definiert. Ein hoher Grad an Kongruenz erweist sich als nachteilig für den Konsumenten. Dieses Ergebnis wird benutzt, um für ein einfaches Investitionsmodell den zu erwartenden Nutzen, der sich bei einem Konsum über mehrere Perioden ergibt, zu ermitteln.

Similar content being viewed by others

References

Arrow K (1971) The values of and demand for information. In: Essays in the theory of risk-bearing. Markham, Chicago

Beckmann M (1977) A paradox in consumption theory. In: Henn R, Moeschlin O (eds) Mathematical Economics and Game Theory; Essays in Honor of O. Morgenstern. Lecture Notes in Economics and Mathematical Systems, Vol 141. Springer, Berlin

Beckmann, M (1986) Tastes and Welfare, mimeo

Bøhren Ø, Ekern S (1981) Probabilities proportional to time-state prices. Econ Lett 8: 1–6

Cheng K (1977) Majorization; its extensions and preservation theorems. Technical Report 121, Dept. of Statistics, Stanford

Hirshleifer J (1970) Investment, interest and capital. Prentice-Hall, Englewood Cliffs

Koopmans T (1960) Stationary ordinal utility and impatience. Econometrica 28: 287–309

Marshall A, Olkin I (1979) Inequalities: theory of majorization and applications. Academic Press, New York

Thon D, Thorlund-Petersen L (1993) The value of perfect information in a simple investment problem. Inf Econ Policy 5: 51–71

Veinott A (1971) Leastd-majorized network flows with inventory and statistical applications. Manag Sci 17: 547–567

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Thon, D., Thorlund-Petersen, L. On the congruence between consumer tastes and market prices. OR Spektrum 18, 163–167 (1996). https://doi.org/10.1007/BF01539708

Received:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF01539708