Conclusion

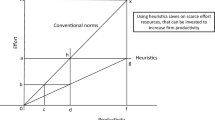

Politicians believe in an old fashioned conjecture. They all think welfare must always be increased if one only reduce inefficiency. But this intuition is wrong. If we look at piecemeal price changes, temporarily decreasing efficiency can be necessary for improving welfare.

This conclusion shows that the usual argument of political administrations to advise the management of public enterprises to reduce the inefficiency of production can, under the above mentioned circumstances, lead to welfare losses. On this account the efficiency rule of thumb must be supported by welfare considerations, otherwise misleading results can occur.

But we should not be too concerned. If the starting point of the piecemeal policy path is located not too far from the welfare optimum, the usual efficiency argument leads to satisfactory results.

Last not least we mentioned the economic duality of decreasing efficiency and instability; here our results fit into the usual conception of the economists' world.

Similar content being viewed by others

References

D. Bös (1981): Economic Theory of Public Enterprise, Lecture Notes in Economics and Mathematical Systems 188, Berlin.

D. Bös (1985a): Public Sector Pricing, in: M. S. Feldstein and A. Auerbach (eds.): Handbook of Public Economics, vol. I, Amsterdam, pp. 129–212.

D. Bös (1985b): Public Enterprise Economics, Theory and Application, Amsterdam, forthcoming.

M. Boiteux (1956, 1971): Sur la Gestion des Monopoles Public Astreints à l'Equilibre Budgétaire, Econometrica24, pp. 22–40. English edition: On the Management of Public Monopolies Subject to Budgetary Constraints, Journal of Economic Theory3, pp. 219–240.

P. A. Diamond and J. A. Mirrlees (1971): Optimal Taxation and Public Production I, American Economic Review61, pp. 8–27.

R. Guesnerie (1977): On the Direction of Tax Reform, Journal of Public Economics7, pp. 179–202.

K. P. Hagen (1979): Optimal Pricing in Public Firms in an Imperfect Market Economy, Scandinavian Journal of Economics81, pp. 475–493.

P. Hammond (1984): Approximate Measures of Social Welfare and the Size of Tax Reform, in: D. Bös, M. Rose, and Ch. Seidl (eds.): Beiträge zur neueren Steuertheorie, Berlin, pp. 95–115.

D. G. Luenberger (1973): Introduction to Linear and Nonlinear Programming, Reading, MA.

O. L. Mangasarian (1969): Nonlinear Programming, New York.

J. Quirk and R. Saposnik (1968): Introduction to General Equilibrium Theory and Welfare Economics, New York.

A. Smith (1983): Tax Reform and Temporary Inefficiency, Journal of Public Economics20, pp. 265–270.

Author information

Authors and Affiliations

Additional information

This research was supported by Deutsche Forschungsgemeinschaft, Sonderforschungsbereich 303. I am grateful to Dieter Bös, Udo Ebert, and Hans-Dieter Stolper as well as the anonymous referees of this journal for extensive comments on previous drafts of this paper.

Rights and permissions

About this article

Cite this article

Peters, W. Can inefficient public production promote welfare?. Zeitschr. f. Nationalökonomie 45, 395–407 (1985). https://doi.org/10.1007/BF01355513

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01355513