Abstract

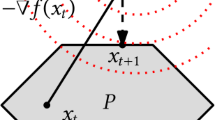

The paper presents a discrete-time dynamic programming algorithm that is suitable to track nonlinearities in intertemporal optimization problems. In contrast to using linearization methods for solving intertemporal models, the proposed algorithm operates globally by iteratively computing the value function and the controls in feedback form on a grid. A conjecture of how the trajectories might behave is analytically obtained by letting the discount rate approach infinity. The dynamic found serves as a useful device for computing the trajectories for finite discount rates employing the algorithm. Commencing with a large step and grid size, and then pursuing time step and grid refinements allows for the replication of the nonlinear dynamics for various finite discount rates. As the time step and grid size shrink, the discretization errors vanish. The algorithm is applied to three economic examples. Two examples are of deterministic type; the third is stochastic. In the deterministic cases limit cycles are detected.

Similar content being viewed by others

References

Asada, T. and W. Semmler (1995) “Growth, Finance and Cycles: An Intertemporal Model”, forthcoming Journal of Macroeconomics vol. 17, no. 4.

Asada, T., W. Semmler and A. Novak (1994) “Endogenous Growth and the Balanced Growth Equilibrium”, New School for Social Research, mimeo.

Berkovitz, L.D. (1974)Optimal Control Theory, Heidelberg/New York: Springer-Verlag.

Boldrin, M. and L. Montrucchio (1986) “On the Indeterminacy of Capital Accumulation Paths”,Journal of Economic Theory, 40, 26–39.

Boldrin, M. (1988) “Persistent Oscillations and Chaos in Economic Models: Notes for A Survey”, in: P.H. Anderson, K.J. Arrow and D. Pines (eds.),The Economy as an Evolving Complex System, Reading: Addison-Wesley, 49–77.

Boldrin, M. and R.J. Deneckere (1990) “Sources of Complex Dynamics in Two-Sector Growth Models”,Journal of Economic Dynamics and Control, 14: 627–53.

Boldrin, M. and A. Rustichini (1991) “Indeterminacy of Equilibria in Models with Infinitely Lived Agents and External Effects”, Northwestern University, Discussion Paper No. 955.

Boldrin, M. and M. Woodford (1992) “Equilibrium Models Displaying Endogenous Fluctuations and Chaos: A Survey”, in J. Benhabib, ed.,Cycles and Chaos in Economic Equilibrium Princeton: Princeton University Press.

Brock, W.A. (1986) “Distinguishing Random and Deterministic Systems”Journal of Economic Theory, 40: 168–195.

Brock, W.A. (1992) “Pathways to Randomness in the Economy: Emergent Nonlinearity and Chaos in Economics and Finance”, University of Wisconsin, mimeo.

Brock, W.A., D.A. Hsie and B. LeBaron (1991)Nonlinear Dynamics, Chaos and Instability, Cambridge: MIT-Press.

Clark, C.W. (1971) “Economically Optimal Policies for the Utilization of Biologically Renewable Resources”,Mathematical Bioscience, 17: 245–268.

Clark, C.W. (1976)Mathematical Bioeconomics: The Optimal Management of Renewable Resources, New York: J. Wiley, new edition, 1990.

Clark, C.W., G.R. Munro and F.H. Clarke (1979) “The Optimal Exploitation of Renewable Resource Stock: Problems of Irreversible Investment”,Econometrica, vol. 47, no. 1, 25–47.

Clarke, F.H. (1983)Optimization and Nonsmooth Analysis, New York: J. Wiley.

Danthine, J.P. and J.B. Donaldson (1993) “Computing Equilibria of Non-Optimal Economics”, forthcoming in T. Cooley, ed.,Frontiers of Business Cycle Research.

Dechert, W.D. and K. Nishimura (1983) “A Complete Characterization of Optimal Growth Path in an Aggregate Model with Non-Concave Production Function”,Journal of Economic Theory, 31: 332–354.

Dockner, E. and G. Feichtinger (1991) “On the Optimality of Limit Cycles in Dynamic Economic Systems”,Journal of Economics, vol. 53, no. 1: 31–50.

Falcone, M. (1987) “A Numerical Approach to the Infinite Horizon Problem of Deterministic Control Theory”,Applied Mathematics and Optimization, 15: 1–13.

Falcone, M. (1991) “Corrigenda: A Numerical Approach to the Infinite Horizon Problem of Deterministic Control Theory”,Applied Mathematics and Optimization, 23: 213–214.

Grebogi, C. (1994) “Shadowing in Chaotic Systems”, Dept. of Mathematics, University of Maryland, mimeo.

Lucas, R.E. (1988) “On the Mechanics of Economic Growth”,Journal of Monetary Economics, no. 22: 3–42.

Luu, R. (1990) “Optimal Control by Dynamic Programming Using Systematic Reduction in Grid Size”,International Journal of Control, 51, 1: 995–1013.

Majumdar, M. and T. Mitra (1982) “Intertemporal Allocation with Non-Convex Technology, The Aggregate Framework”,Journal of Economic Theory, 27: 101–136.

Montrucchio, L. (1992) “Dynamical Systems that Solve Continuous-Time Concave Optimization Problems: Anything Goes”, in J. Benhabib, ed.,Cycles and Chaos in Economic Equilibrium, op. cit..

Reed, W.J. (1984) “The Effects of the Risk of Fire on the Optimal Rotation of a Forest”,Journal of Environmental Economics and Management, vol. 11, 180–190.

Romer, P. (1990) “Endogenous Technical Change”,Journal of Political Economy, vol. 98, no. 5: 71–105.

Semmler, W. (1991) “Optimal Inventive Investment and the Diffusion of Technology”, paper prepared for the Viennese Workshop on Optimal Control and Economic Dynamics.

Semmler, W. (1994), ed., Business Cycles: Theory and Empirical Methods, Boston: Kluwer Academic Publishers.

Semmler, W. and M. Sieveking (1994a) “On the Optimal Exploitation of Interacting Resources”,Journal of Economics, vol. 51, no. 1: 23–49.

Semmler, W. and M. Sieveking (1994b) “External Finance and Critical Foreign Debt”, New School for Social Research, mimeo.

Semmler, W. and G. Gong (1994) “Estimating Deep Parameters of Real Business Cycle Models”, New School for Social Research, mimeo.

Sieveking, M. (1988) “A Generalization of the Poincaré-Bendixson Theorem”, University of British Columbia, mimeo.

Sieveking, M. (1991) “Stability of Limit Cycles in the Plane”, University of Frankfurt, Department of Mathematics, mimeo.

Sieveking, M. and W. Semmler (1990) “Optimization without Planning: Economic Growth and Resource Exploitation with a Discount Rate Tending to Infinity, Working Paper, no. 12, New School for Social Research.

Sieveking, M. and W. Semmler (1994) “The Present Value of Resources with Large Discount Rates”, Dept. of Mathematics, University of Frankfurt, mimeo.

Sorger, G. (1988) “On the Optimality of Given Feedback Controls”, Institute for Econometrics, University of Technology, mimeo, Vienna.

Taylor, J.B. and H. Uhlig (1990), “Solving Nonlinear Stochastic Growth Models: A Comparison of Alternative Solutions”, in Journal of Business and Economic Statistics, vol. 8, no. 1, 1–17.

Author information

Authors and Affiliations

Additional information

The present paper draws on joint work with Malte Sieveking whom I want to thank for many discussions.

Rights and permissions

About this article

Cite this article

Semmler, W. Solving nonlinear dynamic models by iterative dynamic programming. Comput Econ 8, 127–154 (1995). https://doi.org/10.1007/BF01299714

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF01299714