Abstract

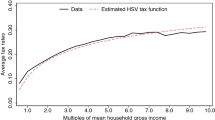

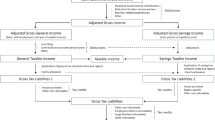

A simple econometric model of a state personal income tax is presented. The model is designed for economies subject to rapid population increase by means of a double log specification of an average tax schedule. Various tests are presented to validate the model. It is then incorporated into a full econometric model and the revenue and general equilibrium effects of two types of tax cut are considered. It is found that changes in state personal income tax rate schedules and deduction provisions have significant general equilibrium effects on open economies and these result in substantial induced revenue impacts.

Similar content being viewed by others

References

Delaware Econometric Modeling Group. “An Improved Quarterly Forecasting Model of a Small Region.” University of Delaware, Newark, Delaware, 1976.

Friedlaender, Ann; Treyz, George; and Tresch, Richard. “A Quarterly Econometric Model of Massachusetts.” Massachusetts Senate Ways and Means Committee, June 1975.

Glickman, Norman J. “Son of ‘The Specification of Regional Econometric Models.’”Regional Science Association Papers. Vol. 32, 1974.

Kresge, David T. “Alaska's Growth to 1990. ”Alaska Review of Business and Economic Conditions, Vol. XIII, No. 1, January 1976.

McLaren, J. Alec. “An Income Tax Simulation Model for the State of Minnesota.”National Tax Journal. March 1973, pp. 71–77.

Pechman, Joseph. “A New Tax Model for Revenue Estimating. ” Brookings Studies of Government Finance Reprint #102, The Brookings Institution, Washington, D.C., 1965.

Pindyck, Robert S. and Rubinfeld, Daniel L.Econometric Models and Economic Forecasts. New York: McGraw Hill, 1976.

Singer, Neil. “Estimating State Income Tax Revenues; A New Approach. ”Review of Economics and Statistics. November 1970, pp. 427–433.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Goldsmith, O.S. A state personal income tax simulation model. Ann Reg Sci 13, 44–54 (1979). https://doi.org/10.1007/BF01284078

Issue Date:

DOI: https://doi.org/10.1007/BF01284078