Abstract

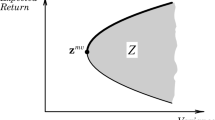

A wide variety of applied problems involve programs trading off one objective against another, such as time versus cost. The present article does this by interchanging the objective function and one constraint. The approach is a practical formulation of the bi-objective program. We state the correspondences between the primal and dual solution sets: under certain conditions the primal solution sets correspond and dual solution sets coincide or are equivalent. The article concludes with numerical illustrations and a large-scale application to portfolio analysis.

Similar content being viewed by others

References

Berge C (1959) Espaces topologiques, ch 3. Dunod, Paris

Dreze JH, Moeseke P van (1974) A finite algorithm for homogeneous portfolio programming. In: Moeseke P van (ed) Mathematical programs for activity analysis. North-Holland and American Elsevier, Amsterdam and London, pp 79–91

Leblanc G, Moeseke P van (1979) Portfolios with reserve coefficient. Metroeconomica 31(1):103–118

Markowitz HM (1959) Portfolio selection. Wiley, New York

Moeseke P van (1965) Stochastic linear programming. Yale Economic Essays 5:197–253

Moeseke P van (1968) Towards a theory of efficiency. In: Quirk J, Zarley A (eds) Papers in quantitative economics, vol I. University Press of Kansas, Lawrence, pp 1–30

Moeseke P van (1974) Saddlepoint in homogeneous programming without Slater condition. Econometrica 43(3):593–596

Moeseke P van (1985) Socio-economic interface and social income. Mathematical Social Sciences 9(3):263–273

Moeseke P van (1986) Existence theorems for imperfect capital markets. Massey Economic Papers 4(A8603):57–75

Moeseke P van, Hohenbalken B von (1974) Efficient and optimal portfolios by homogeneous programming. Zeitschrift für Operations Research 18:205–214

Pareto V (1896/97) Cours d'economie politique. Rouge, Lausanne

Uzawa H (1958) The Kuhn-Tucker theorem in concave programming. In: Arrow K, Hurwicz L, Uzawa H (eds) Studies in linear and nonlinear programming. Stanford University Press

Wendell RE (1980) Multiple-objective mathematical programming with respect to multiple decision-makers. Operations Research (ORSA) 28(5):1100–1111

White DJ (1985) Vector maximization and Lagrange multipliers. Mathematical Programming 31: 192–205

Young M (1985) Portfolio selection by homogeneous programming. Massey University, New Zealand (175 pp, unpublished)

Author information

Authors and Affiliations

Additional information

Research initiated at the Australian National University during my tenure of the Professorial Fellowship in Economic Policy of the Reserve Bank of Australia. I am greatly indebted to Mr. M. Young of Young & Co., Sharebrokers, New Zealand Stock Exchange, for access to the data base of Section 5 and to Mrs. J. Goldsmith (Massey University) for organizing the entire computer exercise. Helpful comments by Professor K. A. Fox (Iowa State University) and Dr. F. vande Ginste (Science Foundations, Brussels), and numerical assistance by Miss S. Guthrie (Massey University) are gratefully acknowledged.

Rights and permissions

About this article

Cite this article

van Moeseke, P. Applied Bi-objective programs. Zeitschrift für Operations Research 31, B31–B54 (1987). https://doi.org/10.1007/BF01272655

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01272655