Abstract

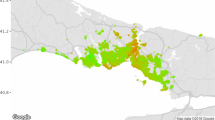

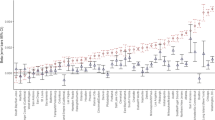

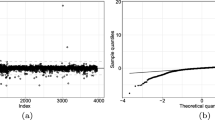

The monocentric model predicts a housing price gradient from the central business district, and it follows that the extension of this model to account for modern multinodal metropolitan areas would predict housing price gradients from multiple employment centers. Empirical analysis using hedonic regression techniques for the estimation of price gradients in a multinodal context is limited. This study extends prior work by exploring nonlinear housing price gradients in a multinodal urban area with an unusually robust database of housing sales transactions, and using a geographic information system for spatial analysis. The results confirm the importance of non-CBD employment centers, a strong if asymmetric CBD price gradient, and significant nonlinear gradients from such other urban amenities as major retail sites and highways.

Similar content being viewed by others

References

Alonso, William.Location and Land Use. Cambridge, MA: Harvard University Press, 1964.

Bailey, Martin J. “A Note on the Economics of Residential Zoning and Urban Renewal.”Land Economics 35 (1959), 288–292.

Bender, Bruce, and Hwang, Hae-Shin. “Hedonic Housing Price Indices and Secondary Employment Centers.”Journal of Urban Economics 17 (1985), 90–107.

Berry, Brian J.L., and Bednarz, R. “The Disbenefits of Neighborhood and Environment to Urban Property.” InGeographic Humanism, Analysis and Social Action, D.R. Deskins, et al. eds. Ann Arbor, MI: Michigan Geographical Publication No. 17, 1977, 111–148.

Berry, Brian J.L., and Bednarz, R. “A Hedonic Model of Prices and Assessments for Single-Family Homes in Chicago: Does the Assessor Follow the Market or the Market the Assessor?”Land Economics L1 (1975), 21–40.

Berry, Brian J.L. “Ghetto Expansion and Single-Family Housing Prices: Chicago, 1968–1972.”Journal of Urban Economics 3 (1976), 397–423.

Blackley, Dixie M., Follain, J.R. and Lee, H. “An Evaluation of Hedonic Price Indexes for Thirty-four Large SMSAs.”AREUEA Journal 14 (1986), 179–205.

Courant, Paul N. “Urban Residential Structure and Racial Prejudice.” Discussion Paper no. 62, Institute of Public Policy Studies, University of Michigan, 1974.

Follain, J.R., and E. Jimenez. “Estimating the Demand for Housing Characteristics: A Survey and Critique.”Regional Science and Urban Economics 15 (1985), 77–107.

Follain, J.R., Ozanne, J. and Alburger, V.Place to Place Indexes of the Price of Housing. Urban Institute Paper on Housing. Urban Institute, December 1979.

Getis, A. “Second-Order Analysis of Point Patterns: The Case of Chicago as a Multicenter Urban Region.”The Professional Geographer 35 (1983), 73–80.

Gillingham, R. “Place to Place Rent Comparison.”Annals of Economic and Social Measurement 4 (1975), 153–74.

Goodman, Allen C. “Hedonic Prices, Price Indices and Housing Markets.”Journal of Urban Economics 5 (1978), 471–484.

Goodman, A., and Kawai, M. “Replicative Evidence on Rental and Owner Demand for Housing.”Southern Economic Journal 50 (1984), 1036–57.

Gordon, P., Richardson, H.W. and Wong, H.L. “The distribution of population and employment in a polycentric city: the case of Los Angeles.”Environment and Planning 18 (1986), 161–173.

Greene, D.L. “Urban Subcenters: Recent Trends in Urban Spatial Structure.”Growth and Change 11 (1980), 29–40.

Greenlees, J.S. “An Empirical Evaluation of the CPI Home Purchase Index.”AREUEA Journal 10 (1982), 1–24.

Harrison, Jr. D., and Rubinfeld, D. “Hedonic Housing Prices and the Demand for Clean Air.”Journal of Environmental Economics and Management 5 (1978), 81–102.

Heikkila, E. “Multicollinearity in Regression Models with Multiple Distance Measures.”Journal of Regional Science 28 (1988), 345–361.

Heikkila, E., Gordon, P., Kim, J.I., Peiser, R.B. and Richardson, H.W. “What Happened to the CBD-Distance Gradient?: Land Values in a Policentric City.”Environment and Planning A 21 (1989), 221–232.

Hoch, I. “Changes in Land Values along Edens Expressway.”CATS Research News 1 (6, 1957), 10–15.

Linneman, P.D. “Some Empirical Results on the Nature of the Hedonic Price Functions for the Urban Housing Market.”Journal of Urban Economics 8 (1980), 47–68.

Linneman, P.D. “The Demand for Residence Site Characteristics.”Journal of Urban Economics 9 (1981), 129–148.

Mark, H., and Goldberg, M.A., “Alternative Housing Prices Indices: An Evaluation.”AREUEA Journal 12 (1984), 30–49.

Mills, Edwin S., and Hamilton, B.W.Urban Economics, Fourth Edition, Glenview, Illinois: Scot Foresman and Company, 1989.

Mills, Edwin S. “An Aggregative Model of Resource Allocation in a Metropolitan Area.”American Economic Review 57 (1967), 197–210.

Murray, Michael P. “Hedonic Prices and Composite Commodities.”Journal of Urban Economics 5 (1978), 188–197.

Mum, Richard F.Cities and Housing. Chicago, IL: University of Chicago Press, 1969.

Muth, Richard F.Urban Economic Problems. New York, NY: Harper & Row, 1975.

North Central Texas Council of Governments,1988 Land Use. Arlington, Texas, 1988.

Peiser, R.B. “Determinants of Non-Residential Land Values.”Journal of Urban Economics 22 (1987), 340–360.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Waddell, P., Berry, B.J.L. & Hoch, I. Residential property values in a multinodal urban area: New evidence on the implicit price of location. J Real Estate Finan Econ 7, 117–141 (1993). https://doi.org/10.1007/BF01258322

Issue Date:

DOI: https://doi.org/10.1007/BF01258322