Abstract

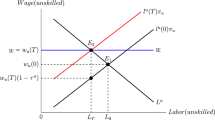

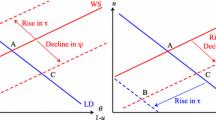

This paper analyzes the effect of labor-tax progression on employment and welfare in an economy with a unionized labor market. The government influences wage bargaining through its tax policies. Wages can be reduced by increasing the marginal labor-tax rate. If there are no restrictions on profit taxation, a first-best optimum with full employment is realized; this first-best optimum can always be implemented by a progressive tax schedule. If profit taxation is restricted, unemployment may arise. For this case, we show that the welfare-maximizing degree of tax progression is influenced by a variety of factors, in particular the wage elasticity of labor demand, the distribution of bargaining power, and the existence of unemployment benefits. Examples are given for both progressive and regressive tax structures. Comparative-static analysis reveals that a decline in union bargaining power, an increase in unemployment benefits, and an increase in the overall work force reduce the efficient degree of tax progression.

Similar content being viewed by others

References

Blanchard, O. J., and Summers, L. H. (1987): “Fiscal Increasing Returns, Hysteresis, Real Wages, and Unemployment.”European Economic Review 32: 543–560.

Boadway, R. W., and Bruce, N. (1984):Welfare Economics. Oxford: Blackwell.

Boadway, R. W., and Marceau, N. (1994): “Minimum Wage Legislation and Unemployment Insurance as Instruments for Redistribution.”Scandinavian Journal of Economics 96: 67–81.

Booth, A. L. (1995):The Economics of the Trade Union. Cambridge: Cambridge University Press.

Bovenberg, L. A., and Van der Ploeg, F. (1994): “Effects of the Tax and Benefit System on Wage Formation and Unemployment.” Mimeo, Tilburg University, Tilburg.

Creedy, J. (1990): “Flattening the Tax Structure, Changing the Tax Mix, and Union's Wage Demands.”Journal of Economic Studies 17: 5–15.

Dixit, A. (1986): “The Comparative Statics of Nash Equilibria.”Review of Economic Studies 27: 107–122.

Fehr, E. (1990): “Fiscal Incentives in a Model of Equilibrium Unemployment.”Journal of Institutional and Theoretical Economics 146: 617–639.

Guesnerie, R., and Roberts, K. (1987): “Minimum Wage Legislation as a Second-Best Policy.”European Economic Review 31: 490–498.

Hamermesh, D. S. (1986): “The Demand for Labor in the Long Run.” InHandbook of Labor Economics, vol. I, edited by O. Ashenfelter and R. Layard. Amsterdam: North-Holland.

Hersoug, T. (1984): “Union Wage Responses to Tax Changes.”Oxford Economic Papers 36: 37–51.

Hoel, M. (1990): “Efficiency Wages and Income Taxes.”Journal of Economics/Zeitschrift für Nationalökonomie 51: 89–99.

Koskela, E., and Vilmunen, J. (1996): “Tax Progression Is Good for Employment in Popular Models of Trade Union Behaviour.”Labour Economics 3: 65–80.

Lejour, A. M., and Verbon, H. A. (1996): “Capital Mobility, Wage Bargaining, and Social Insurance Policies in an Economic Union.”International Tax and Public Finance 3: 495–513.

Lockwood, B. (1990): “Tax Incidence, Market Power, and Bargaining Structure.”Oxford Economic Papers 42: 187–209.

Lockwood, B., and Manning, A. (1993): “Wage Setting and the Tax System-Theory and Evidence for the United Kingdom.”Journal of Public Economics 52: 1–29.

Malcomson, J. M., and Sator, N. (1987): “Tax Push Inflation in a Unionized Labour Market.”European Economic Review 31: 1581–1596.

McDonald, I. M., and Solow, R. M. (1981): “Wage Bargaining and Employment.”American Economic Review 71: 896–908.

Mirrlees, J. A. (1971): “An Exploration in the Theory of Optimum Income Taxation.”Review of Economic Studies 38: 175–208.

Musgrave, R., and Musgrave, P. B. (1984):Public Finance in Theory and Practice, 4th edn. New York: McGraw-Hill.

Oswald, A. J. (1982): “Wages, Trade Unions, and Unemployment: What Can Simple Models Tell Us?”Oxford Economic Papers 34: 526–545.

— (1985): “The Economic Theory of Trade Unions.”Scandinavian Journal of Economics 87: 160–193.

Palokangas, T. (1987): “Optimal Taxation and Employment Policy with a Centralized Wage Setting.”Oxford Economic Papers 39: 799–812.

Pissarides, C. A. (1996): “Are Employment Tax Cuts the Answer to Europe's Unemployment Problem?” Manuscript, London School of Economics, London.

Sandmo, A. (1983): “Progressive Taxation, Redistribution and Labour Supply.”Scandinavian Journal of Economics 85: 311–323.

Sorensen, P. B. (1994): “From the Global Income Tax to the Dual Income Tax: Recent Tax Reforms in the Nordic Countries.”International Tax and Public Finance 1: 57–79.

Sorensen, P. B. (1997): “Optimal Tax Progressivity in Imperfect Labour Markets.” Paper prepared for the 53rd Congress of the IIPF in Kyoto, August 25–28, 1997.

Stern, N. (1987): “The Effects of Taxation, Price Control and Government Contracts in Oligopoly and Monopolistic Competition.”Journal of Public Economics 32: 133–158.

Stiglitz, J. E. (1987): “Pareto-Efficient and Optimal Taxation and the New New Welfare Economics.” InHandbook of Public Economics, vol. 2, edited by A. J. Auerbach and M. Feldstein. Amsterdam: North-Holland.

Summers, L., Gruber, J., and Vergara, R. (1993): “Taxation and the Structure of Labor Markets: the Case of Corporatism.”Quarterly Journal of Economics 108: 385–411.

Tuomala, M. (1990):Optimal Income Taxation and Redistribution. Oxford: Oxford University Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Fuest, C., Huber, B. Wage bargaining, labor-tax progression, and welfare. Journal of Economics Zeitschrift für Nationalökonomie 66, 127–150 (1997). https://doi.org/10.1007/BF01234403

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01234403