Abstract

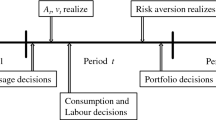

A two-period consumption model with an “ordinal certainty equivalent” preference is developed to characterize the comparative static effect of an increase in uncertainty of investment returns on the riskfree interest rate, the equity premium, expected growth of consumption, and the marginal propensity to consume out of current income. The results reconcile a few often reported consumption-related anomalies.

Similar content being viewed by others

References

Basu, P. (1994): “Tax Rate Uncertainty and the Sensitivity of Consumption to Income in an Overlapping Generations Model.”Journal of Economic Dynamics and Control, forthcoming.

Basu, P., and Ghosh, S. (1993): “Saving under General Changes in Uncertainty: a Nonexpected Utility Maximizing Approach.”Southern Economic Journal 60: 119–127.

Barsky, R. B. (1989): “Why Don't the Prices of Stocks and Bonds Move Together”American Economic Review 79: 1132–1145.

Christiano, L. J. (1987): “Is Consumption Insufficiently Sensitive to Innovation in Income?”American Economic Review 77, Papers and Proceedings: 337–341.

Cochrane, J. (1991): “Production Based Asset Pricing and the Link between Stock Returns and Economic Fluctuations.”Journal of Finance 46: 209–237.

Deaton, A. (1987): “Life Cycles Models of Consumption: Is the Evidence Consistent with the Theory?” InAdvances in Econometrics, Fifth World Congress, vol. 2, edited by T. F. Bewley. Cambridge: Cambridge University Press.

Mehra, R., and Prescott, E. C. (1985): “The Equity Premium: a Puzzle.”Journal of Monetary Economics 15: 145–161.

Rothschild, M., and Stiglitz, J. E. (1970): “Increasing Risk I: a Definition.”Journal of Economic Theory 2: 225–243.

Selden, L. (1979): “An OCE Analysis of the Effect of Uncertainty on Saving under Risk Preference Independence.”Review of Economic Studies 46: 73–82.

Weil, P. (1989): “The Equity Premium Puzzle and the Risk-free Rate Puzzle.”Journal of Monetary Economics 24: 401–421.

West, K. D. (1988): “The Insensitivity of Consumption to News About Income.”Journal of Monetary Economics 21: 17–33.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Basu, P. Capital risk and consumption puzzles: A pedagogical note. Zeitschr. f. Nationalökonomie 60, 99–107 (1994). https://doi.org/10.1007/BF01228027

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01228027