Summary

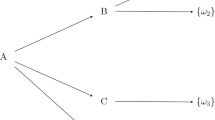

We construct an endogenous state space in an exchange economy with possibly infinite horizon. Every period agents trade securities whose payoffs depend on future dividends and asset prices. We reject the perfect foresight assumption on the ground that agents have not only limited knowledge of other individuals' endowments and preferences, but also limited capacity to compute equilibria. We choose instead absence of arbitrage as the principle which allows agents to determine if a system of future prices is possible. We give an alogrithm to compute the set of nonarbitrage prices every period, with both finite and infinite horizon. We then apply this endogenous structure of uncertainty to an infinite horizon temporary equilibrium model.

Similar content being viewed by others

References

Aliprantis, C. D., Brown, D. J., Burkinshaw, O.: Existence and optimality of competitive equilibria. Berlin: Springer-Verlag 1990

Aliprantis, C. D., Burkinshaw, O.: Positive operators. Orlando, Fla: Academic Press, Inc. 1985

Ash, R. B.: Real analysis and probability. San Diego, California: Academic Press, Inc. 1972

Black, F., Scholes, M.: The pricing of options and corporate liabilities. Journal of Political Economy81, 637–659 (1973)

Border, K. C.: Fixed point theorems with applications to economics and game theory. Cambridge Mass.: Cambridge University Press 1985

Brown, D. J., Werner, J.: Arbitrage and existence of equilibrium in infinite asset markets. Technical Report No. 43, Stanford Institute for Theoretical Economics, Stanford University 1992

Chiappori, P. A., Guesnerie, R.: Sunspots equilibria in sequential markets models. In: Hildenbrand, W., Sonnenschein, H. (eds.) Handbook of mathematical economics, vol. 4, pp. 1683–1762. Amsterdam: North-Holland 1991

Chichilnisky, G., Dutta, J., Heal, G.: Options and price uncertainty. Stanford Institute for Theoretical Economics, Stanford University 1991

Cox, J., Ingersoll, J., Ross, S.: An intertemporal general equilibrium model of assets prices. Econometrica53, 363–384 (1985)

Cox, J., Rubinstein, M.: Options markets. Englewood Cliffs, N.J: Prentice-Hall 1985

Grandmont, J. M.: Temporary general equilibrium theory. In: Arrow, K. J., Intriligator, M. D. (eds.) Handbook of Mathematical Economics, vol. 2, pp. 879–922. Amsterdam: North-Holland 1982

Green, J. R.: Temporary general equilibrium in a sequential trading model with spot and futures transactions. Econometrica41, 1103–1123 (1973)

Hahn, F.: Notes on incomplete markets. Mimeo 1991

Henrotte, P.: Existence and optimality of equilibria in markets with tradeable derivative securities. Technical Report No. 48, Stanford Institute for Theoretical Economics, Stanford University 1992

Henrotte, P.: Construction of a state space for interrelated securities with an application to temporary equilibrium theory. Cahier de Recherche du Groupe HEC, 1996

Hildenbrand, W.: Core and equilibria of a large economy. Princeton, N. J.: Princeton University Press 1974

Kurz, M.: The Kesten-Stigum model and the treatment of uncertainty in equilibrium theory. In: Balch, M. S., McFadden, P. L., Wu, S. Y. Essays on economic behavior under uncertainty, pp 389–399 (eds.) Amsterdam: North-Holland 1974

Kurz, M.: On rational belief equilibria. Economic Theory4, 859–876 (1994a)

Kurz, M.: On the Structure and Diversity of Rational Beliefs. Economic Theory4, 877–900 (1994b)

Magill, M., Shaefer, W.: Incomplete markets. In: Hildenbrand, W., Sonnenschein, H. (eds.) Handbook of Mathematical Economics, vol. 4 1523–1614. Amsterdam: North-Holland 1991

Rockafellar, R. T.: Convex analysis. Princeton, N. J.: Princeton University Press 1970

Svensson, L. E. O.: Efficiency and speculation in a model with price-contingent contracts. Econometrica49 131–151 1981

Werner, J.: Arbitrage and the existence of competitive equilibrium. Econometrica55, 1403–1418 1987

Author information

Authors and Affiliations

Additional information

I would like to thank Professor Donald Brown for his constant help and guidance. I have also greatly benefited from helpful discussions with Professors Jacques Drèze, Bernard Dumas, Mordecai Kurz, Carsten Nielsen, Jan Werner, and Ho-Mou Wu.

Rights and permissions

About this article

Cite this article

Henrotte, P. Construction of a state space for interrelated securities with an application to temporary equilibrium theory. Econ Theory 8, 423–459 (1996). https://doi.org/10.1007/BF01213504

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01213504