Abstract

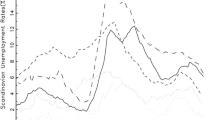

The present paper applies to the Nelson-Plosser data set the recursive, rolling, and sequential tests proposed by Banerjee, Lumsdaine and Stock (1992) for unit roots in the presence of mean or trend breaks. Unlike Perron's method, these three types of test endogenize the break point in the mean or trend and thus are more appealing in empirical studies. The (reverse) recursive test indicates rejection of the unit root null in industrial production and unemployment rate. The sequential test indicates that nominal GNP and common stock prices are stationary with a break in the mean.

Similar content being viewed by others

References

Banerjee A, Dolado J, Galbraith JW (1990) Recursive tests for unit roots and structural breaks in long annual GNP series. Unpublished manuscript., Institute of Economics and Statistics, Oxford UK

Banerjee A, Lumsdaine RL, Stock JH (1992) Recursive and sequential tests of the unit root and trend-break hypotheses: Theory and international evidence. Journal of Business and Economic Statistics 10:271–287

Christiano LJ (1992) Searching for a break in GNP. Journal of Business and Economic Statistics 10:237–249

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74:427–431

Nelson CR, Plosser CI (1982) Trends and random walk in macroeconomic time series. Journal of Monetary Economics 10:139–162

Perron P (1988) Trends and random walks in macroeconomic time series: Further evidence on a new approach. Journal of Economic Dynamics and Control 12:297–332

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis.Econometrica 57:1361–1401

Perron P (1990) Further evidence on breaking trend functions in macroeconomic variables. Memorandum 350, Princeton University, Econometric Research Program

Rappoport P, Reichlin L (1989) Segmented trends and non-stationary time series. Economic Journal 99:168–177

Sims CA, Stock JH, Watson MW (1990) Inference in linear time series models with some unit roots. Econometrica 58:113–144

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business and Economic Statistics 10:251–270

Author information

Authors and Affiliations

Additional information

Helpful comments from G. S. Maddala and two anonymous referees are greatly acknowledged.

Rights and permissions

About this article

Cite this article

Li, H. A reexamination of the Nelson-Plosser data set using recursive and sequential tests. Empirical Economics 20, 501–518 (1995). https://doi.org/10.1007/BF01180679

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01180679