Abstract

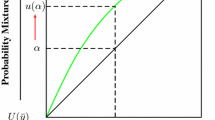

This paper extends the existing literature concerning the relationship between two parameter decision models and those based on expected utility in two main directions. The first relaxes Meyer's location and scale (or Sinn's linear class) condition and shows that a two-parameter representation of preferences over uncertain prospects and the expected utility representation yield consistent rankings of random variables when the decision maker's choice set is restricted to random variables differing by mean shifts and monotone meanpreserving spreads. The second shows that the rank-dependent expected utility model is also consistent with two-parameter ranking methods if the probability transform satisfies certain dominance conditions. The main implication of these results is that the simple two-parameter model can be used to analyze the comparative statics properties of a wide variety of economic models, including those with multiple sources of uncertainty when the random variables are comonotonic. To illustrate this point, we apply our results to the problem of optimal portfolio investment with random initial wealth. We find that it is relatively easy to obtain strong global comparative statics results even if preferences do not satisfy the independence axiom.

Similar content being viewed by others

References

Arrow, K.J. (1974).Essays in the Theory of Risk Bearing. Amsterdam: North Holland.

Chew, S.H., E. Kami, and Z. Safra. (1987). “Risk Aversion in EURDP Theory,”Journal of Economic Theory 42, 370–381.

Feder, G. (1977). “The Impact of Uncertainty in a Class of Objective Functions,”Journal of Economic Theory 16, 504–512.

Feller, William. (1966).An Introduction to Probability Theory and Its Applications: Volume II. New York: Wiley.

Kihlstrom, R., D. Romer, and S. Williams. (1981). “Risk Aversion with Random Initial Wealth,”Econometrica 49, 911–920.

Machina, M. (1982). “Expected Utility Analysis Without the Independence Axiom,”Econometrica 50, 393–405.

Meyer, J. (1987). “Two-Moment Decision Models and Expected Utility Maximization,”American Economic Review 77, 421–30.

Meyer, J., and M. Ormiston. (1983). “The Comparative Statics of Cumulative Distribution Function Changes for the Class of Risk Averse Agents,”Journal of Economic Theory 31, 153–69.

Meyer, J., and M. Ormiston. (1985). “Strong Increases in Risk and Their Comparative Statics,”International Economic Review 26, 425–437.

Meyer, J., and M. Ormiston. (1989). “Deterministic Transformations of Random Variables and the Comparative Statics of Risk,”Journal of Risk and Uncertainty 2, 179–188.

Ormiston, M. (1992). “First and Second Degree Transformations and Comparative Statics Under Uncertainty,”International Economic Review 33, 33–44.

Pratt, J. (1964). “Risk Aversion in the Small and in the Large,”Econometrica 32, 122–136.

Quiggin, J. (1982). “A Theory of Anticipated Utility,”Journal of Economic Behavior and Organization 3, 323–343.

Quiggin, J. (1992a). “Increasing Risk: Another Definition,” In A. Chikan (ed.),Progress in Decision, Utility, and Risk Theory. Dordrecht: Kluwer Academic Publishers.

Quiggin, J. (1991b). “Comparative Statics for Rank-Dependent Expected Utility Theory,”Journal of Risk and Uncertainty 4, 339–350.

Quiggin, J. (1992).Probability Transformations: A General Model of Choice Under Uncertainty. Australian National University.

Ross, S. (1981). “Some Stronger Measures of Risk Aversion in the Small and in the Large with Applications,”Econometrica 49, 621–638.

Rothschild, M., and J. Stiglitz. (1970). “Increasing Risk I: A Definition,”Journal of Economic Theory 2, 225–243.

Sandmo, A. (1971). “On the Theory of the Competitive Firm Under Price Uncertainty,”American Economic Review 61, 65–73.

Schmeidler, D. (1989). “Subjective Probability and Expected Utility Without Additivity,”Econometrica 57, 571–587.

Sinn, H. (1983).Economic Decisions under Uncertainty, 2nd English ed. Amsterdam: North-Holland.

Tobin, J. (1969). “Liquidity Preference as Behavior Toward Risk,”Review of Economic Studies 25, 13–14.

Author information

Authors and Affiliations

Additional information

We would like to thank an anonymous referee for valuable comments and suggestions. This research was funded in part by the Arizona State University, College of Business, Summer Grant Program.

Rights and permissions

About this article

Cite this article

Ormiston, M.B., Quiggin, J. Two-parameter decision models and rank-dependent expected utility. J Risk Uncertainty 7, 273–282 (1993). https://doi.org/10.1007/BF01079627

Issue Date:

DOI: https://doi.org/10.1007/BF01079627