Abstract

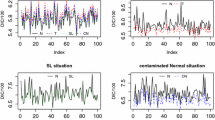

Brown and Gibbons (1985) developed a theory of relative risk aversion estimation in terms of average market rates of return and the variance of market rates of return. However, the exact sampling distributions of the relative risk aversion estimators have not been derived. The main purpose of this paper is to derive the exact sampling distribution of an appropriate relative risk aversion estimator. First, we have derived theoretically the density of Brown and Gibbons' maximum likelihood estimator. It is shown that the centralt is not appropriate for testing the significance of estimated relative risk aversion distribution. Then we derived the minimum variance unbiased estimator by a linear transformation of the Brown and Gibbons' maximum likelihood estimator. The density function is neither a central nor a noncentralt distribution. The density function of this new distribution has been tabulated. There is an empirical example to illustrate the application of this new sampling distribution.

Similar content being viewed by others

References

Blume, M.E., “Portfolio Theory: A Step Towards Its Practical Application.”Journal of Business 43, 152–173, (1970).

Brown, D.P. and Gibbons, M.R., “A Simple Econometric Approach for Utility-Based Asset Pricing Models.”Journal of Finance XL, 359–381, (1985).

Cox, J., J. Ingersoll, and S. Ross, “A Theory of the Term Structure of Interest Rates.”Econometrica 53, 385–407, (1985).

Fama, E.F., “The Behavior of Stock-Market Prices.”Journal of Business 38, 34–105, (1965).

Grossman, S. and R. Shiller, “The Determinants of Variability of Stock Market Prices,”American Economic Review 71, 222–227, (May 1981).

Hakansson, N., “Optimal Investment and Consumption under Risk for a Class of Utility Functions.”Econometrica 38, 587–607, (September 1970).

Hogg, R.V., and A.T. Craig,Introduction to Mathematical Statistics, 4th Ed. New York: Macmillan, 1978.

Ibbotson Associates,Stocks, Bonds, Bills and Inflation: (1926–1988). Chicago: Ibbotson Associates, 1989.

Kendall, A.G., and A. Stuart,The Advanced Theory of Statistics, vol 2, 4th Ed. New York: Macmillan, 1979.

Kraus, A., and R. Litzenberger, “Market Equilibrium in a Multiperiod State Preference Model with Logarithmic Utility.”Journal of Finance 30, 1213–1227, (December 1975).

Lintner, J., “The Lognormality of Security Returns, Portfolio Selection and Market Equilibrium.” Unpublished manuscript, Harvard University, (1983).

Loève, M.,Probability Theory, 3rd Ed. Princeton, NJ: Van Nostrand, 1963.

Merton, R., “Optimum Consumption and Portfolio Rules in a Continuous Time Model.”Journal of Economic Theory 3, 373–413, (1971).

Rothschild, M. and J. Stiglitz, “Increasing Risk II: Its Economic Consequences.”Journal of Economic Theory 3, 66–84, (March 1971).

Royden, H.L.,Real Analysis, 3rd Ed. New York: Macmillan, 1988.

Rubinstein, M.L., ‘The Strong Case for the Generalized Logarithmic Utility Models as the Premier Model of Financial Markets.” in H. Levy and M. Sarnat, eds.,Financial Decision Making under Uncertainty. New York: Academic Press, 1977.

Samuelson, P., ‘Lifetime Portfolio Selection by Dynamic Stochastic Programming.”Review of Economics and Statistics 51, 239–246, (August 1969).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Karson, M.J., Cheng, D.C. & Lee, C.F. Sampling distribution of the relative risk aversion estimator: Theory and applications. Rev Quant Finan Acc 5, 43–54 (1995). https://doi.org/10.1007/BF01074851

Issue Date:

DOI: https://doi.org/10.1007/BF01074851