Abstract

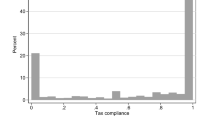

A factorial survey design is used to examine the taxpaying decisions of a random sample of adults. Data collected by asking respondents to rate their chances of cheating on their taxes under varying experimental conditions show only a small proportion of the sample expects to evade taxes. The few likely offenders judge lower tax rates to reduce their incentive to cheat, while higher audit rates, heavier prison sentences, and fines act as key inhibitors to tax cheating. The implications of this methodology and these data for future studies of tax evasion and deviance are briefly discussed.

Similar content being viewed by others

References

Andenaes, J. (1966). The general preventive effects of punishment.Univ. Pa. Law Rev. 114: 949–983.

Andenaes, J. (1975). General prevention revisited. InNational Swedish Council for Crime Prevention, General Deterrence-A Conference on Current Research and Standpoints, Stockholm, Sweden, pp. 12–59.

Anderson, A. B., Harris, A. R., and Miller, J. (1983). Models of deterrence theory.Soc. Sci. Res. 12: 236–262.

Anderson, L. S., Chiricos, T. G., and Waldo, G. P. (1977). Formal and informal sanctions: A comparison of deterrent effects.Soc. Problems 25: 103–114.

Bailey, W. C., and Lott, R. P. (1976). Crime, punishment and personality: An examination of the deterrence question.J. Crim. Law Criminol, 67: 99–109.

Baldry, J. C. (1987). Income tax evasion and the tax schedule: Some experimental results.Publ. Finance 42: 357–383.

Blake, J., and Davis, K. (1964). Norms, values, and sanctions. In Paris, R. E. L. (ed.),Handbook of Modern Sociology, Rand McNally, Chicago, pp. 456–484.

Bohrnstedt, G. W. (1983). Measurement. In Rossi, P. H., Wright, J. D., and Anderson, A. B. (eds.),Handbook of Survey Research, Academic Press, New York, pp. 69–121.

Clotfelter, C. T. (1983). Tax evasion and tax rates: An analysis of individual returns.Rev. Econ. Stat. 65: 363–373.

Cohen, L. (1978). Sanction threats and violation behavior: An inquiry into perceptual variation. In Wellford, C. (ed.),Quantitative Studies in Criminology, Sage, Beverly Hills, Calif., pp. 84–99.

Dubin, J. H., Graetz, M. J., and Wilde, L. L. (1987). Are we a nation of tax cheaters? New econometric evidence on tax compliance.Am. Econ. Rev. 77: 240–245.

Geerken, M. R., and Gove, W. R. (1975). Deterrence: Some theoreticai considerations.Law Soc. Rev. 9: 497–513.

Gibbs, J. P. (1975).Crime, Punishment, and Deterrence, Elsevier-North Holland, New York.

Gibbs, J. P. (1982). Law as a means of social control. In Gibbs, J. P. (ed.),Social Control: Views from the Social Sciences, Sage, Beverly Hills, Calif., pp. 83–113.

Gibbs, J. P. (1987). The state of criminological theory.Criminology 25: 821–840.

Grasmick, H. G., and Bryjak, G. J. (1980). The deterrent effect of perceived severity of punishment.Soc. Forces 59: 471–491.

Grasmick, H. G., and Scott, W. J. (1982). Tax evasion and mechanisms of social control: A comparison with grand and petty theft.J. Econ. Psychol. 2: 213–230.

Internal Revenue Service (1983).Income Tax Compliance Research: Estimates for 1973–1981, Government Printing Office, Washington, D.C.

Kaplan, S. E., and Reckers, P. M. J. (1985). A study of tax evasion judgments.Natl. Tax J. 38: 97–102.

Kerlinger, F. N., and Pedhazur, E. J. (1973).Multiple Regression in Behavioral Research, Holt, Rinehart and Winston, New York.

Louis Harris and Associates, Inc. (1987).1987 Taxpayer Opinion Survey, A report prepared for the Internal Revenue Service, Louis Harris and Associates, Inc., New York.

Mason, R., and Calvin, L. D. (1978). A study of admitted income tax evasion.Natl. Tax J. 13: 73–89.

Mason, R., and Calvin, L. D. (1984). Public confidence and admitted income tax evasion.Natl. Tax J. 37: 489–496.

Pedhazur, E. J. (1982).Multiple Regression in Behavioral Research: Explanation and Prediction, 2nd ed., Holt, Rinehart and Winston, New York.

Rossi, P. H., and Anderson, A. B. (1982). The factorial survey approach: An introduction. In Rossi, P. H., and Nock, S. (eds.),Measuring Social Judgments: The Factorial Survey Approach, Sage, Beverly Hills, Calif., pp. 15–67.

Rossi, P. H., and Nock, S. (eds.) (1982).Measuring Social Judgments: The Factorial Survey Approach, Sage, Beverly Hills, Calif.

Rossi, P. H., Simpson, J. E., and Miller, J. A. L. (1985). Beyond crime seriousness: Fitting the punishment to the crime.J. Quant. Criminol. 1: 59–90.

Schwartz, R. D., and Orleans, S. (1967). On legal sanctions.Univ. Chicago Law Rev. 34: 274–300.

Scott, W. J., and Grasmick, H. G. (1981). Deterrence and income tax cheating: Testing interaction hypotheses in utilitarian theories.J. Appl. Behav. Sci. 17: 395–408.

Slemrod, J. (1985). An empirical test for tax evasion.Rev. Econ. Stat. 67: 232–238.

Spicer, M. W. (1986). Civilization at a discount: The problem of tax evasion.Natl. Tax J. 39: 13–20.

Spicer, M. W., and Becker, L. A. (1980). Fiscal inequity and tax evasion: An experimental approach.Natl. Tax J. 33: 171–175.

Spicer, M. W., and Lundstedt, S. B. (1976). Understanding tax evasion.Publ. Finance 31: 295–305.

Teevan, J. J. (1976). Deterrent effects of punishment: Subjective measures continued.Can. J. Criminol Corr. 18: 152–160.

Thurman, Q. C., St. John, C., and Riggs, L. R. (1984). Neutralization and tax evasion: How effective would a moral appeal be in improving compliance to tax laws?Law Policy 6: 309–327.

Tittle, C. (1980).Sanctions and Social Deviance: The Question of Deterrence, Praeger, New York.

Vogel, J. (1974). Taxation and public opinion in Sweden: An interpretation of recent survey data.Natl. Tax J. 27: 499–513.

Williams, K. R., and Hawkins, R. (1986). Perceptual research on general deterrence: A critical review.Law Soc. Rev. 20: 545–572.

Witte, A. D., and Woodbury, D. F. (1985). The effect of tax laws and tax administration on tax compliance: The case of the U.S. individual income tax.Natl. Tax J. 38: 1–13.

Yankelovich, Skelly, and White, Inc. (1984).Taxpayer Attitudes Study Final Report, A report prepared for the Internal Revenue Service, Yankelovich, Skelly and White, Inc., New York.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Thurman, Q.C. General prevention of tax evasion: A factorial survey approach. J Quant Criminol 5, 127–146 (1989). https://doi.org/10.1007/BF01062520

Issue Date:

DOI: https://doi.org/10.1007/BF01062520