Abstract

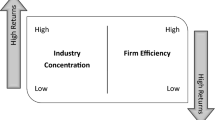

Aggregation of homogeneous product markets into industry classifications or disequilibrium in terms of differences between expected and actual market shares can lead to bias in the estimated relationship between concentration and profitability from regressions using cross-industry data. The relationship between concentration and profitability over the period from 1965 to 1980 is estimated for various samples of Canadian manufacturing industries. Regressions for the full sample of industries lead to rejection of the hypotheses from either structure-conduct-performance (structuralist) analysis or a model of oligopolistic equilibrium. However, regressions for subsamples of industries selected to remove industries subject to aggregation provide results consistent with the structuralist hypothesis, while regressions for industries selected to remove industries subject to both aggregation and disequilibrium provide results consistent with the oligopolistic equilibrium hypothesis.

Similar content being viewed by others

References

Bloch, H. (1981) ‘Concentration and profitability in Canadian manufacturing: An indirect test of the effect of aggregation",Canadian Journal of Economics,14, 130–135.

Bothwell, J. L., Cooley, T. F. and Hall, T. E. (1984) ‘A new view of the market structure-performance debate’,Journal of Industrial Economics,32, 397–417.

Clarke, R. and Davies, S. W. (1982) ‘Market structure and price-cost margins",Economica,49, 277–287.

Cowling, K. and Waterson, M. (1976) ‘Price-cost margins and market structure’,Economica,43, 267–274.

Department of Corporate and Consumer Affairs (1971)Concentration in the Manufacturing Industries of Canada, Ottawa: Information Canada.

Dickson, V. A. (1982) ‘Collusion and price-cost marginsrs,Economica,49, 39–42.

Maddala, G. S. (1988)Introduction to Econometrics, New York: Macmillan Publishing Company

Scherer, F. M. and Ross, D. (1990)Industrial Market Structure and Economic Performance (Third Edition, Boston: Houghton Mifflin Company.

Schmalensee, R. (1989), ‘Inter-industry studies of structure and performance’, in R. Schmalensee and R. Willig (eds),Handbook of Industrial Organization, Volume 2, Amsterdam: North Holland.

Statistics Canada (1973)Industrial Organization and Concentration in the Manufacturing, Mining and Logging Industries, 1968, Ottawa: Information Canada.

Statistics Canada (1983).Industrial Organization and Concentration in the Manufacturing, Mining and Logging Industries, 1980, Ottawa: Minister of Supply and Services Canada.

Weiss, L. W. (1974) ‘The concentration-profitability relationship and antitrust’, in H. J. Goldschmid, H. M. Mann and J. F. Weston (eds.),Industrial Concentration: The New Learning, Boston: Little Brown and Company.

Author information

Authors and Affiliations

Additional information

An earlier version of this paper was presented at the 1990 Meetings of the Canadian Economics Association. Helpful comments from Jeff Church, Steve Davies, Simon Domberger, Ben Heijdra, Dave Sapsford, Pam Weidler and participants at the meetings are gratefully acknowledged. Useful suggestions were also received from an anonymous referee of this journal.

Rights and permissions

About this article

Cite this article

Bloch, H. Sample-selection procedures for estimating the relationship between concentration and profitability from cross-industry data. Rev Ind Organ 9, 71–84 (1994). https://doi.org/10.1007/BF01024220

Issue Date:

DOI: https://doi.org/10.1007/BF01024220