Abstract

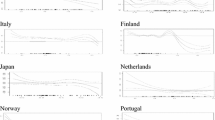

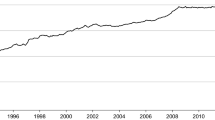

This paper examines whether there is a tendency for actual exchange rates to return to their fundamental equilibrium exchange rates (FEERs) when the latter are estimated based on popular exchange rate models. Co-integration tests and unit root tests are applied. There is little evidence that the exchange rates of Japan and Germany have a reversion to the purchasing-power-parity (PPP) rates or Williamson's FEERs or the underlying external and internal balance (UEI) FEERs.

Similar content being viewed by others

References

Adler, Michael and Bruce Lehman (1983) “Deviations from Purchasing Power Parity in the Long Run,”Journal of Finance 38, 1471–1478.

Artus, Jacques R. and Anne K. McGuirk (1981) “A Revised Version of the Multilateral Exchange Rate Model,”International Monetary Fund Staff Papers 28, 275–309.

Barrell, Ray and Simon Wren-Lewis (1989) “Fundamental Equilibrium Exchange Rates for the G-7,” CEPR Discussion Paper No. 323.

Corbae, Dean and Sam Ouliaris (1988) “Co-integration and Tests of Purchasing Power Parity,”The Review of Economics and Statistics 70, 508–511.

Dickey, David A. and Wayne A. Fuller (1981) “The Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root,”Econometrica 49, 1057–1072.

Dornbusch, Rudiger (1976) “Expectations and Exchange Rate Dynamics,”Journal of Political Economy 84, 1161–1176.

Edison, Hali J. (1987) “Purchasing Power Parity in the Long Run: A Test of the Dollar-Pound Exchange Rate, 1890–1978,”Journal of Money, Credit and Banking 19, 376–387.

Enders, Walter (1988) “ARIMA and Co-integration Tests of PPP under Fixed and Flexible Exchange Rate Regimes,”Review of Economics and Statistics 70, 504–508.

Engle, Robert and C.W.J. Granger (1987) “Co-integration and Error Correction: Representation, Estimation, and Testing,”Econometrica 55, 251–276.

Frenkel, Jacob A. (1981) “Flexible Exchange Rates, Prices and the Role of News,”Journal of Political Economy 89, 665–705.

Frenkei, Jacob A. and Morris Goldstein (1986) “A Guide to Target Zones,”International Monetary Fund Staff Papers 33, 633–670.

Fuller, Wayne A. (1976)Introduction to Statistical Time Series. New York: John Wiley.

Granger, C.W.J. (1986) “Developments in the Study of Co-integrated Economic Variables,”Oxford Bulletin of Economics and Statistics 48, 213–228.

Huizinga, John (1987) “An Empirical Investigation of the Long-Run Behavior of Real Exchange Rates,”Carnegie-Rochester Conference Series on Public Policy 27, 149–214.

Kim, Yoonbai (1990) “Purchasing Power Parity in the Long Run: A Co-integration Approach,”Journal of Money, Credit and Banking 22, 348–357.

Lothian, James R. (1990) “A Century Plus of Japanese Exchange Rate Behavior,”Japan and the World Economy 2, 47–70.

McKinnon, Ronald I. (1988) “Monetary and Exchange Rate Policies for International Financial Stability: A Proposal,”Journal of Economic Perspectives 2, 83–103.

Ohno, Kenichi (1987) “Estimating Purchasing Power Parities in the 1970s and 80s: The Price Pressure Approach,” Working Paper, Stanford University.

Perron, Pierre (1988) “Trends and Random Walks in Macroeconomic Time Series: Further Evidence from a New Approach,”Journal of Economic Dynamics and Control 12, 297–332.

Phillips, Peter C.B. and Pierre Perron (1988) “Testing for a Unit Root in Time Series Regression,”Biometrika 75, 335–346.

Roli, Richard (1979) Violations of Purchasing Power Parity and Their Implications for Efficient International Commodity Markets.” in M. Sarnat and G.P. Szego (eds),International Finance and Trade 1, Cambridge, MA: Ballinger, pp. 345–361.

Stockman, Alan C. (1987) “The Equilibrium Approach to Exchange Rates”,Economic Review, Federal Reserve Bank of Richmond, pp. 12–30.

Williamson, John (1985)The Exchange Rate System, Policy Analysis in international Economics 5, Institute for International Economics, Washington D.C.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Zhou, S. Fundamental equilibrium exchange rates and exchange rate dynamics. Open Econ Rev 4, 189–209 (1993). https://doi.org/10.1007/BF01000519

Issue Date:

DOI: https://doi.org/10.1007/BF01000519