Abstract

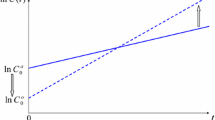

This paper examines the current-account effect of a devaluation in a Chamberlinian model where both saving and investment are based on intertemporal optimization. It shows that devaluation tends to deteriorate the current account along the time horizon, leading to a reduction of the stock of foreign assets permanently. In contrast to recent work, these real effects do not rely on short-run disequilibrium in the goods or labor market. Besides, a temporary devaluation may generate hysteresis effects on both micro- and macro-economic aspects of a small economy.

Similar content being viewed by others

References

Abel, A.B. and O.J. Blanchard (1983) “An Intertemporal Model of Saving and Investment,”Econometrica 51, 673–692.

Baldwin, Richard (1988) “Hysteresis in Import Prices: The Beachhead Effect,”American Economic Review 78, 772–784.

Brock, Philip (1988) “Investment, the Current Account, and the Relative Price of Non-Traded Goods in a Small Open Economy,”Journal of International Economics 24, 235–253.

Das, Satya P. and Yoshio Niho (1986) “A Dynamic Analysis of Protection, Market Structure, and Welfare,”International Economic Review 27, 513–523.

Dixit, Avinash and Joseph Stiglitz (1977) “Monopolistic Competition and Optimal Product Diversity,”American Economic Review 67, 297–308.

Dornbusch, Rudiger (1976) “Expectations and Exchange Rate Dynamics,”Journal of Political Economy 84, 1161–1176.

Gavin, Michael (1991a) “Devaluation, the Terms of trade, and Investment in a Keynesian Economy,” Discussion Paper Series No. 543, Department of Economics, Columbia University.

Gavin, Michael (1991b) “Tariffs and the Current Account: On the Macroeconomics of Commercial Policy,”Journal of Economic Dynamics and Control 15, 27–52.

Helpman, Elhanan and Paul Krugman (1985)Market Structure and Foreign Trade. Cambridge: MIT Press.

Korkman, Sixten (1978) “The Devaluation Cycle,”Oxford Economic Papers 30, 357–367.

Kouri, Pentti, J.K. (1979) “Profitability and Growth in a Small Open Economy.” In A. Lindbeck (ed)Inflation and Employment in Open Economies. Amsterdam: North Holland.

LeRoy, Stephen F. (1980) “Entry and Equilibrium Under Adjustment Costs,”Journal of Economic Theory 23, 348–360.

Matsuyama, K. (1987) “Current Account Dynamics in a Finite Horizon Model,”Journal of International Economics 23, 299–313.

Murphy, Robert (1989) “Stock Price, Real Interest Rates, and Optimal Capital Accumulation,IMF Staff Papers 36, 102–108.

Nielsen, Søren Bo (1991) “Current Account Effects of a Devaluation in an Optimizing Model with Capital Accumulation,”Journal of Economic Dynamics and Control 15, 569–588.

Persson, T. and Lars E.O. Svensson (1985) “Current Account Dynamics and the Terms of Trade: Harberger-Laursen-Metzler Two Generations Later,”Journal of Political Economy 93, 43–65.

Risager, Ole (1988) “Devaluation, Profitability, and Investment,”Scandinavian Journal of Economics 90, 125–140.

Sen, Partha and Stephen Turnovsky (1989) “Deterioration of the Terms of Trade and Capital Accumulation: A Re-examination of the Laursen-Metzler Effect,”Journal of International Economics 26, 227–250.

Spence, Michael A. (1976) “Product Selection, Fixed Costs, and Monopolistic Competition,”Review of Economic Studies 43, 217–235.

Svensson, Lars E.O. and A. Razin (1983) “The Terms of Trade and the Current Account: The Harberger-Laursen-Metzler Effect,”Journal of Political Economy 91, 97–125.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Lin, HC., Tseng, HK. Exchange rate shocks and the current account under monopolistic competition: An intertemporal optimization model. Open Econ Rev 4, 133–150 (1993). https://doi.org/10.1007/BF01000516

Issue Date:

DOI: https://doi.org/10.1007/BF01000516