Summary

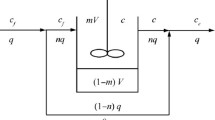

This paper examines two aspects of equilibrium — and stability concepts, which go beyond the traditional analyses. Firstly the speed by which a systems returns to the equilibrium position after an initial disturbance and, secondly, the introduction of stochastic elements in the analysis of stability. Both aspects are presented against the background of a simple model of the Austrian economy.

It is known that a system of difference equations is stable if the greatest sigenvalue is smaller than one. In trying to estimate confidence intervals it can be shown that an evaluation according to deterministic criteria alone can indeed be misleading, even though the probability of an instable solution is small in the model under examiniation.

The speed, by which a system returns to the equilibrium position after an initial disturbance, is measured by the half-life-period. This is the time it takes for the effects of the initial disturbance to be reduced to half their original values. In the model under examination the half-line amounts to one year (real solution) or two years (complex solution) respectively. If we take the stochastic nature of the eigenvalues into consideration, we get, for the 95% level of significance, figures of 3 months to 6 years in the real case. The large spread results from the fact that the half-life-concept is very sensitive even towards minor changes in the eigenvalues.

This paper shows that the conventional methods of estimation of coefficients in stability-analyses are not sufficiently accurate.

Similar content being viewed by others

Literaturverzeichnis

K.J. Arrow-F.H. Hahn: General Competitive Analysis. San Francisco 1971.

W.J. Baumol: Dynamic Economics. Princeton 1973.

T.M. Brown: Habit Persistence and Lags in Consumer Behavior. Econometrica, 20, S. 355–371.

G.C. Chow: Multiplier, Accelerator and Liquidity Preference in the Determination of National Income in the US. Review of Economics and Statistics, 49, S. 1–15.

G.C. Chow: Analysis and Control of Dynamic Economic Systems. New York 1975.

G. Debreu: Theory of Value. New York 1959.

M.K. Evans: Macroeconomic Activity, Theory, Forecasting and Control. New York 1969.

I. Fisher: The Theory of Interest. New York 1930.

M. Friedman: A Theory of Consumption Function. New Jersey N. Y. 1957.

A.S. Goldberger-A.L. Nagar-H.S. Odeh: The Covariance Matrices of Reduced form Coefficients and of Forecasts for a Structural Econometric Model. Econometrica, 29/4, S. 556–573.

J.R. Hicks: Mr. Keynes and the Classics: A Suggested Interpretation. Econometrica 5, 1937, S. 147–159.

J.R. Hicks: Value and Capital. Oxford 1939.

L. Hurwicz-R. Radner-S. Reiter: A Stachostic Decentralized Resource Allocation Process. Econometrica, 43, S. 187–222.

L.M. Koyck: Distributed Lags and Investment Analysis. Amsterdam 1954.

H.J. Kushner: Stochastic Stability and Control. New York 1967.

P. van Moeseke: Mathematical Programming for Activity Analysis. Amsterdam 1974.

M. Morishima: Equilibrium, Stability and Growth. Oxford 1964.

J.R. Moroney-J.M. Mason: The Dynamic Impacts of Autonomous Expenditures and the Monetary Base on Aggregate Income. Journal of Money, Credit and Banking, S. 793–814.

T. Negiski: General Equilibrium Theory and International Trade. Amsterdam 1972.

R. Radner: Market Equilibrium and Uncertainty: Concepts and Problems. In:M.D. Intriligator-D.A. Kendrick (ed.): Frontiers of Quantitave Economics, II, S. 43–90. Amsterdam 1974.

P.A. Samuelson: Foundations of Economic Analysis. Cambridge Mass. 1947.

H. Theil: Principles of Econometrics. Amsterdam 1971.

H. Theil-J.C.G. Boot: The Final Form of Econometric Equation Systems. International Statistical Review 30, S. 136–152.

G. Tintner: A Simple Theory of Business Fluctuations. Econometrica. 10, S. 317–320.

G. Tintner: The Simple Theory of Business. Fluctuations. A Tentative Verification. Review of Economics and Statistics 26, S. 148–157.

G. Tintner: Une theorie simple de fluctuations économiques. Revue d'économie politique, 57, S. 209–215.

G. Tintner: Econometrics. New York 1952.

G. Tintner-W. Pollan: Ein einfaches makroökonomisches Modell für Österreich. Jahrbücher für Nationalökonomie und Statistik, 181, S. 397–403.

G. Tintner-G. Kadekodi-M.V. Rama Sastry: A Macro-model of the Economy for the Explanation of Trend and Business Cycle with Application to India. In:W. Sellekaerts (ed.): Econometrics and Economic Theory, Essays in Honour of Jan Tinbergen, S. 139–146. London 1974.

G. Tintner-J.K. Sengupta: Stochastic Economics. New York 1972.

B. von Hohenbalken-G. Tintner: Econometric Models of the OECD Member Countries, the United States and Canada, and their Application to Economic Policy. In: Weltwirtschaftliches Archiv, Vol. 89, 1962, S. 29 ff.

A. Zellner-H. Theil: Three-Stage Least Squares: Simultaneous Estimation of Simultaneous Equations. Econometrica, 30/1, S. 54–78.

Rights and permissions

About this article

Cite this article

Tintner, G., Böhm, B. & Rieder, R. Stabilitätskonzepte am Beispiel Österreichs. Empirica 4, 85–104 (1977). https://doi.org/10.1007/BF00928963

Issue Date:

DOI: https://doi.org/10.1007/BF00928963