Abstract

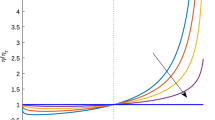

Brownian motion has been extensively applied in the field of mathematical finance in modeling the stochastic processes of returns on securities. In this paper basic and generalized Langevin Equations with memory are used to augment Brownian motion to capture the well stylized facts of the financial market that frictions and imperfect information exist. The operator method of Fourier-Laplace transform with an appropriate kernel (influence function) is used to circumvent the difficulty associated with solving a time dependent nonlinear differential Equation, and a practical computational method is proposed.

From the Langevin Equation, autocorrelation of the return process and the deviation of the return distribution from an ideal Brownian motion are extracted. It is also proven that the time-dependent differential Equation has a unique solution and that it is much more generalized than a martingale Brownian motion functional.

Similar content being viewed by others

References

Alder, B.J. and Wainwright, T.E. (1967), ‘Velocity Autocorrelations for Hard Spheres’,Physical Review Letters,18, 989–999.

Bollerslev, T., Chow, R.Y., Jarayaman, N. and Kroner, K.F. (1990), ‘ARCH Modelling in Finance: A Selective Review of the Theory and Empirical Evidence’, Working Paper.

Ahlfors, L.V. (1966), Complex Analysis, International Series in Pure and Applied Mathematics, McGraw-Hill, Kogakusya.

Case, M.A. (1971), ‘Velocity Fluctuation of a Body in a Fluid’,The Physics of Fluids,14(10), 2091–2095.

Cole, C.S. and Reichenstein, W. (1994), ‘Forecasting Interest Rates with Eurodollar Futures Rates’,Journal of Futures Market,10(1), 37–50.

Engle, R.F. (1982), ‘Autoregressive Conditional Heteroskedastisity with Estimates of the Variance of United Kingdom Inflation’,Econometrica,50, 987–1007.

Fama, E. (1965), ‘The Behavior of Stock Market Prices’,Journal of Business,38, 34–105.

Feder, J. (1988), Fractals, Plenum Press.

Granger, C.W.J. and Newbold, P (1977), Forecasting Economic Time Series, Academic Press.

Heston, S.L. (1993), ‘A Closed Form Solution for Options with Stochastic Volatility with Application to Bond and Currency Options’,Review of Financial Studies,6(2), 327–343.

Hori, Jyunichi (1977), The Langevin Equation (in Japanese), Iwanami-Syoten.

Hsieh, D.A. (1989), ‘Testing for Nonlinear Dependence in Daily Foreign Exchange Rate’,Journal of Business,62(3), 339–368.

Kannan, D. and Bharucha-Reid, A.T. (1972), ‘Random Integral Equation Formulation of a Generalized Langevin Equation’,Journal of Statistical Physics,5(3), 209–233.

Kariya, T. (1993), Quantitative Methods For Portfolio Analysis, Theory And Decision Library (Series B), Kluwer Academic Publishers.

Kariya, T. (1990), Basic Quantitative Course in Portfolio Analysis (in Japanese), Toyokeizai-Shinpou-Sya.

Kariya, T., Tsukuda, Y., Maru, J., Matsue, Y. and Omaki, K. (1995), ‘An Extensive Analysis on the Japanese Markets via S. Taylor's Model’,Financial Engineering and the Japanese Markets,2(1), 15–86.

Karandikar, R.L. and Rachev, S.T. (1993), ‘A Generalized Binomial Model and Option Formulae for Subordinated Stock-Price Processes’, Technical Report No. 242, Department of Statistics and Applied Probability, Univ. of California, Santa Barbara, February.

Kato, K. (1990), Stock Price Changes and Anomaly (in Japanese), Nihon-Keizaishinbun-Sya.

Kitahara, K. (1994), Science in Non-Equilibrium Systems II: Statistical Physics in Relaxation Process (in Japanese), Science Series, Kodan-Sya.

Kondo, J. (1961), Integral Equation, Baifukan.

Konno, S., Shirakawa, S. and Yamazaki, H (1993), ‘A Mean-Absolute Deviation-Skewness Portfolio Optimization Model’,Annals of Operations Research,45, 205–220.

Kubo, R. (1979), ‘Irreversible Process and Stochastic Process: Statistical Dynamics on Stochastic Process and Open System (in Japanese)’,Memorandum of Research Institute of Mathematical Science,367, 50–93.

Kubo, R., Toda, M. and Hashimoto, N. (1985), Statistical Physics II, Springer-Verlag.

Kunitomo, N. (1992), ‘Long Memory and Geometric Brownian Motion in Security Market Models’,Discussion Paper 92-F-12 (University of Tokyo).

Landau, L.D. and Lifshitz, E.M. (1959), Fluid Mechanics, Pergamon.

Loretan, M. and Phillips, P.C.B. (1994), ‘Testing the Covariance Stationarity of Heavy-tailed Time Series’,Journal of Empirical Finance,1(2), 211–248.

Mandelbrot, B.B. (1961), ‘Stable Paretian Random functions and the Multiplicative Variation of Income’,Econometrica,29, 517–543.

Mandelbrot, B.B. (1963), ‘The Variation of Some Speculative Prices’,The Journal of Business,26, 394–419.

Mandelbrot, B.B. and Van Ness, J.W. (1968), ‘Fractional Brownian Motions, Fractional Noises and Applications’,SIAM Review,10, 422–437.

Mandelbrot, B.B. (1971), ‘When Can Price Be Arbitraged Efficiently? A Limit to the Validity of the Random Walk and Martingale Models’,The Review of Economics and Statistics, August,53, 225–236.

Miura, R. (1989), ‘Stock Price Changes by Mixed Normal Model, and Option Pricing (in Japanese)’,Hitotsubashi Ronsou,102(5), 620–644.

Obayashi, K. (1985), ‘Non-Markovian Property and Nonlinear Relaxation (in Japanese)’,Physics Monthly,6(8), 440–444.

Ogura, N. (1985), Theory of Stochastic Process for Physics and Engineering (in Japanese), Corona Publishing.

Okabe, Y. (1992), ‘Characterization of Stochastic Process (in Japanese)’,Mathematical Science,5, 11–17.

Okabe, Y. (1986), ‘On KMO-Langevin Equations for Stationary Gaussian Processes with T-Positive’,Journal of the Faculty of Science, University of Tokyo, Sec. 1A,33(1), 1–56.

Okabe, Y. and Inoue, A. (1992), ‘On the Exponential Decay of the Correlation Functions for KMO-Langevin Equation’,Journal of Mathematics,18(1), 13–24.

Okabe, Y. (1986), ‘On the Theory of Brownian Motion with the Alder-Wainwright Effect’,Journal of Statistical Physics,45(5/6), 953–981.

Peters, E.E. (1989) ‘Fractal Structure in the Capital Markets (in Japanese)’,Security Analysts Journal,27(27), 58–66.

Spiegel, M.R. (1965), Theory and Problems of Laplace Transforms, Schaum's Outline Series, McGraw-Hill.

Sunahara, Y (1982), Theory of Stochastic Systems 11 (in Japanese), Asakura-Syoten.

Suzuki, M. (1981), ‘Passage from an Initial Unstable State to Final Stable State’,Advances in Chemical Physics,46, 195–279.

Suzuki, M. (1992), ‘Fokker-Plank Equation (in Japanese)’,Mathematical Science (extra issue), 128–137.

Takahashi, M. (1992), Valuation of Derivative Assets Utilizing Hurst Exponent (in Japanese), Master Thesis in University of Tsukuba.

Taylor, S.J. (1986), Modelling Financial Time Series, John Wiley and Sons Ltd.

Terasawa, K. (1974), Introduction to Mathematics for Natural Scientists (in Japanese), Iwanami-Syoten.

Toda, M. and Kubo, R. (1972), ‘Statistical Physics (in Japanese),’ Basic Theories in Modern Physics,6, Iwanami-Syoten.

Yajima, Y. (1989), ‘A Central Limit Theorem of Fourier Transforms of Strongly Dependent Stationary Processes’,Journal of Time Series Analysis,10(4), 375–383.

Yamada, N. and Kunieda, T. (1971), Laplace Transformation and Operational Calculus (in Japanese), Corona Publishing.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Takahashi, M. Non-ideal Brownian motion, generalized Langevin Equation and its application to the security market. Financial Engineering and the Japanese Markets 3, 87–119 (1996). https://doi.org/10.1007/BF00868082

Issue Date:

DOI: https://doi.org/10.1007/BF00868082