Abstract

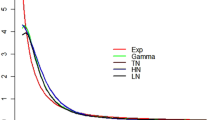

A proof of the asymptotic distribution of the estimated mean-variance frontier is given. A Bayesian prediction interval is derived for the capital asset pricing model. Numerical illustrations show that the prediction intervals for the CAPM are smaller than those for the constant mean model, if the fit of the CAPM is better than that of the constant mean model.

Similar content being viewed by others

References

Black, F., M.C. Jensen and M. Scholes, “The capital asset pricing model: some empirical tests,” in Jensen (ed.) Studies in the theory of capital markets, Praeger, New York, 1972.

Cook, P. and L. D. Boremeling, “Estimation and prediction uncertainty in mean-variance portfolio management,” mimeograph, 1990.

Elton, E.J. and M.J. Gruber, Modern portfolio theory and investment analysis, 4th edition, John Wiley and Sons, New York, 1991.

Johson, J.D., “Confidence regions for the mean-variance efficient set: an alternative approach to estimation risk,” mimeograph, 1990.

Rao, C.R., Linear statistical inference and its application, 2nd edition, John Wiley and Sons, New York, 1973.

Tsurumi, H., “Bayesian prediction intervals for the mean-variance efficient set of the CAPM model,” paper in preparation, 1991.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Tsurumi, H. On statistical inference on the mean-variance efficient set. Rev Quant Finan Acc 2, 169–178 (1992). https://doi.org/10.1007/BF00243800

Issue Date:

DOI: https://doi.org/10.1007/BF00243800