Summary and Conclusions

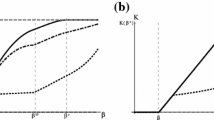

Discussants of the electric power industry point to three principal reasons for corporately unaffiliated electric utility companies to establish formal interorganizational relations: optimal short-run dispatching of production facilities, the “scale economies” (more precisely, the subadditivity) of long-run costs, and the advantage of pooling the risk of equipment failure. This paper has analyzed the organizational properties of power pools established to realize the advantages of subadditive long-run costs. A formal organizational model of a power pool was presented, recognizing the economic and normative structure of a pool. The normative structure chosen was the “subsidy freedom” equity concept familiar in the literature on natural monopoly and in game theory. The principal result of the paper is the construction of a subsidy-free cost allocation rule for the deterministic multiple-technology long-run system planning problem.

The applicability of this result depends on the organization of the “power pool” as an entity capable of contracting for the power needed by the members. Conspicuously in the model used here, the optimal poolwide cost is allocated but ownership of the generating plants is not.

In power ppols of independently owned utilities (IOUs), capacity planning may be centralized but, with the exception of joint ventures in individual generating plants, ownership is maintained at the level of the member firms. IOU power pools allocate separately the fixed and variable costs of the system. Pool members often take turns in building new plants for the pool, thereby indirectly allocating system capacity costs. Having identifiable ownership in the generating plants, the members can allocate the energy costs of the system in a subsidy-free manner using the short-run marginal cost of energy established by central dispatching or energy brokering (Herriot 1985). But that is an approach to short-run energy charges which is very differet from the energy charge in the peaker rule studied here, and it may result in an allocation of total costs that is not subsidy-free.

There are partnership among rural electric distribution cooperatives, called “generation and transmission (G&T) co-ops,” which do share costs without allocating ownership interests. G&T co-ops build generating plants or secure power contracts from IOUs sufficient to meet their members' requirements at an agreed level of reliability. Ownership of the plants, and liability for the contracts, is not disaggregated. Yet in most cases the G&T co-op does not sell power to non-members, so all costs must be allocated among the member firms.

The ownership structure presumed here could also obtain under the scenarios for electric power deregulation envisioned by Joskow and Schmalensee (1983). If the distribution segment is disaggregated from generation and transmission, then locally franchised distribution firms mist face in common the subadditive long-run cost function discussed in the second section. The regional bulk power market would therefore have the structure of a natural monopsony, so the distribution firms would have an incentive to pool their forecast loads and collectively negotiate long-term power contracts with the independent generating firms. Ownership of generation would rest with the generation firms, but the cost of the regionally optimal portfolio of power contracts would have to be allocated among the pooled distribution firms

The deterministic system planning model used here is somewhat simplistic, certainly as must any model to be admit a closed-form solution in a contexts where the “real” capacity planning problems are solved using very large scale linear programs and simulation. However, the cost allocation rule derived for this model may be useful guidepost for the development of practical cost-sharing rules in power pools. An important implication of the peaker rule (4) is the equity of not attempting to allocate separately the fixed and variable costs of a system. Though adjustments must be made to the peaker rule to account fully for the uncertainties, indivisibilities, unreliabilities, and nonhomogeneities faced by system planners, as well as for the growth of future loads and the development of new generation technologies, this cost-allocation rule appears to be helpful as a starting point in power pool rate design.

Similar content being viewed by others

References

Anderson, D. 1972. “Models for Determining Least-cost Investments in Electricity Supply.” Bell Journal of Economics and Management Science 3:267–299.

Bailey, E. 1982. “Introduction.” In Contestable Markets and the Theory of Industrial Structure, edited by W.J. Baumol, J.C. Panzar, and R.D. Willig. New York: Harcourt, Brace Jovanovich.

Chao, Hung-Po. 1983. “Peak-load Pricing and Capacity Planning with Demand and Supply Uncertainty.” Bell Journal of Economics 14(1): 179–190.

Cramer, C.A., and J. Tschirhart 1983. “Power Pooling: An Exercise in Industrial Coordination.” Land Economics 52:24–34.

Crew, M.A., and P.R. Kleindorfer. 1975. “Optimal Plant Mix in Peak Load Pricing.” Scottish Journal of Political Economy 22:277–291.

Crew, M.A., and P.R. Kleindorfer. 1976. “Peak Load Pricing with a Diverse Technology.” Bell Journal of Economics 7:207–231.

Crew, M.A., and P.R. Kleindorfer. 1979. Public Utility Economics. New York: St. Martin's Press.

Crew, M.A., and P.R. Kleindorfer 1986. The Economics of Public Utility Regulation. Cambridge, MA: MIT Press.

Faulhaber, G.R. 1975. “Cross-subsidization: Pricing in Public Enterprises.” American Economic Review 65:966–977.

Faulhaber, G.R., and S.B. Levinson. 1981. “Subsidy-free Pricing and Anonymous Equity.” American Economic Review 71:1083–1091.

Federal Energy Regulatory Commission. 1981. Power Pooling in the United States. Washington: U.S. Government Printing Office, Report FERC-0049.

Gately, D. 1974. “Sharing the Gains to Regional Cooperation: A Game Theoretic Application to Planning and Investment in Electric Power.” International Economic Review 15:195–208.

Gegax, D., and J. Tschirhart. 1984. “An Analysis of Interfirm Cooperation: Theory and Evidence from Electric Power Pools.” Southern Economic Journal 20:1077–1097.

Herriott, S.R. 1984. The Political Economy of Partnerships with Applications to Power Pooling in the Electric Utility Industry. PhD. dissertation, Department of Engineering-Economic Systems, Stanford University.

Herriott, S.R. 1985. “The Organizational Economics of Power Brokers and Centrally Dispatched Power Pools.” Land Economics 61:308–313.

Joskow, P. and R. Schmalensee 1983. Markets for Power. Cambridge, MA: The MIT Press.

Kay, J.A. 1971. “Recent Contributions to the Theory of Marginal Cost Pricing: Some Comments.” Economic Journal 81:366–371.

Mirman, L.J., D. Samet, and Y. Tauman 1983. “An Axiomatic Approach to the Allocation of a Fixed Cost Through Prices.” Bell Journal of Economics 14:13–151.

Mirman, L.J., Y. Tauman, and I. Zang 1985. “Supportability, Sustainability and Subsidy-free Prices.” Rand Journal of Economics 16:114–126.

Ordeshook, P.C. 1986. Game Theory and Political Theory. Cambridge, MA: Cambridge University Press.

Sharkey, W.W., and L.G. Telser. 1978. “Supportable Cost Functions for the Multiproduct Firm.” Journal of Economic Theory 18:23–37.

Sherali, H.D., A.L. Soyster, F.H. Murphy, and S. Sen. 1984. “Intertemporal Allocation of Capital Costs in Electric Utility Capacity Expansion Planning under Uncertainty.” Management Science 30:1–19.

Spulber, D. 1985. “Risk Sharing and Inventories.” Journal of Economic Behavior and Organization 6:55–68.

Sterzinger, G.J. 1983. “The ‘Peaker’ Methodology for Finding the Marginal Costs of Electricity.” Public Utilities Fortnightly 112:35–39.

Turvey, R. 1968. Optimal Pricing and Investment in Electricity Supply. Cambridge, MA: MIT Press.

Varian, H.R. 1978. Microeconomic Analysis. New York: Norton.

Wenders, J.T. 1976. “Peak Load Pricing in the Electric Utility Industry.” Bell Journal of Economics 7:232–241.

Wilson, R.B. 1968. “On the Theory of Syndicates.” Econometrica 36(1): 119–132.

Zajac, E.E. 1978. Fairness or Efficiency: An Introduction to Public Utility Pricing. Cambridge, MA: Ballinger.

Zald, M.N. 1970. “Political Economy: A Framework for Analysis”. In Power in Organizations, edited by Mayer N. Zald Nashville, TN: Vanderbilt University Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Herriott, S.R. A long-run cost allocation problem in the political economy of electric utility power pools. J Regul Econ 1, 69–86 (1989). https://doi.org/10.1007/BF00150298

Issue Date:

DOI: https://doi.org/10.1007/BF00150298