Abstract

Two definitions of risk aversion have recently been proposed for non-expected utility theories of choice under uncertainty: the former refers the measure of risk aversion (Montesano 1985, 1986 and 1988) directly to the risk premium (i.e. to the difference between the expected value of the action under consideration and its certainty equivalent); the latter defines risk aversion as a decreasing preference for an increasing risk (introduced as mean preserving spreads) (Chew, Karni and Safra 1987, Machina 1987, Röell 1987, Yaari 1987).

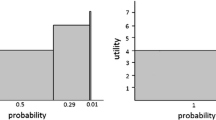

When the von Neumann-Morgenstern utility function exists both these definitions indicate an agent as a risk averter if his or her utility function is concave. Consequently, the two definitions are equivalent. However, they are no longer equivalent when the von Neumann-Morgenstern utility function does not exist and a non-expected utility theory is assumed. Examples can be given which show how the risk aversion of the one definition can coexist with the risk attraction of the other. Indeed the two definitions consider two different questions: the risk premium definition specifically concerns risk aversion, while the mean preserving spreads definition concerns the increasing (with risk) risk aversion.

The mean preserving spreads definition of risk aversion, i.e. the increasing (with risk) risk aversion, requires a special kind of concavity for the preference function (that the derivatives with respect to probabilities are concave in the respective consequences). The risk premium definition of local risk aversion requires that the probability distribution dominates on the average the distribution of the derivatives of the preference function with respect to consequences. Besides, when the local measure of the first order is zero, there is risk aversion according to the measure of the second order if the preference function is concave with respect to consequences.

Yaari's (1969) measure of risk aversion is closely linked to the r.p. measure of the second order. Its sign does not indicate risk aversion (if positive) or attraction (if negative) when the measure of the first order is not zero (i.e., in Yaari's language, when subjective odds differ from the market odds).

Similar content being viewed by others

References

Chew, S. H., Karni, E. and Safra, Z.: 1987, ‘Risk Aversion in the Theory of Expected Utility with Rank Dependent Probabilities’, Journal of Economic Theory 42, 370–381.

de Finetti, B.: 1952, ‘Sulla preferibilità’, Giornale degli Economisti e Annali di Economia 11, 685–709.

Hadar, J. and Russell, W. R.: 1969, ‘Rules for Ordering Uncertain Prospects’, American Economic Review LIX, 25–34.

Machina, M. J.: 1984, ‘Temporal Risk and the Nature of Induced Preferences’, Journal of Economic Theory 33, 199–231.

Machina, M. J.: 1987, ‘Choice under Uncertainty: Problems Solved and Unsolved’, Economic Perspectives 1, 121–154.

Montesano, A.: 1985, ‘The Ordinal Utility under Uncertainty and the Measure of Risk Aversion in Terms of Preferences’, Theory and Decision 18, 73–85.

Montesano, A.: 1986, ‘A Measure of Risk Aversion in Terms of Preferences’, in Daboni, L., Montesano, A. and Lines, M. (eds.), Recent Developments in the Foundations of Utility and Risk Theory, Reidel, Dordrecht, pp. 327–335.

Montesano, A.: 1988a, ‘A Generalized Measure of Risk Aversion, without the Independence Axiom’, in Munier, B. R. (ed.), Risk, Decision and Rationality, Reidel, Dordrecht, pp. 629–637.

Montesano, A.: 1988b, ‘The Risk Aversion Measure without the Independence Axiom’, Theory and Decision 24, 269–288.

Quiggin, J.: 1982, ‘A Theory of Anticipated Utility’, Journal of Economic Behavior and Organization 3, 323–343.

Röell, A.: 1987, ‘Risk Aversion in Quiggin and Yaari's Rank-Order Model of Choice under Uncertainty’, Economic Journal 97 (Conference 1987), pp. 143–159.

Yaari, M. E.: 1969, ‘Some Remarks on Measures of Risk Aversion and on Their Uses’, Journal of Economic Theory 1, 315–329.

Yaari, M. E.: 1987, ‘The Dual Theory of Choice under Risk’, Econometrica 55, 95–115.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Montesano, A. On the definition of risk aversion. Theor Decis 29, 53–68 (1990). https://doi.org/10.1007/BF00134104

Issue Date:

DOI: https://doi.org/10.1007/BF00134104