Abstract

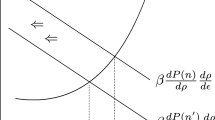

This paper develops an arbitration scheme for resolving a distribution of wealth problem by applying Nash's assumptions to marginal rather than to total utilities. The problem considered is that of distributing a fixed amount of wealth between two claimants, and the paper compares properties of this problem's Nash solution with those of the marginal utility solution. The Nash solution is shown to emphasize application of symmetry considerations to the status quo ante, the marginal utility solution their application to the players' post arbitration positions (as measured by functions that fully describe the players' utilities but that are independent of positive linear transformations). It is argued that while the Nash assumptions are appropriate for many arbitration problems in which a solution reflects the players' status quo ante positions, the marginal utility assumptions are useful when it is desired that a solution attempt to minimize post-arbitration differences between the players' positions. The latter seems to be preferable in contexts where an arbitrator weights the solution's effects on out-comes more heavily than he weights considerations of the status quo ante. Examples are situations such as those involving income redistribution, where attempts to reduce inequality may guide the redistribution decisions. The effects on each type of solution of changes in the status quo ante are also investigated and related to the risk preference properties of the players' utilities.

Similar content being viewed by others

References

Arrow, K. J., (1950) ‘A Difficulty in the Concept of Social Welfare’, Journal of Political Economy 58, 328–46. Reprinted in Arrow K. J. and Scitovsky, T. eds., Readings in Welfare Economics, Homewood, Ill: Irwin, 1969.

Arrow, K. J. (1970) Theory of Risk-Bearing, Chicago: Markham.

Harsanyi, J. C. (1956) ‘Approaches to the Bargaining Problem Before and After the Theory of Games: A Critical Discussion of Zeuthen's, Hicks', and Nash's Theories,’ Econometrica 24, 144–157.

Harsanyi, J. C. (1962) ‘Rationality Postulates for Bargaining Solutions in Co-operative and in Non-Cooperative Games’, Management Science 9, 141–153.

Harsanyi, J. C. (1962) ‘Bargaining in Ignorance of the Opponent's Utility Function,’ Journal of Conflict Resolution 6, 29–38.

Kuhn, H. W. (1967) On Games of Fair Division, in M. Shubik, ed., Essays in Mathematical Economics in Honor of Oskar Morgenstern, Princeton: Princeton University Press, 29–38.

Luce, R. D. and Raiffa, H. W. (1957) Games and Decisions, New York: Wiley.

Mossin, J. (1968) ‘Merger Agreements: Some Game-Theoretic Considerations,’ Journal of Business 41, 460–471.

Nash, J. F. Jr. (1950) ‘The Bargaining Problem,’ Econometrica 18, 155–162.

Pratt, J. W. (1964) ‘Risk Aversion in the Small and in the Large,’ Econometrica 32, 122–136.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Neave, E.H. On arbitration schemes for a wealth distribution problem. Theor Decis 9, 295–312 (1978). https://doi.org/10.1007/BF00133457

Issue Date:

DOI: https://doi.org/10.1007/BF00133457