Abstract

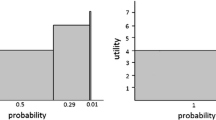

In the expected utility case, the risk-aversion measure is given by the Arrow-Pratt index. Three proposals of a risk-aversion measure for the nonexpected utility case are examined. The first one sets “the second derivative of the acceptance frontier as a measure of local risk aversion.” The second one takes into account the concavity in the consequences of the partial derivatives of the preference function with respect to probabilities. The third one measures risk aversion through the ratio between the risk premium and the standard deviation of the lottery. The third proposal catches the main feature of risk aversion, while the other two proposals are not always in accordance with the same crude definition of risk aversion, by which there is risk aversion when an agent prefers to get the expected value of a lottery rather than to participate in it.

Similar content being viewed by others

References

Arrow, K.J. (1965).Aspects of the Theory of Risk Bearing. Helsinki: Yrjio Jahnssonian Saatio.

Biswas, T. (1983). “A Note on the Generalized Measures of Risk Aversion”,Journal of Economic Theory, 29, 347–352.

Chew, S.H., E. Karni and Z. Safra. (1987). “Risk Aversion in the Theory of Expected Utility with Rank Dependent Probabilities”,Journal of Economic Theory 42, 370–381.

de Finetti, B. (1952). “Sulla Preferibilità”,Giornale degli Economisti e Annali de Economia 11, 455–465.

Deschamps, R. (1973). “Risk Aversion and Demand Functions”,Econometrica 41, 455–465.

Hanoch, G. (1977). “Risk Aversion and Consumer Preferences”,Econometrica 45, 413–426.

Khilstrom, R.E. and L.J. Mirman. (1974). “Risk Aversion with Many Commodities”,Journal of Economic Theory 8, 361–388.

Machina, M.J. (1987). “Choice under Uncertainty: Problems Solved and Unsolved”,Economic Perspectives 1, 121–154.

Montesano, A. (1985). “The Ordinal Utility under Uncertainty and the Measure of Risk Aversion in Terms of Preferences”,Theory and Decision 18, 73–85.

Montesano, A. (1988). “The Risk Aversion Measure without the Independence Axiom”,Theory and Decision 24, 269–288.

Montesano, A. (1990). “On the Definition of Risk Aversion”,Theory and Decision 29, 53–68.

Pratt, J.W. (1964). “Risk Aversion in the Small and in the Large”,Econometrica 32, 122–136.

Röell, A. (1987). “Risk Aversion in Quiggin and Yaari's Rank-Order Model of Choice under Uncertainty”,Economic Journal 97 (Conference 1987), 143–159.

Segal, U. (1987). “The Ellsberg Paradox and Risk Aversion: An Anticipated Utility Approach”,International Economic Review 28, 175–202.

Stiglitz, J.E. (1969). “Behavior Towards Risk with Many Commodities”,Econometrica 37, 660–667.

Varian, H.R. (1984).Microeconomic Analysis, 2nd ed. New York: Northon.

Yaari, M.E. (1969). “Some Remarks on Measures of Risk Aversion and on their Uses”,Journal of Economic Theory 1, 315–329.

Yaari, M.E. (1987). “The Dual Theory of Choice under Risk”,Econometrica 55, 95–115.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Montesano, A. Measures of risk aversion with expected and nonexpected utility. J Risk Uncertainty 4, 271–283 (1991). https://doi.org/10.1007/BF00114157

Issue Date:

DOI: https://doi.org/10.1007/BF00114157