Abstract

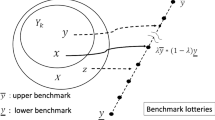

The widely observed preference for lotteries involving precise rather than vague of ambiguous probabilities is called ambiguity aversion. Ambiguity aversion cannot be predicted or explained by conventional expected utility models. For the subjectively weighted linear utility (SWLU) model, we define both probability and payoff premiums for ambiguity, and introduce alocal ambiguity aversion function a(u) that is proportional to these ambiguity premiums for small uncertainties. We show that one individual's ambiguity premiums areglobally larger than another's if and only if hisa(u) function is everywhere larger. Ambiguity aversion has been observed to increase 1) when the mean probability of gain increases and 2) when the mean probability of loss decreases. We show that such behavior is equivalent toa(u) increasing in both the gain and loss domains. Increasing ambiguity aversion also explains the observed excess of sellers' over buyers' prices for insurance against an ambiguous probability of loss.

Similar content being viewed by others

References

Allais, M. (1953). “Le comportement de l'homme rationel devant le risque: Critique des postulats et axiomes de l'ecole americaine,”Econometrica 21, 503–546.

Allais, M. (1979). “The Foundations of a Positive Theory of Choice Involving Risk and a Criticism of the Postulates and Axioms of the American School.” In M.Allais and O.Hagen (eds.),Expected Utility Hypotheses and the Allais Paradox. Dordrecht, Holland: Reidel, pp. 437–469.

Anscombe, F. J. and R. J.Aumann. (1963). “A Definition of Subjective Probability,”Annals of Mathematical Statistics 34, 199–205.

Bell, D. E. and P. H.Farquhar. (1986). “Perspectives on Utility Theory,”Operations Research 34, 179–183.

Chew, S. H. (1983). “A Generalization of the Quasilinear Mean with Applications to the Measurement of Income Inequality and Decision Theory Resolving the Allais Paradox,”Econometrica 51, 1065–1092.

Chew, S. H. (1984). “An Axiomization of the Rank Dependent Quasilinear Mean Generalizing the Gini Mean and the Quasilinear Mean,” preprint, Department of Political Economy, Johns Hopkins University, Baltimore, MD.

Chew, S. H. and K. R.MacCrimmon. (1979). “Alpha-Nu Choice Theory: A Generalization of Expected utility Theory,” Working Paper 669, University of British Columbia, Vancouver, Canada.

Curley, S. P., S. A.Eraker, and J. F.Yates. (1984). “An Investigation of Patient's Reactions to Therapeutic Uncertainty,”Medical Decision Making 4, 501–511.

Curley, S. P., J. F.Yates, and R. A.Abrams. (1986) “Psychological Sources of Ambiguity Avoidance,”Organizational Behavior and Human Decision Processes 38, 230–256.

Edwards, W. (1962). “Utility, Subjective Probability, Their Interaction, and Variance Preferences,”Journal of Conflict Resolution 6, 4251.

Einhorn, H.J. and R.M.Hogarth. (1985). “Ambiguity and Uncertainty in Probabilistic Inference,”Psychological Review 92, 433–461.

Einhorn, H. J. and R. M.Hogarth (1986). “Decision Making under Ambiguity,”Journal of Business 59, S225-S250.

Ellsberg, D. (1961). “Risk, Ambiguity, and the Savage Axioms,”Quarterly Journal of Economics 75, 643–669.

Fellner, W. (1961). “Distortion of Subjective Probabilities as a Reaction to Uncertainty,”Quarterly Journal of Economics 75, 670–689.

Fishburn, P. C. (1988). “Uncertainty Aversion and Separated Effects in Decision Making under Uncertainty.” In J.Kacprzyk and M.Fedrizzi (eds.),Combining Fuzzy Imprecision with Probabilistic Uncertainty in Decision Making. New York: Springer-Verlag.

Gardenfors, P. and N. E.Sahlin. (1982). “Unreliable Probabilities, Risk Taking, and Decision Making,”Synthese 53, 361–386.

Gilboa, I. (1987). “Expected Utility with Purely Subjective Non-Additive Probabilities,”Journal of Mathematical Economics 16, 65–88.

Hazen, G. B. (1987). “Subjectively Weighted Linear Utility,”Theory and Decision 23, 261–282.

Hazen, G. B. (1989). “Ambiguity Aversion and Ambiguity Content in Decision Making under Uncertainty,”Annals of Operations Research 19, 415–434.

Hogarth, R. M. and H. J. Einhorn. (1989). “Venture Theory: A Model of Decision Weights,” Center for Decision Research, Graduate School of Business, University of Chicago.

Hogarth, R. M. and H.Kunreuther. (1985). “Ambiguity and Insurance Decisions,”American Economic Review 75, 386–390.

Hogarth, R. M. and H.Kunreuther. (1989). “Risk, Ambiguity and Insurance,”Journal of Risk and Uncertainty 2, 5–37.

Kahn, B. E. and R. K.Sarin. (1988). “Modeling Ambiguity in Decisions Under Uncertainty,”Journal of Consumer Research 15, 265–272.

Kyburg, H. E. (1968). “Bets and Beliefs,”American Philosophical Quarterly 5, 63–78.

Lee, J.-S. (1988).Decision Analysis Under Uncertainty with Ambiguous Probabilities Ph. D. dissertation, Department of Industrial Engineering and Management Sciences, Northwestern University, Evanston, IL.

Luce, R. D. and L.Narens. (1985). “Classification of Concatenation Measurement Structures According to Scale Type,”Journal of Mathematical Psychology 29, 1–72.

Luce, R. D. (1988). “Rank-Dependent, Subjective Expected-Utility Representations,”Journal of Risk and Uncertainty 1, 305–332.

Nau, R. (1986). “A New Theory of Indeterminate Probabilities and Utilities,” Working Paper No. 8609, The Fuqua School of Business, Duke University, Durham, North Carolina.

Pratt, J. W. (1964). “Risk Aversion in the Small and in the Large,”Econometrica 32, 122–136.

Quiggin, J. (1982). “A Theory of Anticipated Utility,”Journal of Economic Behavior and Organization 3, 323–343.

Raiffa, H. (1961). “Risk, Ambiguity and the Savage Axioms: Comment,“Quarterly Journal of Economics 75, 690–694.

Raiffa, H. (1968).Decision Analysis: Introductory Lectures on Choices under Uncertainty. Reading, MA: Addison-Wesley.

Sarin, R. K. and R. L.Winkler. (1990). “Ambiguity and Decision Modeling: A Preference-Based Approach,” Fuqua School of Business and Institute of Statistics and Decision Sciences, Duke University, Durham, NC.

Savage, L. J. (1954).The Foundations of Statistics. New York: Wiley.

Schmeidler, D. (1984). “Subjective Probability and Expected Utility without Additivity,” Preprint 84, Institute for Mathematics and Its Applications, University of Minnesota, Minneapolis.

Segal, U. (1984). “Nonlinear Decision Weights with the Independence Axiom,” Working Paper No. 353, Department of Economics, University of California, Los Angeles.

Segal, U. (1987). “The Ellsberg Paradox and Risk Aversion: An Anticipated Utility Approach,”International Economic Review 28, 175–202.

Sherman, R. (1974). “The Psychological Difference Between Ambiguity and Risk,”Quarterly Journal of Economics 83, 324–329.

Slovic, P. and A.Tversky. (1974). “Who Accepts Savage's Axiom?”Behavior Science 19, 368–373.

Spetzler, C. S. and C. A. S.Stael von Holstein. (1975). “Probability Encoding in Decision Analysis,”Management Science 22, 340–358.

Weber, M. and C.Camerer. (1987). “Recent Developments in Modelling Preferences under Risk,”OR Spektrum 9, 129–151.

Wothke, W. (1985). “Allais' Paradox Revisited: The Implications of the Ambiguity Adjustment Model,” Department of Psychology, Northwestern University, Evanston, IL.

Yaari, M. E. (1987). “The Dual Theory of Choice under Risk,”Econometrica 55, 95–115.

Yates, J. F. and L. G.Zukowski (1976). “Characterization of Ambiguity in Decision Making,”Behavioral Science 21, 19–25.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hazen, G.B., Lee, JS. Ambiguity aversion in the small and in the large for weighted linear utility. J Risk Uncertainty 4, 177–212 (1991). https://doi.org/10.1007/BF00056125

Issue Date:

DOI: https://doi.org/10.1007/BF00056125